Highlights

- The ASX 200 benchmark index closed 1.23% lower to end at 6,474.20 points.

- Over the last five days, the index has lost 1.53% and has shed 11.70% over the last 52 weeks.

- Industrials, incurring the most losses, closed 3.04% lower while consumer discretionary closed 2.72% down.

- Materials sector managed to post some gains, closed 0.67% up on ASX today.

Australian share market closed on a negative note today (30 September 2022) with the benchmark S&P/ASX 200 losing 1.23% to end at 6,474.20 points (as of 4:17 PM AEST).

Key pointers from ASX close today

- The ASX 200 benchmark index closed 1.23% to end at 6,474.20 points.

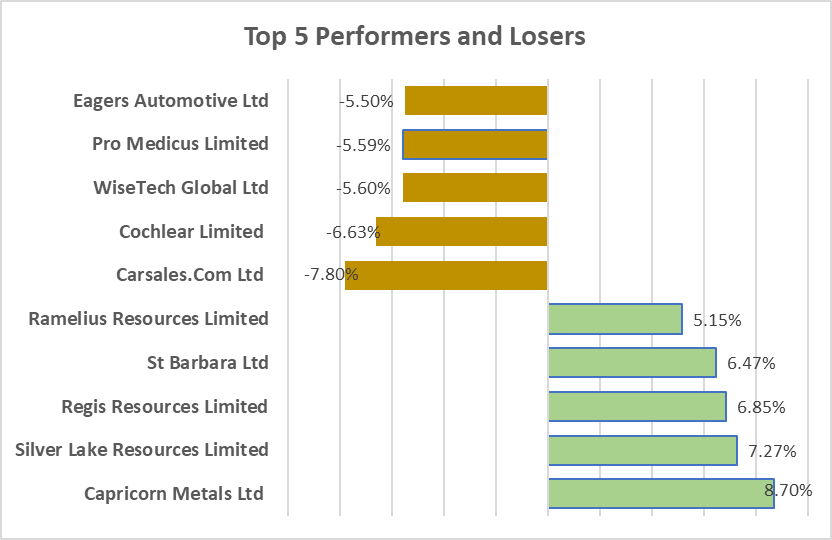

- Capricorn Metals Ltd (ASX:CMM) and Silver Lake Resources Limited (ASX:SLR) closed 8.33% and 7.272% higher respectively.

- Com Ltd (ASX:CAR) and Cochlear Limited (ASX:COH), ended 7.598% and 6.820% lower respectively.

- Over the last five days, the index has lost 1.53% and has gone down 11.70% over the last 52 weeks.

- Nine out of 11 sectors ended the day in red zone.

- Industrials, incurring the most losses, closed 3.04% lower while consumer discretionary closed 2.72% down.

- Materials sector managed to post some gains, closed 0.67% up on ASX today.

- Volatility indicator A-VIX index was 10.30% up at 4.17 PM AEST.

- The All-ordinaries Index fell 1.21%.

Newsmakers

Stanmore Resources (ASX:SMR): The Australian Foreign Investment Review Board (FIRB) has given Stanmore Resources the go-ahead to buy Mitsui's remaining 20% stake in BHP Mitsui Coal.

BHP Mitsui Coal, a Mitsui subsidiary, has changed its name to Stanmore SMC and will now be owned entirely by Stanmore.

Meanwhile, shares of Stanmore Resources closed 0.934% higher at AU$2.160 per share on ASX today.

AXP Energy (ASX:AXP): In its pipeline of US projects, AXP Energy (AXP) has reported a "substantial" growth in reserves and contingent resources.

The company reported a 2% rise in proven reserves, which it ascribed to oil production-related workover and pipeline projects.

Meanwhile, shares of AXP Energy closed at AU$0.0050 per share, up 25% on ASX today.

Image Source: © 2022 Kalkine Media ®

Data Source- ASX website dated 27 September 2022

Bond yield

Australia’s 10-year Bond Yield stands at 3.95% as of 4.11 PM AEST.

In global markets

On Thursday, 29 September, the key US indices finished the day down as investors' confidence appeared to have been impacted by worries about economic growth. On the other hand, the market's mood had also been affected by the treasury yields' reversing path.

The mounting concerns regarding an economic slowdown brought on by the central bank's aggressive efforts to control inflation have impacted the general atmosphere, and investors seem to be keeping their distance from risk-bet stocks while remaining on the sidelines.

The S&P 500 fell 2.11% to 3,640.47. The Dow Jones was down 1.54% to 29,225.61. The NASDAQ Composite lost 2.84% to 10,737.51, and the small-cap Russell 2000 fell 2.35% to 1,674.93.

In Asia, the Asia Dow was down 2.57%, Nikkei in Japan fell 2.05% and Shanghai Composite in China lost 0.26% while the Hang Seng in Hong Kong increased by 0.22% at 4.11 PM AEST.

In commodities markets

Crude Oil WTI was spotted trading at US$81.12/bbl while Brent Oil was at US$88.29/bbl at 4.11 PM AEST.

Gold was at US$1667.65 an ounce, copper was at US$3.461/lbs and iron ore was at US$101/T at 4.12 PM AEST.