Summary

- The stocks of IAG and REA Group stayed on extreme ends of their respective 52 weeks’ ledger following the release of FY20 results.

- REA Group delivered a resilient performance in FY20 despite COVID-19-driven uncertainty.

- REA Group’s reported net profit marked a rise of 7 per cent to $112.6 million.

- IAG observed a tale of two different halves in FY20, with strong underlying operating performance in 1H20 and softer underlying margin in 2H20.

- IAG witnessed Gross written premium (GWP) growth of 1.1 per cent in FY20, in line with its guidance of low single digit growth.

While developments around COVID-19 pandemic still appear to be ruling the movements in Australian share market, the ongoing earnings season has been dictating the market trend for the past one week.

The Australian benchmark index, S&P/ASX 200 posted a weekly gain of 1.3 per cent as August 2020 earnings season rolled in during the week. Surging commodity prices and increasing value of resources exports drove ASX 200 higher despite prevalence of pandemic-induced restrictions in Victoria.

While S&P/ASX 200 fared better over the week, the index closed the trading session 0.62 per cent down on 7th August 2020, with miners leading the losses. During the day, Insurance Australia Group Limited (ASX:IAG) and REA Group Limited (ASX:REA) caught considerable attention for their FY20 performance updates announced to the market.

The stocks of IAG and REA Group stayed on extreme ends of their respective 52 weeks’ ledger following the release of FY20 results. While IAG’s stock remained closer to its 52-week low level at $5.03, REA Group’s stock inched near its 52-week high level at $113.42 on 7th August 2020.

The stock price movements appear to be closely imitating the companies’ performances in FY20. With that said, let us take a closer look at IAG and REA’s FY20 results for the period ended 30th June 2020:

REA Group Delivers Resilient Performance in FY20

Despite unprecedented market conditions and global uncertainty amid COVID-19 pandemic, international digital advertising player, REA Group Limited (ASX:REA) delivered a resilient performance during the year ended 30th June 2020.

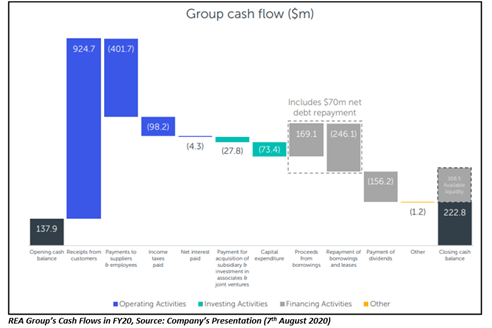

The Group posted a Revenue and EBITDA of $820.3 million (6 per cent ↓ on pcp) and $492.1 million (5 per cent ↓ on pcp), respectively from its core operations in FY20. Moreover, the Group’s reported net profit marked a rise of 7 per cent to $112.6 million over the period.

While the first half result of the Group was impacted by considerable falls in new project commencements and residential listings, the tide took a turn at the start of second half of FY20 with an improvement in national residential listings led by Sydney and Melbourne. However, COVID-19-driven effects emerged in mid-March 2020, knocking down the real estate market in April and May.

As coronavirus restrictions eased in June 2020, the real estate market staged a revival, with new residential listings soaring by 11 per cent Y-o-Y.

Dividend Update: The Group has declared a fully franked final dividend of 55.0 cents per share for the half year ending June 2020, taking its FY20 total dividend to 110.0 cents per share. The total FY20 dividend has been determined based on the Group’s NPAT (Net Profit after Tax) from core operations.

Outlook: Based on existing market outlook, the Group is targeting no increase in its core operating costs during FY21. While it expects its expenditure growth rates to differ between the quarters, it anticipates its core operating costs to stay around 5-10 per cent lower in Q1 FY21 relative to Q1 FY20.

IAG Notes a Tale of Two Distinct Halves in FY20

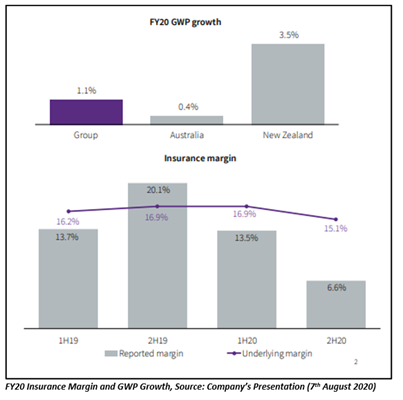

Insurance player, Insurance Australia Group Limited (ASX:IAG) observed a tale of two different halves in FY20, with strong underlying operating performance in 1H20 and softer underlying margin in 2H20.

The Group witnessed Gross written premium (GWP) growth of 1.1 per cent in FY20, in line with its guidance of low single digit growth. The Group’s GWP growth stood at 0.8 per cent in 2H20 and was diminished by an estimated adverse COVID-19 shock of ~$80 million, which reduced reported 2H20 growth by more than 100 basis points.

2H20 saw a deterioration in long tail reserving in Australia, high natural peril activity, extreme volatility in investment market and the additional effect of coronavirus influences on IAG’s results.

While IAG’s GWP margin was in line with its guidance, its FY20 reported margin fell outside pre-existing guidance of 12.5-14.5 per cent to 10.1 per cent. The lower margin was driven by prior period reserving, professional risks and workers’ compensation areas, higher than expected level of natural peril events and credit spread effects.

Dividend Update: IAG has not announced a final dividend for FY20 amid negative cash earnings of more than $100 million in 2H20 that lowered its full year cash earnings to $279 million. The Group’s decision applies to its dividend policy of distributing 60-80 per cent of full year cash earnings, which generates a figure slightly less than the 10 cents per share of interim dividend paid in March 2020.

Based on interim dividend, the Group has already distributed about 83 per cent of its FY20 cash earnings to its shareholders.

Outlook: The Group observes considerable uncertainty around its FY21 financial outlook amid COVID-19-induced impacts on its business and broader economic repercussions. Consequently, the Group has not provided its guidance for FY21.

All in all, August 2020 earnings season is unfurling as a sink or swim test for market’s rally, revealing full-extent of COVID-induced repercussions on ASX-listed businesses.

Note: $ represents AUD in the article unless otherwise stated.