Acquisitions help companies in expanding operations, selling their products to new customers and penetrating into new markets and geographical locations. All these things are basically the sources of revenue synergies.

Role of Revenue synergies in Acquisition

Revenue synergy is one of the major attractions of acquisitions. When two companies join hands to develop competencies in line with their business interests, they are able generate more revenues than they would generate separately. In the process, they are also able to reduce the overall cost of their operations, thereby generating cost synergies as well. Both revenue and cost synergies plays an important role in acquisition rationale. Further, the already established networks and clients of acquired businesses helps companies to sell more products and services, resulting in increased combined revenues.

Identifying Revenue synergies

While acquiring a business, it is the duty of the companyâs Management to identify and locate the expected synergies. These expected synergies play vital role in the valuation of acquisitions. Before acquiring a business, a company should have an estimate of how much money it can earn from the acquisition so that it can take the right decision while paying for the acquisition.

In order to identify the expected synergies, management should carefully analyse the operations of the business that is getting acquired. Before taking any decision, Management must learn about the verticals, clients, markets, products, sales force of the business which is getting acquired.

Methven Ltd Acquisition by GWA

Only a few months back, leading Australian supplier of building fixtures, GWA Group Limited (ASX: GWA) acquired Methven Ltd, a leading New Zealand-based designer and manufacturer of showers, taps and valves, strengthening GWAâs core Australia/New Zealand business while enabling GWA to leverage Methvenâs presence in international markets to accelerate growth opportunities. This is a classic example of how acquisitions helps in expanding operations and scale. GWA is now leveraging its leading market position to rebuild Methven momentum in Australia as well as in New Zealand markets.

For the year ended 30 June 2019, Methvenâs pro-forma revenue was $95.1 million compared to $94.7 million for the prior year. Further, its Pro-forma EBIT was $6.6 million compared to $9.8 million in FY18. The decline in housing activity, particularly in the second half of the year, and delayed new product development, impacted Methvenâs FY19 performance.

Rationale Behind Methven Acquisition

GWA Released its AGM presentation today wherein it highlighted the rationale behind Methven acquisition. GWA highlighted the following points at the AGM:

- This acquisition accelerates GWAâs strategy to deliver superior water solutions;

- The acquisition also strengthens GWAâs position in Bathrooms and Kitchens market across Australia and New Zealand;

- It increases GWAâs market share in Taps segment in Australia from ~12% to ~20%;

- It also increases exposure to the attractive renovation and replacements market to ~59% globally

- Provides a platform for international growth to diversify earnings base

- Significant synergy opportunity with at least NZ$5 million expected by FY21.

The company believes that GWA and Methven are an excellent fit of two like-minded companies. Their combined talent, know-how and intellectual property are expected to develop new products and solutions, in line with GWAâs strategy to deliver further value for its customers and shareholders.

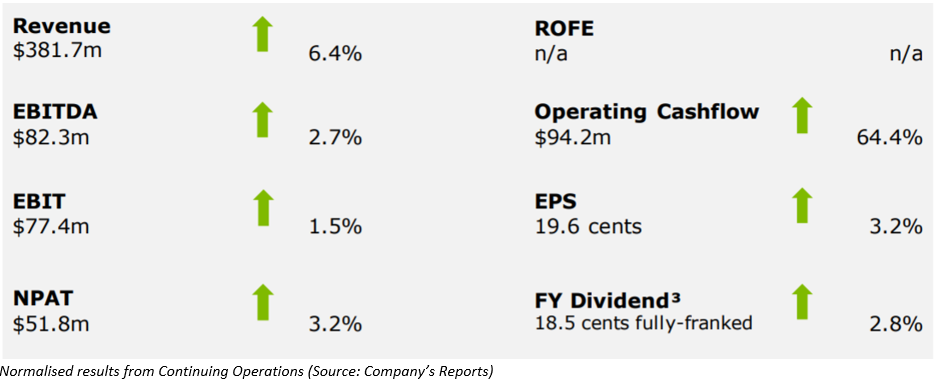

GWAâs Solid FY19 financial Results

Post the acquisition of Methven, GWA remained in a strong financial position and continued strong performance in operating cashflow. Including Methven operations, the company earned revenue of $381.7 million with NPAT of $51.8 million. If Methven operations are excluded, GWAâs revenue is $358.7 million and its NPAT is around $51.6 million.

Excluding Methven, GWAâs normalised EBIT from Continuing Operations was $76.4 million which is consistent with the guidance provided at the half year result in February 2019. During FY19, the companyâs net debt increased to $97.7 million, reflecting the acquisition of Methven which was funded from GWAâs existing debt facilities.

At the AGM, the company also highlighted its continued progress toward strategic initiatives. Significant strategic initiatives taken in FY19 are as follows:

- Joint business planning in B&K drives enhanced ranging / showroom presence

- Trade and Retail sales team targeting merchants to access core Residential R&R opportunity with a separate dedicated team targeting secondary Commercial customers including Commercial R&R and Aged Care

- Strong traction and market engagement from launch of Caroma Smart Command® (connected smart bathroom solutions)

- Strengthening consumer engagement in key markets

- Opportunity for GWA / MVN collaboration on shower and tapware NPD

- $9 - 12m cost out programme FY19 - FY21 on track for margin management and re-investment in core business â $3m delivered in FY19

- Expect at least NZ$5 million cost synergies from Methven integration by FY21

- Innovation & Distribution Centre (Prestons, NSW) delivering reduced inventory and improved customer service

FY20 Market Outlook for GWA

GWA has stated that it will continue to drive revenue synergies with Methven in FY20 and is implementing customer and consumer programs to win market share in both ANZ and international markets across FY20. Methven integration synergies are currently tracking ahead of expectation. It is expected that it will deliver at least $3 million in FY20 of the NZ$5 million synergy target to FY21.

GWA believes that it is now a stronger, more focused business following the divestment of the Door & Access Systemsâ business and the subsequent acquisition of Methven. In terms of revenue opportunities, GWA is focused on increasing market share through its focus on renovation across both commercial and residential segments; customer value add and consumer engagement initiatives; growing Methven in Australia and New Zealand by leveraging GWAâs scale and customer relationships.

The company intends to drive Methven and Caroma revenue opportunities in Asia and the United Kingdom. In addition, it will continue to expand and invest in Caroma Smart Command® across all markets.

Stock Performance

At market close on 25 October 2019, GWAâs stock was trading at a price of $2.990, down by 3.859% intraday, with a market cap of around $820.88 million. In the last one year, the companyâs stock provided a return of 16.48% as on 24 October 2019. The stock has a 52 weeks high price of $3.790 and 52 weeks low of $2.490 with an average volume of ~1,035,587.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.