Highlights

- The ASX 200 benchmark index closed in red today (November 10), losing 35.30 points or 0.50% to end at 6,964.00 points.

- Over the last five days, the index has gained 1.55%, but is down 6.46% for the last year to date.

- Utilities was the biggest gainer, advancing 13.15% followed by Healthcare which ended 0.91% up.

The ASX 200 benchmark index closed in red today (November 10), losing 35.30 points or 0.50% to end at 6,964.00 points.

Key pointers from ASX close today

- The ASX 200 benchmark index closed in red today (November 10), losing 35.30 points or 0.50% to end at 6,964.00 points.

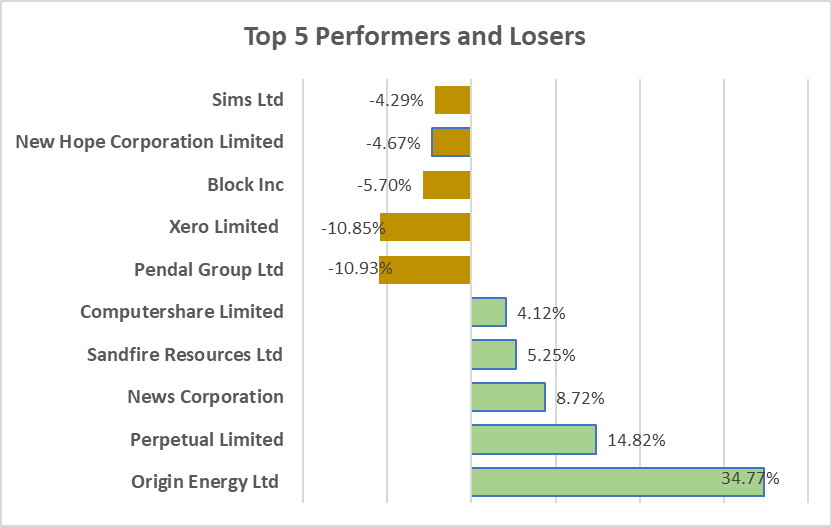

- Origin Energy Ltd (ASX:ORG) and Perpetual Limited (ASX:PPT) gained the most on the ASX today, moving ahead 34.77% and 14.82% respectively.

- Pendal Group Ltd (ASX:PDL) and Xero Limited (ASX:XRO) fell 10.93% and 10.85% respectively.

- Over the last five days, the index has gained 1.55%, but is down 6.46% for the last year to date.

- Six out of 11 sectors closed in red today.

- Utilities was the biggest gainer, advancing 13.15% followed by Healthcare which ended 0.91% up, while energy falls 2.07%.

- The All-Ordinaries Index fell 0.58%.

Newsmakers

Iceni Gold (ASX:ICL): At its 14 Mile Well project near Laverton in Western Australia, Iceni Gold has found a two-kilometer-long gold anomaly through Ultrafine (UFF+) soil sample operations, the company said in an ASX filing today (10 November).

A substantial 2 km long gold soil anomaly has been found after analysis of the UFF+ soil programme results. Burges Bore - 14UF016-8, a soil anomaly, is situated close to the Guyer Well Target Area.

Meanwhile, shares of Iceni Gold closed trading at AU$0.058 each, down 1.69% on ASX today.

MinRex Resources (ASX:MRR): Through an ASX filing, MinRex Resources Limited today (10 November) reported the start of RC drilling at the North Moolyella Lithium-Tin-Tantalum Project close to Marble Bar.

There will be 40 RC drillholes in the initial drilling phase, with a total length of about 2,700m. The southern half of E45/5873's western and eastern zones, which are contained within significant lithium geochemical zones, will be the first to be explored by drilling because MinRex has identified extensive stacked sheeted pegmatites there.

Meanwhile, shares of MinRex closed trading flat at AU$0.042 apiece on ASX today.

Image source: © 2022 Kalkine Media®

Data source- ASX website dated 10 November 2022

Bond yield

Australia’s 10-year Bond Yield stands at 3.73% as of 4.32 PM AEDT.

In global markets

The main indices of Wall Street registered losses as the crucial midterm elections failed to deliver gains for opposition Republicans.

The S&P 500 lost 2.08% to 3,748.57. The Dow Jones was 1.95% down to 32,513.94. The NASDAQ Composite fell 2.48% to 10,353.18, and the small-cap Russell 2000 decreased 2.68% to 1,760.40.

In Asia, the Asia Dow was 1.27% down, Nikkei in Japan fell 0.96% while the Hang Seng in Hong Kong lost 1.75% and Shanghai Composite in China decreased by 0.53% at 4.16 PM AEDT.

In commodities markets

Crude Oil WTI was spotted trading at US$85.89/bbl while Brent Oil was at US$92.46/bbl at 4.18 PM AEDT.

Gold was at US$1710.51 an ounce, copper was at US$3.72/Lbs and iron ore was at US$91.50/T at 4.18 PM AEDT.