Highlights

- The ASX 200 benchmark index closed in red today (November 14), losing 11.70 points or 0.16% to end at 7,146.30 points.

- Over the last five days, the index has gained 3.07%, but is down 4.01% for the last year to date.

- Materials was the biggest gainer, advancing 3.43% followed by energy which ended up 0.87%, while industrials fell 2.39%.

The ASX 200 benchmark index closed in red today (November 14), losing 11.70 points or 0.16% to end at 7,146.30 points.

Key pointers from ASX close today

- The ASX 200 benchmark index closed in red today (November 14), losing 11.70 points or 0.16% to end at 7,146.30 points.

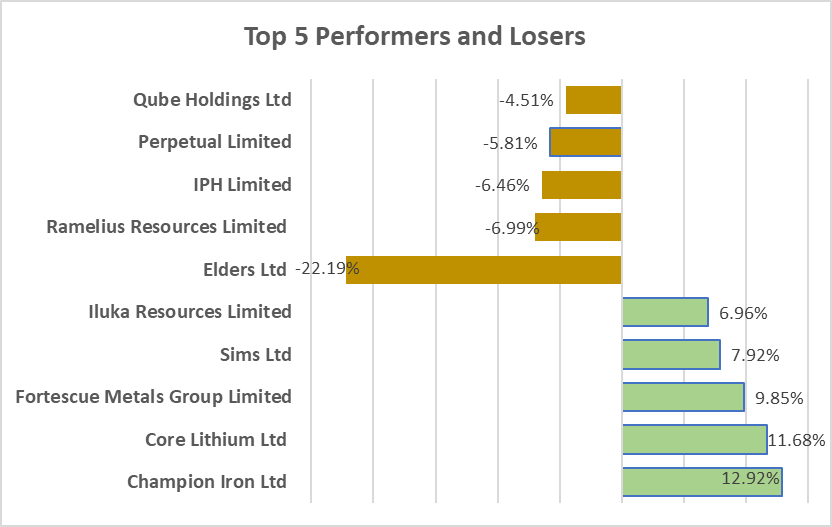

- Champion Iron Ltd (ASX:CIA) and Core Lithium Ltd (ASX:CXO) gained the most on the ASX today, moving ahead by 12.92% and 11.68%, respectively.

- Elders Ltd (ASX:ELD) and Ramelius Resources Limited (ASX:RMS) fell 22.94% and 6.56%, respectively.

- Over the last five days, the index has gained 3.07%, but is down 4.01% for the last year to date.

- Nine out of 11 sectors closed in red today.

- Materials was the biggest gainer, advancing 3.43% followed by energy which ended up 0.87%, while industrials fell 2.39%.

- The All-Ordinaries Index gained 0.0014%.

Newsmakers

Leo Lithium (ASX:LLL): To advance stage one of the Goulamina lithium project in Mali, Leo Lithium has expanded its relationship with engineering and project delivery consultant Lycopodium Minerals, according to an ASX filing.

The AU$22.7 million contract for engineering and procurement (EP) and related project management (PM) services, to be completed over the ensuing 18 to 24 months, has been entirely executed by Lycopodium.

Meanwhile, Leo Lithium's shares closed 4.24% higher at AU$0.62 each on ASX today.

Azure Minerals (ASX:AZS): The West Pilbara region of Western Australia is home to the Andover Project, which is being rapidly assessed for its lithium potential by Azure Minerals Limited.

Together, Azure Minerals and the Creasy Group's private company Croyden Gold hold the lithium project.

Meanwhile, Azure Minerals' shares closed 1.82% lower at AU$0.27 each on ASX today.

Image source: © 2022 Kalkine Media®

Data source- ASX website dated 14 November 2022

Bond yield

Australia’s 10-year Bond Yield stands at 3.77% as of 4.12 PM AEDT.

In global markets

Following pro-growth events in China after the previous week, miners and energy producers set the pace. Supermarkets, healthcare organisations, and other conventional defensive assets decreased as investors switched to industries with greater potential for growth in recovery. The S&P 500 gained 0.92% to 3,992.93. The Dow Jones was 0.096% up to 33,747.84. The NASDAQ Composite jumped by 1.88% to 11,323.33, and the small-cap Russell 2000 increased by 0.79% to 1,882.74.

In Asia, the Asia Dow was 3.86% up, the Hang Seng in Hong Kong gained 2.60%, and Shanghai Composite in China increased by 0.43%, while Nikkei in Japan fell 0.80% at 4.16 PM AEDT.

In commodities markets

Crude Oil WTI was spotted trading at US$89.15/bbl, while Brent Oil was at US$96.03/bbl at 4.18 PM AEDT.

Gold was at US$1761.82 an ounce, copper was at US$3.93/Lbs, and iron ore was at US$93.50/T at 4.18 PM AEDT.