People Infrastructure Ltd (ASX: PPE)

On 19 June 2019, tech-enabled workforce management company, People Infrastructure Ltd (ASX: PPE) notified the execution of agreements to procure 2 Queensland staffing agencies focused in Healthcare; First Choice Care Pty Ltd (First Choice) and Carestaff Nursing Services Pty Ltd (Carestaff).

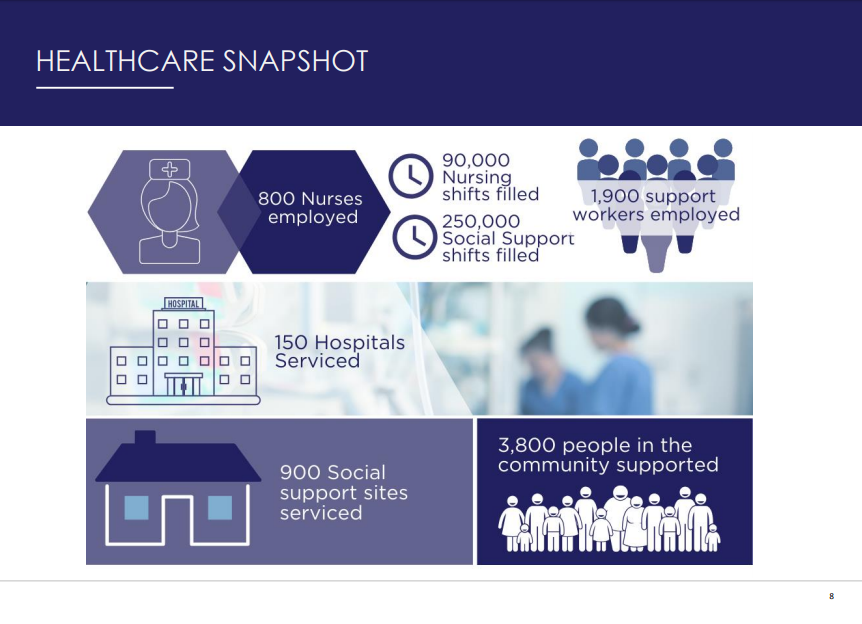

Reportedly, the above-mentioned staffing agencies are the 2 leading providers of nursing staff members at the public and private hospitals along with managing residential aged care across Queensland region.

Furthermore, Carestaff has been leading the staffing space in the Gold Coast region with an experience of 20 years; meanwhile, First Choice is also leading staffing player in Brisbane and the Sunshine Coast along with central and north QLD with an experience of 14 years.

Healthcare Business (Source: Investor Presentation Capital Raising, June 2019)

Healthcare Business (Source: Investor Presentation Capital Raising, June 2019)

Interestingly, People Infrastructure would be the largest provider of staffing service to the healthcare sector in QLD after the acquisition through its brands â First Choice, Carestaff and Edmen Community Staffing Solutions.

As per the release, the combined consideration price for the First Choice & Carestaff would be $16.8 payable at the close, while People Infrastructure expects that the acquisition of both entities would contribute $3.4 million in EBITDA for the next twelve months. Also, PPE expects to complete the procurements in the upcoming weeks, while the transaction related to the First Choice would depend on the approval of third-party change of control.

It is reported, that the consideration would receive the funding from cash reserves, along with capital raised from the $20 million share placement (as notified on 13 June this year).

Also, PPE expects the acquisition to be EPS accretive by FY20, and the company would release the results for FY19 in August 2019.

Declan Sherman, Managing Director of People Infrastructure Ltd, stated that the acquisition represents a logical extension of People Infrastructureâs health and community business in the region, and the prospects of operating synergies and cross-selling opportunities between brands appear very exciting. He also mentioned that the acquisition also places PPE as a leading health and community staffing business in Eastern Australian region underpinned by the brands â First Choice and Carestaff, Network Nursing etc along with leading community care managed workforce provider namely Edmen Community Staffing Solutions.

As mentioned above, on 13 June 2019, People Infrastructure Ltd announced that the capital raising activity had been completed, and the company subsequently raised $20 million via a placement of new fully paid ordinary shares.

In accordance with the release, the placement had to issue ~7.4 million new fully paid ordinary shares in People infrastructure at an issue price of $2.70 per share. Also, the placement witnessed a significant interest from existing and new investors, and the participation in the placement was in excess to the allocation. Importantly, the escalated demand resulted in an increase of capital being raised from $15 million to $20 million.

The release also mentions that the issue price of $2.70 per share, depicts a 6.9% discount to the last traded price $2.90 (per the 13 June 2019âs release) and the issue price also represents a 6.47% discount to the previous 5-day VWAP ($2.89).

It was also reported that the capital raised by the placement facility would be used to facilitate the acquisitions and the cost associated with the placement. It had been reported that the company has a strong pipeline of strategic acquisitions to be made in future, in the health and community care business.

On 20 June 2019, PPEâs stock was trading at A$3.270 (as on 20 June 2019, 12: 47 PM AEST). The return of the stock in the past one year is +92.64% while its year-to-date return is +79.43%. PPE has recorded returns of +24.11%, +33.62% and +74.44% in the past one, three and six months, respectively.

News Corp (ASX: NWS)

Global media giant, News Corp had considered to review its strategic options for News America Marketing (NAM) business, as per the last press release by the company on June 18, 2019.

Source: Companyâs Website

Source: Companyâs Website

News Corp intends to restructure the company and improve shareholder value through a strategic review of its NAM business, while a potential sale is on the cards and other options are being reviewed, reportedly.

It is also reported that the NAM is an established and valuable player in the marketing services industry for various industry participants. Also, News Corp intends to focus on its primary pillars, which include global real estate services and creation, distribution of premium content; the results of the strategic review would help News Corp for its focus on primary pillars. Furthermore, Allen & Company LLC has been retained by the media group as its financial advisor to assist in the review of News America Marketing.

It should be noted that press release also entails that the assurance regarding any actions, transaction or timeline is not guaranteed, and the same level of contingency lies within the possibility of strategic review resulting in a transaction or other strategic change.

Robert Thomson, Chief Executive of News Corp, stated that News Corp believes that the strategic review would enhance the value of shareholder, while streamlining the company to provide better profitability and transparency, and News America Corporation has transformed over the years from a traditional newspaper inserts to one of the leading in-store marketing companies in the US.

About News America Marketing

News America Marketing host a database of millions of shoppers and extensive purchase data to enable retailers and brand partners, to target the appropriate people in the right place and at the right time. NAM has dedicated store marketing media options across the US and Canada in over 60,000 stores; these store marketing media options has a circulation of more than 60 million by nearly 2000 publications reaching households throughout the nation. Sales force of the business employs over 300 people across twelve offices in the US and Canada region.

NWSâ stock was trading at A$20.010, up by 3.571% (on 20 June 2019, 12: 50 PM AEST). The stock of News Corporation has generated a return of -11.17% over the past year, while its year-to-date return is at +19.04%. The returns of the stock in the past six months and one month are +14.73% and +11.16%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.