Highlights

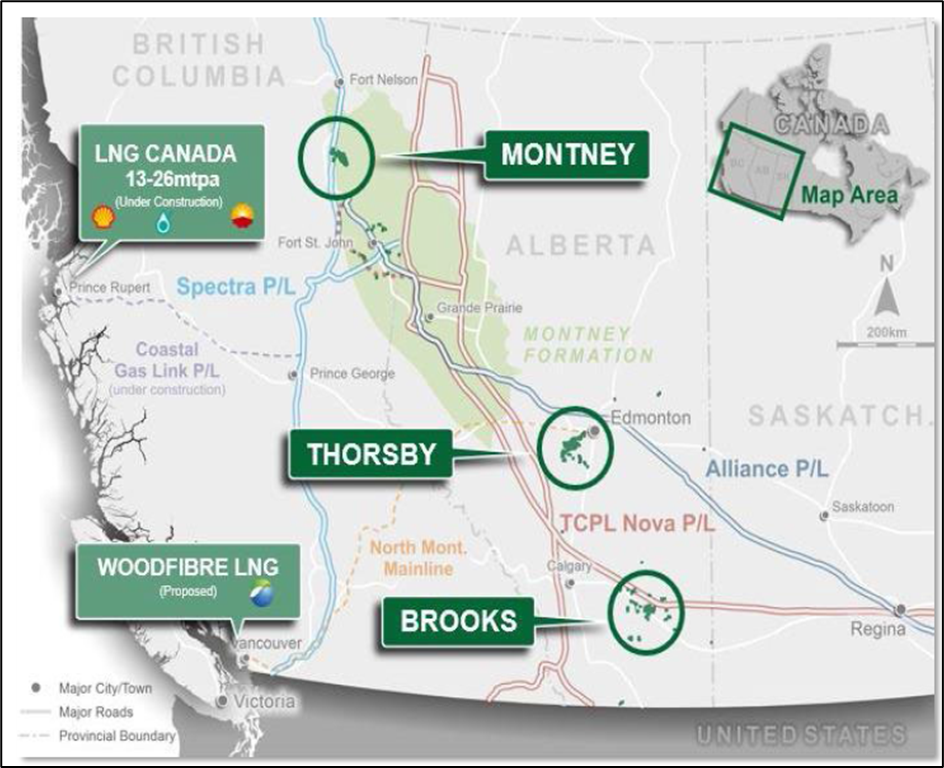

- Calima Energy is ramping up its operational activities on producing assets in the Brooks and Thorsby area.

- The company achieved the highest-ever quarterly revenue for the period ended 30 June 2022.

- CE1 expects to achieve a production level of 4,150 boe/d for the September 2022 quarter.

Calima Energy Ltd (ASX: CE1 | OTCQB: CLEMF) is implementing strategies to tap significant growth opportunities amid strong crude oil prices.

The Canadian oil & gas producer recently announced the expansion of land acreage adjacent to its producing assets in the Brooks area. The move demonstrates the company’s commitment to boost its production through the acquisition of new assets.

Meanwhile, the company remains focused on an aggressive development plan for its producing assets in the Brooks and Thorsby area in Alberta, Canada.

For more details on Calima’s strategy, click here.

Asset Location (Image source: CE1 Presentation, July 2022)

Recent performance points to strong financial metrics

Calima reported another successful and strongly profitable quarter for the period ended 30 June 2022.

The company registered record operating revenues of over AU$37 million and adjusted EBTDA of AU$22.6 million. Free cash flow stood at AU$3.7 million, representing a turnaround from (AU$3.57 million) in previous quarter.

Calima has also announced plans to commence a half-yearly dividend program, starting from 2H 2022. The company intends to pay a dividend of AU$2.5 million, which equates to an annualised yield of nearly 5%.

Moreover, to boost the share price performance and generate substantial returns for its shareholders, Calima initiated a share buyback scheme. The company intends to buy back up to 10% of its issued capital. The company believes that its shares are trading at a substantial discount, and the step could improve return on equity, cash flow per share and earnings per share for all shareholders.

Calima had purchased 4,551,521 shares as of 26 July 2022.

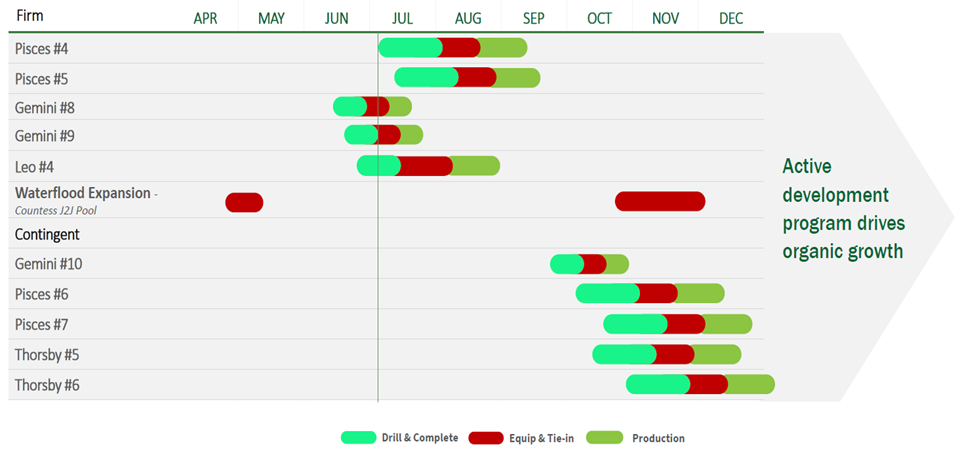

Extensive drilling program to further boost production

Calima’s drilling plans through Q3 are expected to enable a production level of approximately 4,150 boe/d through the September quarter of 2022.

Calima recommenced its development drilling campaign in 2022. The company drilled six wells in the Brooks area and one Thorsby well in the first quarter of 2022. Four new wells were drilled, and one additional well was fractured in the subsequent period.

The wells drilled in the Brooks area targeting the Sunburst conventional play have a payout period of ~8 months. While the fracture-stimulated Glauconitic play wells have a payout period of ~13 months, the payback period depends highly on the price of crude oil and natural gas in the international market. The mentioned payback periods are calculated at a WTI price of US$85/bbl.

Calima’s 2022 drilling program

Image source: CE1 Presentation

How is Calima fulfilling its commitment to responsible operations?

Calima claims that reservoirs in the Brooks and Thorsby assets characterise low CO2 with an average of less than 2%. As a result, it produces a very low CO2 volume and will save considerable costs in the future purchase of carbon credits.

The wells drilled in the Brooks area do not require hydraulic fracturing, thus limiting the use of water. Also, Calima’s development plan involves multiple wells from a single well pad, which lowers the overall environmental footprint of the company.

Proper decommissioning of oil & gas wells is important for the environment as any miss can lead to leakages and cause pollution. Calima plans to decommission 10-15 wells in 2022.

Calima has also invested in the proprietary H2Sweet regenerative reagent H2S removal process. The process aids in reducing CO2 emission rates at Brooks.

All in all, Calima Energy is a returns-focused growth oil & gas producer with top-tier assets, positive cash flow and an ESG-goal orientated.

CE1 shares were trading at AU$0.135 midday on 24 August 2022, up more than 12% from the last close.