GTE, NTU and CHZ are stocks from the metals and mining sector which are on a trading halt on 15 May 2019. Let us understand why the shares are on a trading halt.

Great Western Exploration Limited (ASX: GTE):

Great Western Exploration Limited is a mineral resources company which focuses on copper, cobalt as well as gold mineralization in the underexplored Proterozoic Basins which is situated in the norther Yilgarn.

At present, the shares of Great Western Exploration Limited are under the trading halt until the release of an announcement regarding a capital raising activity. The trading halt is in place until the earliest of regular trading on 17 May 2019 or until the release of the announcement regarding the capital raising activity.

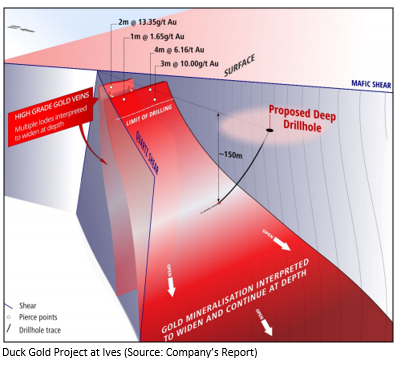

Recently, there was a diamond drilling at Ives Find. Based on the analysis, the understanding of the company regarding the high-grade gold mineralization was enhanced at the Ives Find prospect. Through analysis, it was interpreted that the gold mineralization would increase down dip towards the feeder zone at depth. The company believes that the geological setting at Ives Find is similar to the Jundee style, high-grade gold mineralization, where the gold that was found in the granite was from a much larger gold system. The company had planned for ten drill holes to start in May 2019.

In the March 2019 quarter, there was a net cash outflow of A$0.359 million from the operating activities of the company. The primary drivers of the cash outflow were through the payment made for exploration and evaluation along with administration and corporate costs. There was a net cash outflow of A$0.052 million through the investing activities. By the end of the March 2019 quarter, the company had net cash and cash equivalent of A$0.694 million. The estimated cash outflow of the company in the June 2019 quarter was A$0.350 million.

The shares of GTE traded last on 14 May 2019 with the closing price of A$0.005. GTE holds a market cap of A$4.83 million and approximately 965.2 million outstanding shares.

Northern Minerals Limited

Northern Minerals Limited (ASX: NTU) is a company from the metals and mining sector that focuses on the development of heavy rare earth projects, especially, the element dysprosium.

Today, the shares of Northern Minerals Limited are under trading halt pending for the release of an announcement with respect to Companyâs research and development tax claim registration. The company expects that the announcement will be made on or before the opening of the market on 17 May 2019.

On 18 February 2019, the company made an announcement where it highlighted that the Australian Taxation Office (ATO) has agreed to release 50% of the companyâs claim ($10.98 million) for research and development. Further, it was also highlighted by the company in the announcement that the claims made by the company was under the review of ATO and AusIndustry. The partial release of the claim will help the Companyâs financial position.

On 13 May 2019, the company announced that it had been allocated a $51 million State Budget of Duncan Road and Gordon Downs Road in the East Kimberly. On the same date, the company announced that Xue Congyan and Go & Company Limited is now the substantial holder of 134,134,760 shares with a voting power of 7.03%. Also, Liu Xiaohua who had 110,000,000 shares with 7.77% voting power, now has a voting power of 5.78%.

The shares of NTU traded last on 14 May 2019 with the closing price of A$0.076. NTU holds a market cap of A$145 million and approximately 1.91 billion outstanding shares.

Chesser Resources Limited

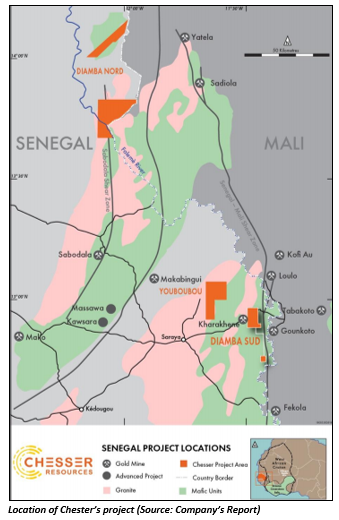

Chesser Resources Limited (ASX: CHZ) is a company from the metals and the mining sector that is aggressively exploring for gold in Eastern Senegal that lies within the highly prospective Kédougou-Kéniéba Inlier.

Today the shares of Chesser Resources are under trading halt pending for an announcement for the proposed capital raising. The company expects that the trading to remain until the earlier of the commencement of normal trading on 17 May 2019 or upon the release of information on the capital raising event.

On 14 May 2019, the company announced that it has received the final assay results from the phase 1 of the reverse circulation (RC) drilling at Diamba Sud Project which is situated in eastern Senegal.

A total of 70 holes were drilled on lines across the four main target. The recent drilling was on hole number 51 and then from hole number 59 to 79. Significant gold intersection from the Diamba Sud Project were reported.

The shares of CHZ traded last on 14 May 2019, with the closing price of A$0.045. CHZ holds a market capitalization of A$10.1 million and approximately 224.41 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.