The below mentioned banking stocks have come with significant updates today. Letâs take a quick look at these stocks.

Westpac Banking Corporation (ASX:WBC)

Australiaâs leading bank, Westpac Banking Corporation (ASX: WBC) released a letter from its Chairman, Mr Lindsay Maxsted comprising his concerns over the companyâs executive remuneration. He expressed that the Westpac Board was disappointed that the company was not able to meet the shareholdersâ expectations on the executive remuneration.

At 2018 Annual General Meeting (AGM), Westpac received a substantial vote against its Remuneration Report, giving a clear message that the executive remuneration was not in line with the shareholdersâ expectations.

This year, the bank expects to make further changes, which will include effectively capturing non-financial risk elements of the performance in executive remuneration. Further, this year, the Board expects to improve the transparency of the remuneration decisions. The remuneration outcomes will be released in the 2019 Annual Report, which is scheduled to be published in early November.

Following the scrutiny from the Royal Commission, which identified various shortcomings of the bank, Westpac planned a range of actions to respond to the Royal Commissionâs findings.

The Bank has completed a detailed self-assessment of its Culture, Governance and Accountability (CGA), which highlighted that at a time when the bankâs CGA is supporting the sound management of non-financial risks, Westpacâs approach is less mature than its management of financial risks approach. Further, it has been confirmed that the bank has an analytical and consultative culture that can slow down its decision-making process, which could further create undue complexity and dilute the bankâs accountability.

In order to avoid this, the bank is undertaking a detailed program to implement the CGA self-assessment recommendations. Currently, Westpac is waiting for direct feedback of the Australian Prudential Regulation Authority (APRA) on the report and will incorporate their recommendations in its plans.

The Chairman, in his letter, also provided an overview of the bankâs half year results. The Chairman has noted that the first half reported profit was down, mainly due to the difficult operating environment and higher restructuring and remediation provisions. However, despite a decline in the earnings, the capital and balance sheet of the bank was in good shape, allowing it to declare an interim dividend steady at 94 cents per share.

The Chairman has advised that the provisions in the first half of 2019 are reflective of the bankâs commitment to deal with the major outstanding issues and these actions, along with the Royal Commission and CGA self-assessment response plans, will ultimately make Westpac a stronger organisation and help it to deliver a more consistent experience for customers.

Recently, Westpac made a significant addition to its Board with the appointment of highly experienced Guilherme (Guil) Lima as Chief Executive of its Business Division. In his 22 years of extensive experience, Mr Lima held various senior level roles in big companies like HSBC and McKinsey.

In the first half of FY19, Westpac recorded a reported net profit of $3,173 million, which was 24% lower than its previous corresponding period (pcp) and along those lines, the bank reported a decline of 22% in its cash earnings, which reached $3,296 million in 1H FY19.

1HFY19 Earnings Snapshot (Source: Company Reports)

During the period, the bank increased new Australian banking customers by over 36,000 and reported 3% growth in general insurance gross written premiums, building momentum in the customer franchise.

Westpac booked provisions of $617 million (after tax) in 1H19 and $281 million in 2H18, mainly in connection to the provisions related to the remediation programs for:

- Certain ongoing advice service fees associated with the groupâs salaried financial planners

- Certain ongoing advice service fees charged by the groupâs authorised representatives that provided financial planning services under Magnitude and Securitor brands

- Refunds to certain business customers who were provided with business loans where they should have been provided with loans covered by the National Consumer Credit Protection Act

- Refunds for certain customers that had interest only loans that did not automatically switch, when required, to principal and interest loans.

Now, letâs have a quick look at Westpac Banking Corporationâs stock performance and the returns it has posted over the past few months. The stock at market close was trading at a price of $28.330, up 0.354% during the dayâs trade, with a market capitalisation of ~$97.32 billion on 24th June 2019. The counter opened the day at $28.110, reached the dayâs high at $28.330 and touched a dayâs low at $28.00, with a daily volume of ~ 5,547,883. The stock has provided a year-to-date return of 15.32% and also posted returns of 18.46%, 7.22% and -0.95% over the past six months, three and one-month period, respectively. Its 52-week high price stands at $30.440 and 52 weeks low price at $23.300, with an average volume of ~7,327,602. The stock is trading at a PE multiple of 13.700x, with an annual dividend yield of 6.66% (as per ASX).

