- Troy Resources is moving ahead with its recapitalisation plan of issuing 16 million shares to raise AU$0.35 million in the June quarter.

- Troy divested its non-core mining rights in Brazil to raise US$4 million in staged payments.

- TRY’s Annual General Meeting is scheduled for 25 July for the approval of the recapitalisation transaction.

- Barrick Gold continues its exploration activities pursuant to the Karouni Earn-in Agreement.

ASX-listed gold miner Troy Resources Limited (ASX:TRY) is committed to re-starting gold production from its Karouni Gold Project. Troy is moving forward with its recapitalisation plan in the June 2022 quarter and raised AU$0.35 million via the issuance of 16 million shares at AU$0.022 a unit.

Smarts Underground will see the next leg of the development of the Karouni Project. The deposit has an estimated Ore Reserve of 89,000 ounces. Findings of the Pre-Feasibility Study indicate that Troy would require to invest approximately AU$7 million to mine the first ore from the deposit.

To fund development activities on the project, Troy is undertaking a major recapitalisation of the Company. The Board and management drew a major fundraiser plan to reduce the Company’s debt and generate new funds to progress the development work.

Through its debt-to-equity conversion, Troy would convert nearly AU$18.7 million of the current debt into equity. Additionally, TRY would raise approximately AU$7.2 million in new funds through the right issues, placement and convertible notes.

The process of recapitalisation has commenced and the Company is progressing well on it. Troy’s Interim CEO and MD, Mr Richard Beazley, feels the reducing debt burden would help in strengthening the financial position of Troy and benefit the Company’s shareholders and other stakeholders.

During the reporting period of the three months ending on 30 June 2022, the Karouni Processing Facility remained under care and maintenance.

Earn-in agreement with Barrick Gold

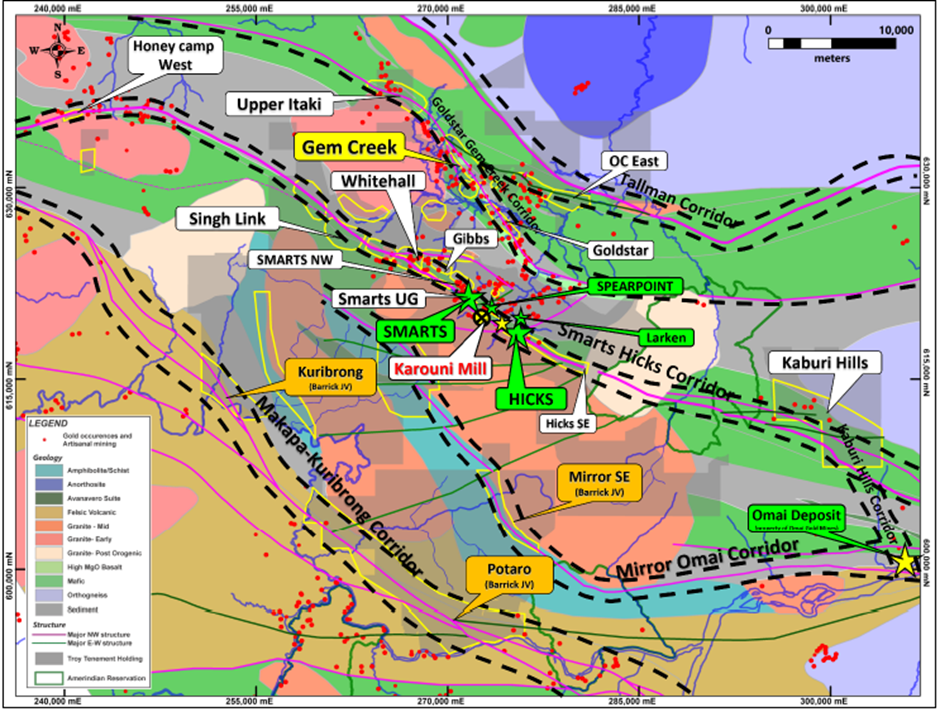

Troy has increased its footprint in the region over the years. The Company had acquired a sizeable tenement package adjacent to the Karouni Project area. Potaro, Kuribrong, Mirror and Mirror SE, are the additional tenements Troy has acquired in the region with an aim to increase the Company’s resources in the country. Troy inked an Earn-in Agreement with Barrick Gold to lead exploration activities on these prospects.

Karouni Gold Project (Image source: TRY update, 24 Jan 2022)

Troy had offered exclusive rights to earn a 51% interest in the exploration tenements. In lieu of 51% interest, Barrick must bear expenses of exploratory operations alone on the tenement.

The agreement with Barrick provides hedging to Troy's commercial interests and allows it to collaborate with world-class gold explorers and producers. According to Troy's recent updates, Barrick’s exploration activities were focused on the Potaro area. The gold major undertook geological mapping, rock chip sampling and air core drilling over the area.

Lease and Assignment of Mineral Rights in Brazil

Troy, through its wholly owned subsidiary Reinarda Mineração Ltda (RML), operated one iron ore mineral right in Brazil. During the quarter, the Company decided to lease and assign the mining rights to PST Empreendimentos e Participações Ltda (PST) as it was a non-core asset for Troy.

Troy, through its Brazilian subsidiary, has signed a Definitive Agreement with PST for the purpose to raise total proceeds of US$4 million, to be paid in six instalments. Troy had already received the first tranche of US$200K from the deal.

To read more about the deal, click here.

The fund raised through the iron-ore licence deal would be used for the development of the Smarts Underground deposit and other corporate affairs. The Company’s Annual General Meeting is scheduled for 25 July 2022. The objective is to secure the approval of the shareholders for recapitalisation transactions.