Highlights

- The ASX 200 benchmark index closed down today (11 October), losing 0.34% to end at 6,645.00 points.

- Over the last five days, the index has lost 0.81% and 8.97% over the last 52 weeks.

- Energy was the biggest loser, closing 1.59% lower followed by IT sector which ended 0.96% down.

The S&P/ASX200 closed lower on Tuesday (11 October), losing 22.80 points or 0.34% to end at 6,645.00 points.

Declines in property, energy, and bank sectors outnumbered gains in utilities and industrial companies.

Key pointers from ASX close today

- The ASX 200 benchmark index closed down today (11 October), 22.80 points or 0.34% to end at 6,645.00 points.

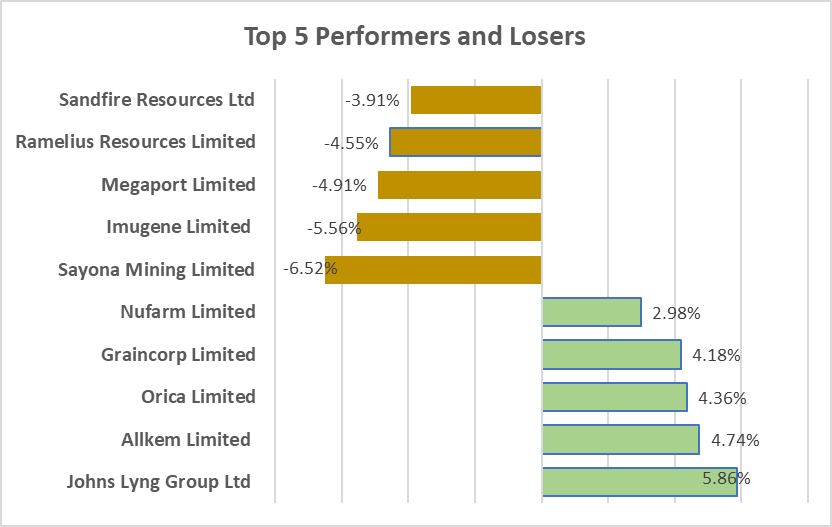

- Johns Lyng Group Ltd (ASX:JLG) and Allkem Limited (ASX:AKE), gained the most on the index, closing 5.86% and 4.74% strong respectively.

- On the benchmark index, Sayona Mining Limited (ASX:SYA) and Imugene Limited (ASX:IMU), marked most of the losses, ending 6,52% and 5.56% lower respectively.

- Over the last five days, the index has lost 0.81%, while it has plunged 8.97% over the last 52 weeks.

- Nine out of 11 sectors closed in red today.

- Energy was the biggest loser, closed 1.59% lower followed by IT sector which ended 0.96% down.

- Volatility indicator A-VIX index was up 3.48% at 4.55 PM AEDT.

- The All-ordinaries Index fell 0.40%.

Newsmakers

BPH Energy (ASX:BPH): In order to fund its investment in clean hydrogen technology and the development of oil and gas projects, BPH Energy (BPH) is planning to raise AU$1.196 million through a private share placement.

To raise the money, the company would issue roughly 66 million additional shares at 1.8 cents each, a 21.7% reduction from its most recent closing price on October 6.

Meanwhile, shares of BHP closed at AU$39.92 per share, down 0.37% on ASX today.

Halo Food Co (ASX:HLF): The MD and CEO of Halo Food Co. (HLF) has submitted his resignation.

Jourdan Thompson, who now serves as CFO, will take over as CEO as he has gained extensive experience of the Halo business.

Meanwhile, shares of Halo Food closed trading at AU$0.045 per share, down 2.17% on ASX today.

Image Source: © 2022 Kalkine Media ®

Data Source - ASX website dated 11 October 2022

Bond yield

Australia’s 10-year Bond Yield stands at 4.04% as of 5.00 PM AEDT.

In global markets

US markets sank for a fourth session on Monday (10 October) with the S&P 500 felling 0.75% to 3,612.39. The Dow Jones was down 0.32% to 29,202.88. The NASDAQ Composite lost 1.04% to 10,542.10, and the small-cap Russell 2000 fell 0.60% to 1,691.92.

In Asia, the Asia Dow was 2.58% down, Nikkei in Japan decreased by 2.59%, the Hang Seng in Hong Kong fell 1.70% while Shanghai Composite in China gained 0.16% at 5.06 PM AEDT.

In commodities markets

Crude Oil WTI was spotted trading at US$90.53/bbl while Brent Oil was at US$96.08/bbl at 5.08 PM AEDT.

Gold was at US$1667.31 an ounce, copper was at US$3.445/lbs and iron ore was at US$98/T at 5.08 PM AEDT.