Financial sector firm, IMF Bentham and Real Estate firm, Charter Hall, recently came up with updates on their financial results. IMF released portfolio update for the quarter ended 30 June 2019 and CLW provided details on its financial performance for FY19.

Let us have a detailed look at the performance of both the companies.

IMF Bentham Limited

IMF Bentham Limited (ASX: IMF) engages in investigation and funding of litigation. In order to provide its services, the company enters into funding agreements with claimants or law firms.

The company recently announced the resolution of a case funded in the United States through Fund 1. The purpose of the funding was to monetise a patent infringement judgement subject to appeal. Upon dismissal of the appeal, the parties agreed on a binding settlement to not have any further appeals. The settlement will generate income of a further US$21.6 million for Fund 1, leading to profit after capitalised overheads of AUD$10.7 million.

In another settlement in relation to the UGL class action, the parties to the proceedings decided to enter into an in-principle agreement for settlement of proceedings through an agreed sum. IMF expects to generate an approximate income of $8.3 million, if the settlement becomes unconditional. This amount will be inclusive of reimbursement for project costs.

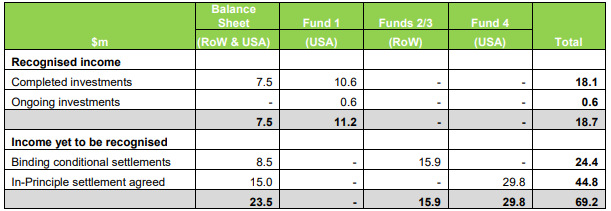

Market Update: The company recently released a market update disclosing that in FY19, the company established funds with aggregate capital commitments of US$1 billion, securing the companyâs medium-term funding requirements for funding investments related to current and future litigation. During the financial year 2019, the company also raised $75 million through an equity placement. In addition, the company refreshed the terms of its listed bonds pushing maturity out to financial year 2023 and raising an additional $41 million through issue of new bonds. In FY20, the company expects to generate an income of $70 million from conditional and in-principle settlements over the period covering 1 July 2019 to date. $23.5 million of these settlements relate to on-balance sheet investments.

June Quarter Performance: During the 3 months ended 30 June 2019, the company witnessed net growth in funded and conditionally funded investments, that led to 25% increase to total EPV for the quarter. Over the financial year, 70% increase to total EPV was reported. The increase in EPV was supported by an estimated capital commitment of $95.0 million during the quarter. The company recognised a consolidated gross income of $18.7 million. This exceeded the aggregate consolidated gross income of the previous three quarters, making it the strongest quarter for FY19.

Performance Highlights (Source: Company Reports)

Funds: During the quarter, level of investment for Fund 1 increased to 96.2% of the available capital, representing an increase of 13%. Level of investment for Fund 2/3 increased to 93.3% of the available capital, depicting a 4% rise. Fund 4 committed to 4.0% of its available capital, making its first two investments during the June quarter. The company also launched Fund 5 with a total investment capacity of US$500 million. Fund 5 investments will commence after the completion of investment period of Fund 2/3.

Stock Performance: The stock of the company generated returns of 2.85% and 13.64% over a period of 1 month and 3 months, respectively. Currently, the stock is trading at a market price of $3.285, up 1.077% on 12 August 2019 (AEST â 12:55 PM) and has a market capitalisation of $664.98 million.

Charter Hall Long Wale REIT

Charter Hall Long Wale REIT (ASX: CLW) is primarily engaged in property investment.

FY19 Financial Performance: During the year, the company reported operating earnings per share of 26.9 cents, increasing 1.9% on the previous year. DPS for the period was reported at 26.9 cents, up 1.9% on FY18. The company reported net tangible assets per security amounting to $4.09, that increased 1% from $4.05 as at 30 June 2018. Statutory profit for the period was reported at $69.6 million, as compared to $83.3 million in the prior corresponding period. Operating earnings for FY19 stood at $70.8 million, up $12.4 million on FY18 operating earnings of $58.4 million. Net property income increase represented like-for-like growth of 2.6%, along with additional $16.5 million from net acquisitions.

The period saw an increase in interest income due to the timing between equity raises and deployment. Operating expenses increased due to portfolio growth and new acquisitions. Owing to new acquisitions and gross property revaluations of $63.8 million, the company witnessed an asset growth of 37%, with assets valued at $510.1 million. The company also raised $406.3 million in equity during the year.

FY19 Financial Results (Source: Company Presentation)

FY19 Financial Results (Source: Company Presentation)

Portfolio Update: During the year, the company completed acquisitions worth $707.0 million, comprising $314.0 million in office space, $109.4 million in industrial property, $207.0 million in Agri-logistics property and $76.6 million of long WALE retail property. Disposals during the period totalled to $173.7 million, of which $135.0 million accounted for disposals across the office sector and $38.7 million across the industrial sector.

Major Leases: Some major leases during the year that helped the company secure long-term income comprised of the agreement with Woolworths dated 12 August 2019, pertaining to lease extension at its Hoppers Crossing Distribution Centre in Victoria. In June 2019, the company completed two lease extensions with SUEZ for the properties located at Newton and Davis Road in Wetherill Park. Another lease in February 2019 saw lease extensions on a number of properties in the Inghams portfolio. 62% of the leases of the Inghams portfolio were extended that increased the Inghamâs portfolio WALE from 15.8 years to 24.6 years.

FY20 Earnings Guidance: The company provided FY20 operating EPS guidance of 28.0 cents per security, reflecting growth of 4.0% over FY19, barring any unforeseen events and no material change in market conditions. Distribution payout ratio for FY20 is targeted at 100% of the operating earnings.

Stock Performance: The stock of the company generated returns of 2.52% and 17.86% over a period of 1 month and 3 months, respectively. Currently, the stock is trading at a market price of $5.385, up 1.989% on 12 August 2019 (AEST â 1:34 PM), with a market capitalisation of $1.72 billion.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.