Australia and New Zealand Banking Group Limited (ASX:ANZ)

Australia and New Zealand Banking Group Limited (ASX: ANZ) made an announcement today stating that ANZ Bank New Zealand Limited (ANZ NZ) is going to work with the Reserve Bank of New Zealand (RBNZ) on independent reviews of its capital models and attestation process to provide assurance that the bank is operating in a prudent manner.

As per the companyâs release, an independent third party will be commissioned under Section 95 of the RBNZ Act, which will look at ANZ NZâs compliance with its capital adequacy requirements.

Earlier, it was noted by RBNZ that ANZ NZ is persistently failing in its controls and attestation process, which is why last month, RBNZ revoked ANZ NZ accreditation to model its own operational risk capital requirement and advised the bank to undertake a full review of its attestation process, and assess its compliance with the capital regulations.

This is not the first time that any bank has faced heat from RBNZ. Earlier in 2017, when Westpac New Zealand failed to comply with the regulatory obligations, RBNZ increased its minimum capital levels to protect the integrity of the capital regime and gave Westpac 18 months to satisfy the Reserve Bank.

As at 31st March 2019, ANZ NZ had $12.4 billion of capital in its balance sheet, making it well capitalised for future operations.

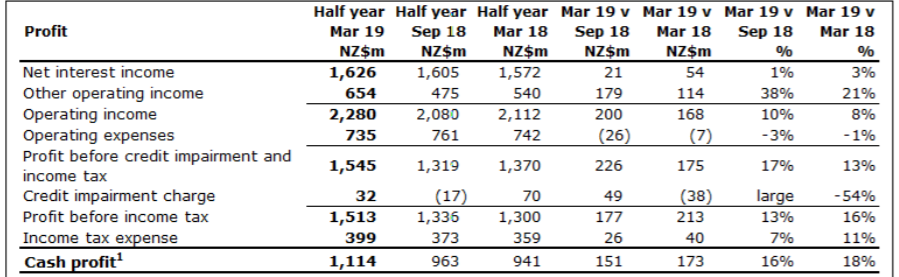

In the first half of FY19, ANZ NZâs net profit after taxation (NPAT) of NZ$929 million, which was 4% lower than its previous corresponding period (pcp). The bank reported cash NPAT of NZ$1,114 million, which was 18% higher than the previous corresponding period, mainly driven by the sale of the life insurance company, OnePath Life (NZ) Limited and a 25% share in Paymark Limited.

H1FY19 Financial (Source: Company Reports)

Now, letâs have a quick look at Australia and New Zealand Banking Group Limitedâs stock performance and the returns it has posted over the past few months. At market close on 24th June 2019, ANZâs stock was trading at a price of $28.680, up by 0.491% during the dayâs trade, with a market capitalisation of ~$80.86 billion.

The counter opened the day at $28.520, reached the dayâs high at $28.720 and touched a dayâs low at $28.420, with a daily volume of ~2,594,749. The stock has provided a year-to-date return of 19.61% and also posted returns of 22.49%, 7.90% and 0.39% over the past six months, three and one-month period, respectively. Its 52-week high price stands at $30.390 and 52 weeks low of $22.980, with an average volume of ~5,628,967. The stock is trading at a PE multiple of 13.030x, with an annual dividend yield of 5.61%.

Australiaâs another leading bank, Commonwealth Bank of Australiaâs (ASX: CBA) stock was up on ASX by 0.559% during todayâs intraday trade, closing the dayâs trade at a price of $82.700, with a market capitalisation of $145.58 billion. CBAâs stock is trading at a PE level of 16.020x, with an annual dividend yield of 5.24%. In the last six months, CBAâs stock has provided a return of 20.09%, and for the three month period, the stock price has increased by 15.62% as on 21st June 2019.

Along with CBAâs stock, National Australia Bankâs (ASX: NAB) stock was also up on ASX, increasing by 0.335% during todayâs trading session. At market close on 24 June 2019, NABâs stock was trading at a price of $26.940, with a market capitalisation of $75.49 billion. NABâs stock is trading at a PE multiple of 13.090x, with an annual dividend yield of 6.78%. In the last six months, NABâs stock has provided a return of 17.56% as on 21st June 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.