Ramelius Resources Limited (ASX:RMS) had made an off-market takeover bid for Explaurum Limited (ASX: EXU). In the offer, Ramelius Resources intends to acquire all the ordinary shares of Explaurum Limited of 1 Ramelius share for every 4 Explaurum shares, and with that, the company will also give $0.02 per share cash.

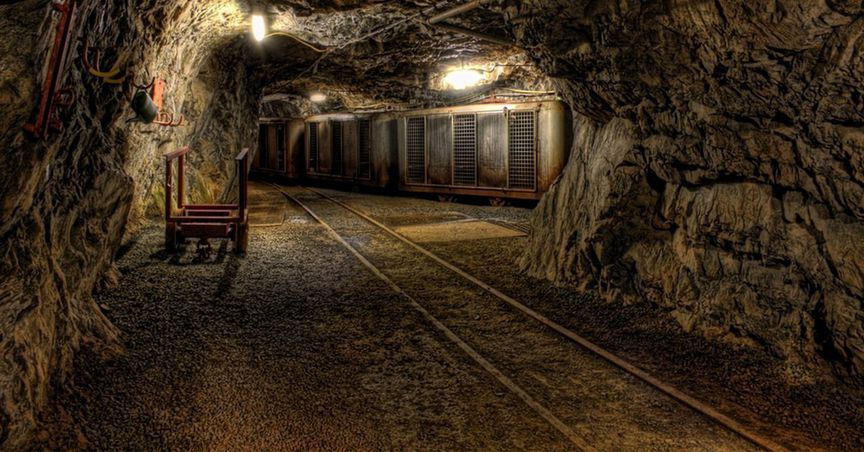

Explaurum Limited is under the mining sector. The company mainly focuses on the gold exploration of the Tampia Gold Project. Explaurum Limited had acquired Tampia Gold Project in September 2015. Ramelius Resources is also a leading gold mining player in Australian mining industry.

Ramelius Resources takeover offer is unconditional, and on 18 December 2018, Explaurumâs independent directors unanimously recommended to its shareholders to accept the offer from Ramelius Resources. Currently, Ramelius Resources owns 79.2% of the ordinary shares in Explaurum Limited.

Ramelius Resources Limited encourages remaining Explaurum shareholders through this announcement to accept their unconditional cash and stock offer without any further delay. Ramelius has also given the following reasons for immediate acceptance of the offer.

- Right now, the offer is unconditional, and the offer provides certainty of value in receiving 1 Ramelius share for every 4 Explaurum Shares, and with that, the company will also give additional $0.02 per share cash.

- Ramelius currently holds 79.2% of the ordinary shares in Explaurum.

- Minority shareholders of Explaurum will face some significant risks, and those risks are:

- Due to this process, liquidity in Explaurum shares will reduce.

- There is a possibility that Explaurum will get delisted from the ASX and it means that the Explaurum shareholders would only be able to sell their shares via an off-market transfer agreement.

Ramelius Resources Limited intends to extend the offer period to 22 February 2019, and the reason for the extension was to give Explaurum shareholders time to accept the offer.

FY18 Financial Performance: The Companyâs total revenue for the year stood at $58,320 in FY18, (over the prior year which was $148,542). The Companyâs total comprehensive loss for the year stood at $1,931,181 in FY18, (over the prior year which was -$1,185,503). The diluted loss per share for the year stood at 0.46 cents per share. In FY18, the company has not declared any dividend for its shareholders. On Balance Sheet front, Net Assets for the year stood at $22,752,700 in FY18, (over the prior year which was $11,906,076). As at 30 June 2018, the company had cash and cash equivalent of $3,389,571 (over the prior year which was $2,354,777).

Stock performance: The shares of Explaurum Ltd closed the dayâs session flat at A$0.145. The market capitalization of the company stands at circa $72.24 Million with approximately 498.22 million outstanding shares. In the time span of the previous six and three months, the stock delivered the returns of 81.25% and 26.09%, respectively. During the last one month, EXU delivered an impressive return of 38.10%.

RMS stock closed the dayâs session at A$0.490, down by 2.97%. It yield a YTD return of 3.06% till date.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.