ASX listed, a biotechnology company, Paradigm Biopharmaceuticals Limited (ASX:PAR) has published its investor presentation. PAR is engaged in developing ethically safe drug for the treatment of musculoskeletal disorders in human.

The company is currently concentrating on repurposing Pentosan Polysulfate Sodium (PPS) (under the name ZILOSUL®) to treat Osteoarthritis (OA), a Blockbuster market, with over 31m sufferers in the US alone. PARâs strategy is to execute partnerships with global pharmaceutical companies for the marketing and commercialization of OA treatment drug, PPS. PAR has concluded on all the necessary components that Big Pharma requires to execute a transaction.

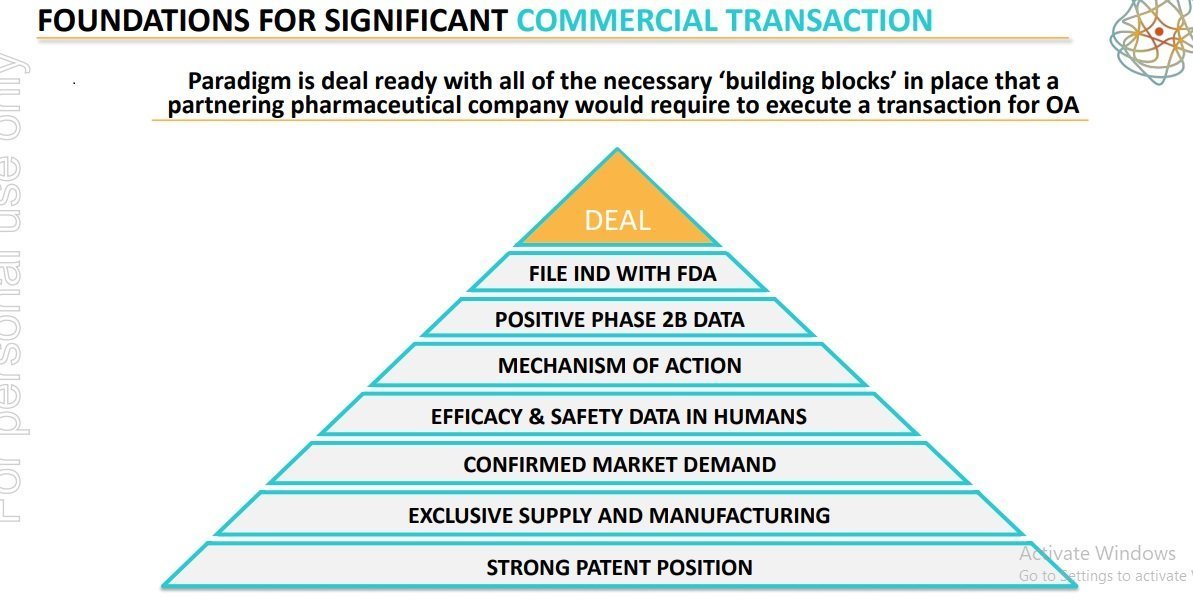

The foundation for the significant commercial transaction has been laid. PAR is deal ready along with all the essential âbuilding blocksâ in place, that a partnering pharmaceutical company would need to implement a transaction for OA.

Source: Company presentation on ASX

Source: Company presentation on ASX

The filing of Investigative New Drug (IND) application with the Regulatory Agency involves:

- Preparation of Phase 3 Clinical Trial protocols.

- Design Phase 3 Clinical Trial.

- Meet with the FDA re-trial design and end-points (pre-IND meeting).

- Lodge IND application with the FDA.

- FDA will generally respond within 30 days â if they do not, the company is free to commence the clinical trial.

Positive Phase 2b clinical trial

In its positive Phase 2b clinical trial, Paradigm demonstrated clinical efficacy in different ways. There was a mean percentage change from baseline in NRS pain. In the Total Population and NRS 4-6 Stratum, Paradigm demonstrated a statistically significant mean change in KOOS Pain, from Baseline versus Placebo at day 39 and day 53.

The new Mechanism of Action (MoA) and PPS role in reducing pain

The company has conducted a non-clinical study to demonstrate the pain reduction MoA of PPS. The study had been concluded, and the manuscript has been sent for peer-review and publication. PAR has registered patent protection on this fresh discovery and trusts this further understanding around the MoA will be instrumental in the commercial development of PPS in OA and other indications.

Efficacy and safety in human beings, positive SAS Data

TGA Special Access Scheme has a Real-World Evidence, where All 183 patients reported on (median age of 56.4 years - range 18 to 84 years) had pain, and failed current standard of care - analgesics, NSAIDs or corticosteroids. The patients were successfully treated. PPSâs excellent and well- known safety profile was re-confirmed by PAR in the treatment of 500, and TGA SAS Patients and 71 patients via PARâs Phase 2a BME and 2b OA clinical trials.

Confirmed market demand

PAR has confirmed market demand for Osteoarthritis and Bone Marrow Edema Lesions (BMEL). OA has a Potential US market for iPPS: US$15bn (knee replacement late stage 3/stage 4) where the cost to the US Economy is greater than US$128bn pa. In November 2018, Paradigm in-licensed the mucopolysaccharidoses (MPS) indication from the Icahn School of Medicine at Mount Sinai, New York. The License includes successful Phase 2a safety and efficacy data.

Exclusive supply and manufacturing

It has an exclusive 20- year supply agreement with bene PharmaChem, which creates the only FDA-approved form of PPS. The bene pharmaChem has been exclusively supplying J&J for more than two decades. PAR is supposed to pay bene pharmaChem, small single-digit royalty on commercial sales.

Strong Patent Position

PAR has strong patents and IP position, and it has patent protection because it is using PPS for new indications. The Minimum life on patents is 2030 and beyond for more recent patents, that is, 2035 â 2040. It has Patents for MPS (global ex-Japan) and Orphan Status and has applied for the patent for Ross River and Chikungunya virus, osteoarthritis and concurrent BMEL.

There is a potential for significant news flow in the short term (less than 6 months)

- OA Phase 2b trial results released. Partnering Discussions Commenced.

- Release Secondary End-point data front the OA Phase 2b trial â Q1/Q2 2019.

- Potential to treat to MPS patients in Australia via the SAS â Q1/Q2 CY2019.

- Up to 50 ex-NFL players in the US to be treated with iPPS for OA pain - Potential for significant media attention if treatment is successful â Q1/Q2 CY2019.

- File IND for Phase 2/3 for Mucopolysaccharidosis (MPS) - Q2 CY2019.

- Further release of patients OA data under the TGA special access scheme throughout 2019.

- File TGA Provisional Approval to sell ZILUSOL (iPPS) in Australia â Q2 CY2019.

- Ross River Phase 2a (safety study) trial results release â Q2/Q3 CY2019.

- File IND and meet with FDA re Phase 3 trial in OA - Q3 CY2019.

- The possibility of being granted âFast Track statusâ for Phase 3 OA trial.

On 7 December 2018, PAR notified the market about the successful trial reports.

The stock of the company is currently trading at A$1.545 (as on 13 March 2019, 3:50 pm AEST), up by 9.964% from its previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.