Highlights

- ANZ provided 146 cents per share as a dividend for FY22.

- A2M received the US FDA approval to import infant milk formula (IMF) products into the US.

- BrainChip strengthened its IP portfolio by securing a US patent for ‘an improved spiking neural network’ .

The S&P/ASX200 closed sharply higher on Friday, gaining 194.00 points or 2.79% to 7,158.00 and setting a new 100-day high. Over the last five days, the index has gained 3.85%, but is down 3.85% for the last year to date. Ten of eleven sectors ended higher along with the S&P/ASX 200 Index. Information Technology was the best performing sector, gaining +4.98% and +0.42% for the past five days.

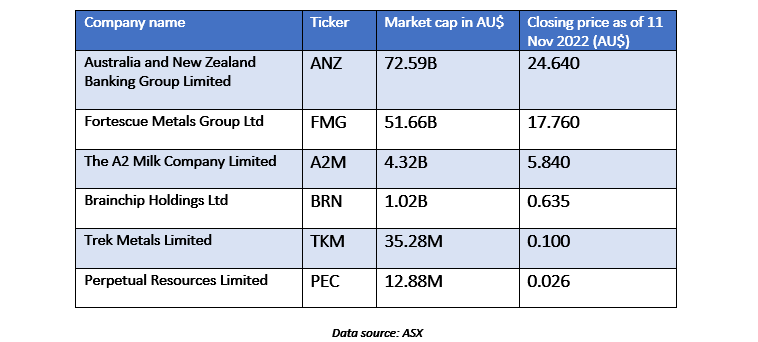

On that note, we at Kalkine Media® will discuss some of the ASX-listed stocks and their recent updates.

Australia and New Zealand Banking Group Limited (ASX:ANZ)

ANZ enjoys the distinction of being one of the big four banks of Australia. Operating in 32 markets, it offers banking and financial products and services to more than 8.5 million retail and business customers.

In FY22, ANZ reported a statutory profit of AU$7,119 million, representing a surge of 16% compared to FY21. Its return on equity was 10.4%, and earnings per share stood at 228.8 cents. The company declared 146 cents per share fully franked – as a dividend. During the reported period, ANZ acquired Suncorp Bank, providing a platform for growth owing to increased sales and diversification.

Fortescue Metals Group Ltd (ASX:FMG)

Fortescue is an Australia-based iron ore producer. It is swiftly expanding its business to become an integrated, global, green energy and resources company.

For the September quarter, FMG reported 47.5 million tonnes (mt) of iron ore shipments, up 4% from the prior corresponding period and a record figure for a first quarter. The company has joined hands with Tree Energy Solutions, aiming to expedite the development of a green hydrogen and green energy import facility in Germany.

The A2 Milk Company Limited (ASX:A2M)

Image source:© Mcpics | Megapixl.com

A2M is focused on developing products containing only the A2 beta-casein protein. Recently, the premium dairy nutritional products company gained approval from the US FDA for importing infant milk formula (IMF) products into the US.

A2M plans to conduct a capital return of almost NZ$150 million through an on-market share buyback.

Brainchip Holdings Ltd (ASX:BRN)

Brainchip Holdings, which is a neural computing technology solutions provider, recently strengthened its intellectual property portfolio by securing a US patent for ‘an improved spiking neural network'. The patent enhances the company’s unique neuromorphic patent portfolio.

Brainchip wrapped up the September quarter with a cash of US$24.6 million compared to US$28.4 million in the prior quarter.

Trek Metals Limited (ASX:TKM)

Trek Metals is a mineral explorer with a major focus on battery metals. The company’s projects include Lawn Hill, Centurion, Jimblebar, Tambourah, Pincunah & Valley of the Gossens, and Hendeka.

Trek Metals recently acquired a 100% interest in precious and base metals exploration tenement E45/4640 from Pilbara Minerals Limited (ASX:PLS), which is an Australian lithium producer.

Perpetual Resources Limited (ASX:PEC)

Perpetual Resources strives to produce high-quality silica for the market – domestic and international. The silica sands explorer has its flagship project - Beharra Silica Sands - in Australia.

In its September quarterly report, the company highlighted Beharra White Sand test work, which confirmed a higher amount of silicon dioxide and a lower amount of iron oxide impurities.

During the quarter, Perpetual Resources accomplished a placement of AU$1.6 million at 3c per share. The proceeds will be used for the advancement of the Beharra project.

_09_03_2024_01_03_36_873870.jpg)