Red Sky Energy Limited (ASX: ROG) is a hydrocarbon explorer and developer. The company was founded in 2001 and deals in exploration, development and acquisition of vital oil and gas resources. ROGâs HQ is based in Melbourne.

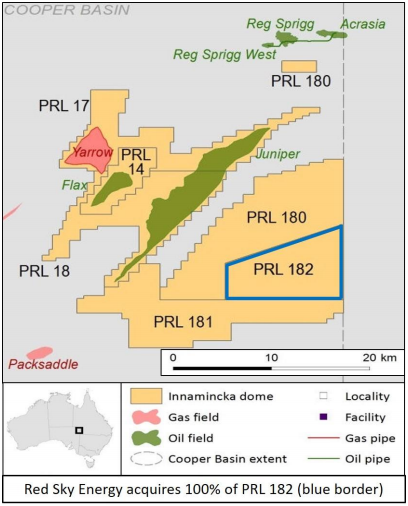

At present, the company is developing the Innamincka Dome Project, consisting of a portfolio of six petroleum tenements, which are high prospective, situated in northeast South Australia, near Innamincka. ROG holds 100% interest in PRL14 (Flax oil field), PRL17 (Yarrow gas field), PRL18 (Juniper oil field), PRL180, PRL181 and PRL182.

Apart from this project, ROG holds complete interest in the Gold Nugget gas production asset in Wyoming, USA. By targeting onshore and offshore Australasia and South East Asia, ROG aims to acquire near field development assets.

Tenements of the Innamincka Dome Project (Source: Companyâs Report)

On 20th May 2019, the company announced that via its wholly-owned subsidiary, Red Sky (NT) Pty Ltd, it has been granted a Ministerial consent and transfer of the remaining 25% in PRL182, from the Bengal Energy (Australia) Pty Ltd. The PRL182 is part of the six Innamincka Dome licences. After this consent, ROG has 100% ownership across the six tenements of the project.

The company executed a conditional sale and purchase agreement (SPA), with Acer Energy Pty Ltd, a Beach Energy Limited (ASX: BPT), in July 2018, in order to acquire operating interest in these permits. After the agreement with Bengal Energy, ROG had entered into conditional agreements for the 100% acquisition of the stake in all the permits.

The terms of this grant were announced on 24th October 2018. According to this announcement, the company had entered into a conditional Sale and Purchase Agreement with the Bengal Energy (Australia) Pty Ltd. The Bengal Energy (Australia) Pty Ltd is a Bengal Energy Ltd subsidiary. The terms of the SPA were as follows:

- Red Sky would acquire a 25% interest in PRL182 and all associated JV properties.

- $1 will be paid by the company for the license to be acquired under the SPA.

- The acquisition would be complete subject to certain conditions precedent inclusive of the regulatory approvals and completion of the acquisition of other interests in the Innamincka Dome project from Beach Energy Limited.

- Wherever the ministerial consent would be required for dealing, parties would have to agree to seek that consent within 180 days of completion. In case of no consent and no alternative agreement, sale and transfer would not be done.

- The obligations of Red Sky (NT) Pty Ltd under the SPA are to be guaranteed by Red Sky.

- The SPA had the imposition of obligations of confidentiality on the parties, warranties from parties and provisions for the limitation of liability.

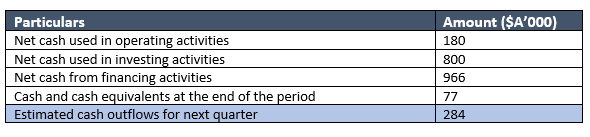

As per the companyâs quarterly report published on 26th April 2019, below are the details of its cash flow statement for the quarter ended 31st March 2019:

Share Price Information:

The companyâs stock closed the dayâs trade flat at $0.002 on ASX as on 20th May 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.