In Australia, dividend stocks are very popular among investors as they provide regular cash streams and are considered less risky. In order to determine the best dividend stocks, investors generally screen stocks on the basis of their annual dividend yields, which is calculated by dividing the annual dividend by the share price of the company. We have prepared a list of top ten Dividend Stocks on the basis of their annual dividend yield. Now, letâs take a look at top 10 Dividend Stocks.

Westpac Banking Corporation (ASX:WBC)

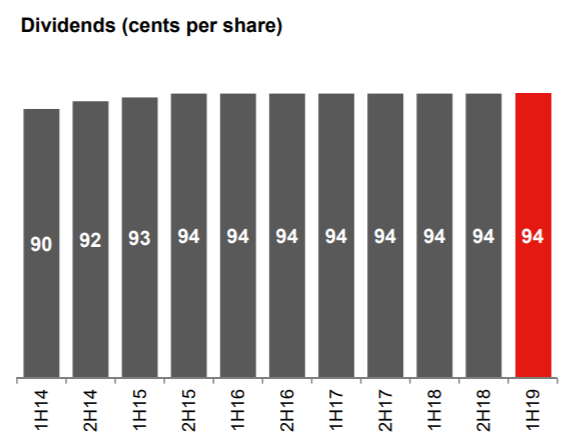

Australiaâs leading bank, Westpac Banking Corporation (ASX: WBC) most recently paid an interim fully franked dividend of 94 cents per ordinary share for 1HFY19. The dividend is representing a payout ratio of 98% and is in line with the WBCâs previous dividends of recent years as depicted in the figure below.

Dividend Summary (Source: Company Reports)

At market close on 9 September 2019, WBCâs stock was trading at a price of $29.540 with a market capitalisation of $103.62 billion. The stock is trading near it its 52 weeks high price of $29.970 and has an annual dividend yield of 6.33%.

Bank of Queensland Ltd (ASX:BOQ)

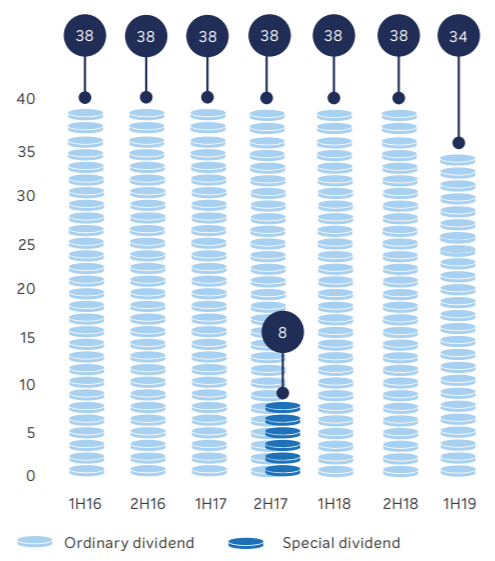

One of the leading regional banks in Australia, Bank of Queensland Ltd (ASX: BOQ) most recently paid a dividend of 34 cents per share for H1 FY19, breaking the trend of paying 38 cents per share since past few years (refer below graph).

Dividend Summary (Source: Company Reports)

At market close on 9 September 2019, BOQâs stock was trading at a price of $9.880 with a market capitalisation of $3.99 billion. The stock is trading at a PE multiple of 12.320x with an annual dividend yield of 7.32%.

Harvey Norman Holdings Limited (ASX:HVN)

Harvey Norman Holdings Limited (ASX: HVN) recently declared a fully-franked 2019 final dividend of 21.0 cents per share. The dividend has a record date of 11 October 2019 and payment date of 1 November 2019. It is to be noted that the final dividend is 23.5% higher than the previous corresponding period (pcp).

At market close on 9 September 2019, HVNâs stock was trading at a price of $4.490 with a market capitalisation of $5.26 billion. The stock is trading very near to its 52 weeks high price of $4.667 and has an annual dividend yield of 7.32%.

IOOF Holdings Limited (ASX:IFL)

Australiaâs leading financial services company, IOOF Holdings Limited (ASX: IFL) recently declared a fully franked final dividends of 19 cents per share, taking the total dividend for FY19 to 44.5 cents per share. The final dividend will be paid on 27 September 2019.

