Summary

- VRX Silica continued developments at its advanced silica sand projects during June 2020 quarter.

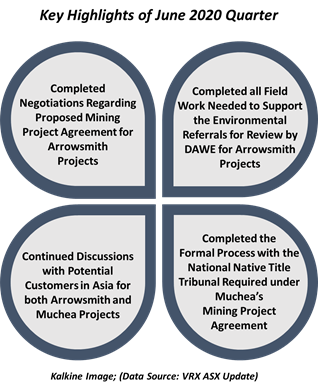

- The Company completed negotiations regarding the proposed mining project agreement for Arrowsmith Projects and finalised the formal process with the National Native Title Tribunal needed under Muchea’s mining project agreement.

- VRX completed all field work required to support the environmental referrals for assessment by DAWE for Arrowsmith Projects.

- The Company also progressed discussions with potential customers in Asia for both Arrowsmith and Muchea Projects.

- With a cash balance of ~$2.6 million as at 30th June 2020, VRX estimates its existing funding to provide support for about five quarters.

Australian silica sand explorer, VRX Silica Limited (ASX:VRX) has announced its quarterly results for the period ended 30th June 2020 on the ASX.

Following the release of quarterly update, the Company’s stock rose by ~2.1 per cent in the early trading session to $0.099.

During the quarter, VRX Silica continued developments at its advanced silica sand projects, comprising Arrowsmith Projects and Muchea Project. These projects hold considerable potential to produce high-quality silica sand products for the global market. The Company has so far received numerous enquiries and expressions of interest for its advanced projects from many organisations across Asia.

With that said, let us quickly browse through the key developments undertaken by VRX Silica at its advanced projects during the quarter:

Mining Project Agreements – Arrowsmith and Muchea

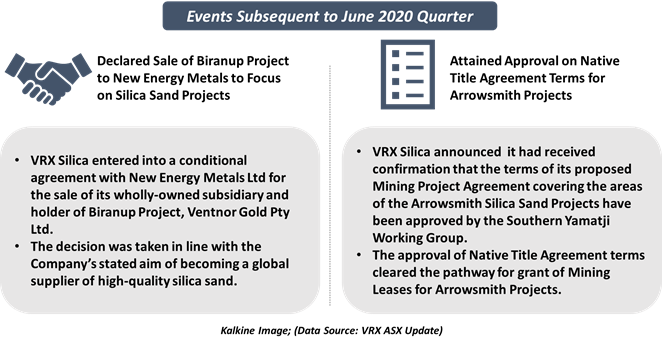

During the quarter, VRX Silica completed negotiations with the Southern Yamatji Native Title claimants and the YMAC (Yamatji Marlpa Aboriginal Corporation) concerning the proposed mining project agreement and approval for the grant of the Mining Leases and Miscellaneous Licences for the Arrowsmith projects.

While COVID-19 crisis caused delays and presented unique challenges in completing the process during June quarter, the Company continued to work constructively with Southern Yamatji Working Group and YMAC to:

- seek a way forward to reach agreement, and

- pave the road for grant of the Mining Leases for the Arrowsmith Projects.

With regards to Muchea Project, VRX Silica concluded the formal process with the National Native Title Tribunal needed under its recently signed Native Title Mining Project Agreement to obtain permit orders for the grant of the Mining Lease M70/1390.

During the quarter, the National Native Title Tribunal made a determination that the grant of the M70/1390 to Wisecat Pty Ltd may be done and this was forwarded to the Minister for Mines by the Company for the grant of the Mining Lease. The Company has requested confirmation from the Minister concerning timing of grant of the Mining Lease and is waiting for the response.

Permitting for Arrowsmith Projects

With regards to permitting for the Arrowsmith Projects, all the field work needed to support the environmental referrals for review by DAWE (Department of Agriculture, Water and the Environment) was completed during the quarter. Besides, a formal referral for Arrowsmith North was also prepared.

VRX Silica expects the assessment process with DAWE and referral to the State EPA for Arrowsmith North to be conducted in September 2020 quarter, followed by Arrowsmith Central Project.

Discussions with Potential Customers

VRX also continued discussions with prospective customers in Asia regarding long-term contracts for offtake of products from both its Muchea and Arrowsmith Projects. The discussions were primarily undertaken with potential customers in Thailand, Taiwan, South Korea, Malaysia and Japan.

While coronavirus pandemic brought face-to-face meetings with potential customers to a standstill, the Company progressed talks through video conferencing. It is imperative to note that the interest of these customers remains robust despite the present economic climate in those nations.

VRX Silica closed June 2020 quarter with a strong cash balance of ~2.6 million and expects its existing funding to support its operating activities for about five quarters.