Highlights

- NeuroScientific has received positive preliminary results from a study of its lead drug candidate EMTINB™ on multiple sclerosis.

- Mice treated with 10mg/kg and 20mg/kg doses of EmtinB™ constantly reached lower clinical scores.

- The company will now advance to a larger study.

Shares of NeuroScientific Biopharmaceuticals Ltd (ASX:NSB) surged by 22.857% to AU$0.215 midday on 15 June 2022 after a significant update on the company’s lead drug candidate EmtinB™.

The clinical-stage drug development company has received highly encouraging preliminary results from a study of EMTINB™ in animal model of multiple sclerosis (MS).

The study, undertaken by the company’s research partner Biospective, Canada, was conducted on a gold-standard animal model (mouse model) for simulating the inflammatory mechanisms of human MS.

What are the key highlights of the study?

The study included an evaluation of EMTINB™ across four dose groups (5mg/kg, 10mg/kg, 20mg/kg, and 40mg/kg), with the drug being administered daily for 30 days following the onset of initial symptoms in the mice.

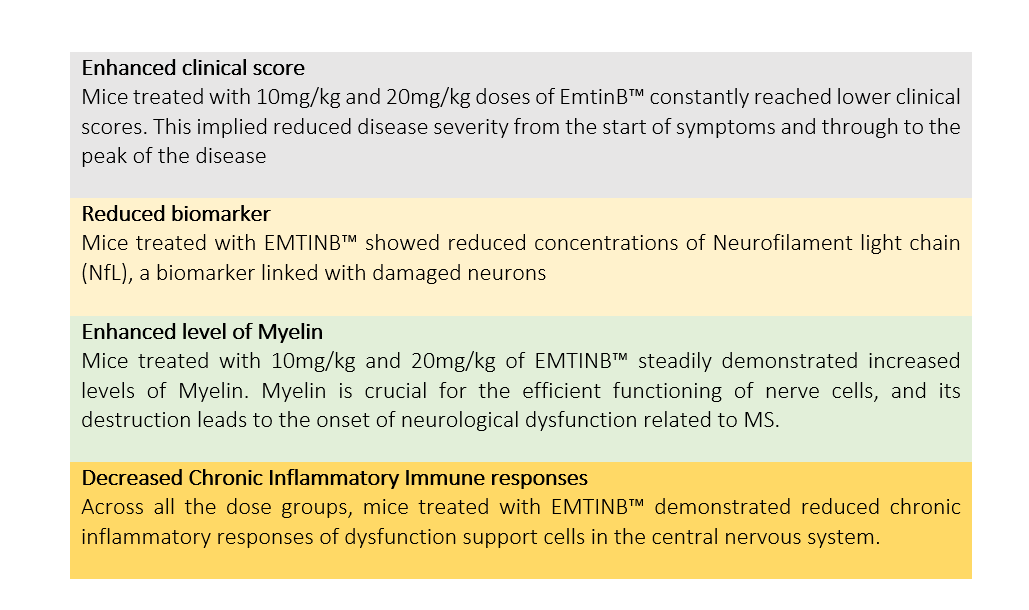

Following are the clinical outcomes from the study (comparison with untreated controls)

Commenting on the results, NeuroScientific’s Managing Director and CEO Matt Liddelow said, “The preliminary results from this study conducted in the gold standard animal model for MS are highly encouraging for the development of EmtinB™ as a treatment for MS, in particular the relapse-remitting type of MS in which inflammation is a key driver of symptoms. In comparison to currently marketed MS therapeutics, EmtinB™ has the potential to be a disease-modifying treatment option for MS patients with a much more tolerable side-effect profile.”

The road ahead

NSB will advance a larger study of EMTINB™ based on these positive preliminary results. The company expects full results in mid-2H 2022.

The company has a market cap of AU$25.10 million.

_06_24_2025_03_45_59_650550.jpg)