At market close on 9 September 2019, IFLâs stock was trading at a price of $5.650 with a market capitalisation of $1.98 billion. The stock is trading at a PE multiple of 69.080x with an annual dividend yield of 6.66%.

Platinum Asset Management Limited (ASX:PTM)

Leading asset management company, Platinum Asset Management Limited (ASX: PTM) recently declared a dividend of 14 cents per share, relating to the six months ended 30 June 2019. The dividend has a record date of 28 August 2019 and a payment date of 20 September 2019. The stock currently has an annual dividend yield of 6.57%.

At market close on 16 September 2019, PTMâs stock was trading at a price of $4.090 with a market capitalisation of circa $2.41 billion.

Whitehaven Coal Ltd (ASX:WHC)

Energy company, Whitehaven Coal Ltd (ASX: WHC) declared a dividend of 30 cents per share, payable on 19 September 2019. The dividend includes an ordinary dividend of 13 cents (50% franked) and a special dividend of 17 cents (unfranked).

At market close on 16 September 2019, WHCâs stock was trading at a price of $3.370 with a market capitalisation of circa $3.42 billion. WHCâs stock currently has an annual dividend yield of 8.41%.

National Australia Bank Limited (ASX:NAB)

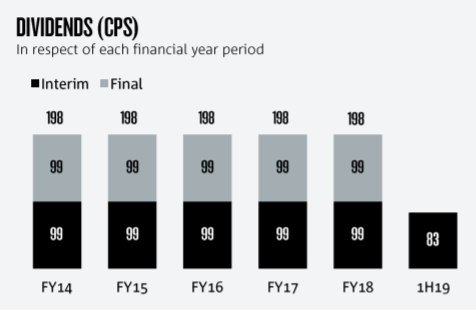

Australiaâs leading bank, National Australia Bank Limited (ASX: NAB) most recently paid a dividend of 83 cents per share (100% franked) relating to H1 FY19. The dividend was not in line with previous dividends that the bank has paid (refer below image).

At market close on 16 September 2019, NABâs stock was trading at a price of $29.130 with a market capitalisation of circa $84.07 billion. NABâs stock is trading very near to its 52 weeks high price of $29.255. The stock is trading at a PE multiple of 14.210 and an annual dividend yield of 6.24%. In the last six months, NABâs stock has provided a return of 15.99% as on 13 September 2019.

Estia Health Limited (ASX:EHE)

Healthcare company, Estia Health Limited (ASX: EHE) has declared a fully franked final dividend of 7.8cps declared, taking the total FY19 dividend to 15.8 cents per share representing 100% of NPAT. The dividend will be paid on 2nd October 2019.

In the last six months, EHEâs stock has provided a return of 7.08% as on 13 September 2019. Currently, EHEâs stock is trading at a PE multiple of 16.220x with an annual dividend yield of 6.15%. At market close on 16 September 2019, EHEâs stock was trading at a price of $2.550 with a market capitalisation of circa $669.78 million.

AGL Energy Limited (ASX:AGL)

AGL Energy Limited (ASX: AGL) recently declared a dividend of 64 cents per share, taking the total FY19 dividend to 119 cents per share, up 2 cents per share on pcp. The growth in FY19 dividend was supported by the companyâs strong earnings over the period.

In the last six months, AGLâs stock has provided a negative return of 12.93% as on 13 September 2019. Currently, AGLâs stock is trading at a PE multiple of 13.860x with an annual dividend yield of 6.22%. At market close on 16 September 2019, AGLâs stock was trading at a price of $18.870 with a market capitalisation of circa $12.55 billion.

Australia and New Zealand Banking Group Ltd (ASX:ANZ)

Australia and New Zealand Banking Group Ltd (ASX: ANZ) mostly recently paid a dividend of 80 cents per share, relating to the first half of FY19. The dividend is in line with the first half of the previous year (refer below graph).

ANZ dividend Per share (Source: Company reports)

In the last six months, ANZâs stock has provided a return of 3.92% as on 13 September 2019. Currently, ANZâs stock is trading at a PE multiple of 12.710x with an annual dividend yield of 5.75%. At market close on 16 September 2019, ANZâs stock was trading at a price of $27.600 with a market capitalisation of circa $78.94 billion.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.