Material sector comprises of companies involved in the discovery, development, and processing of raw materials. Players involved in operations related to the mining and metal refining, in addition to forestry and chemical products are part of the material sector.

Nufarm Limited (ASX:NUF) is a material sector player that develops and manufactures seeds and crop protection solutions and is the global partner working with farmers, agronomists, and their partners to get more benefit for their land.

NUF updated the market on 30 September 2019 that:

- Nufarm and Japan-based Sumitomo Chemical Company Limited have reached a deal, under which the former would sell its crop protection and seed treatment operations in South American countries including Chile, Brazil, Colombia and Argentina to the latter.

- The deal is valued at $1,188 million in cash, to be carried out on a cash-free, debt-free basis.

- However, the deal does not include Nuseed assets.

- After the deal completion, Nufarm is expected to buy preference securities worth $97.5 million that were issued to Sumitomo in the month of August 2019.

- After entering a supply agreement (2-year) in addition to a transitional services agreement with the Japanese player, NUF is likely to provide procurement services. Moreover, the company would continue to deliver certain products to the South American businesses.

- The Board of Nufarm has unanimously recommended the deal, which is expected to be completed in the first half of FY20.

- However, the deal is subject to shareholder approval, in addition to competition approval by the relevant regulatory bodies in South America.

- With the completion of the deal, Nufarm would operate a global crop protection business (diversified). Additionally, the company will operate a seed technology business. This operation has an attractive commercialisation opportunity for omega-3 canola.

Commenting on the deal, Nufarm Managing Director and CEO, Greg Hunt, stated that the deal would enable the company to redeploy its focus towards other business segments that could help NUF in achieving higher margins as well as robust cash flow.

Let us have a look at other developments of the company.

Change of directorâs interest

Anne Bernadette Brennan acquired 15,156 ordinary shares on 21 August 2019 via the transfer of holdings to BrennanPuren Super Fund.

Placement of Preference Securities and trading update

As notified by the company on 1 August 2019:

- Nufarm Limited had undertaken a placement of $97.5 million of preference securities to existing shareholder and strategic business partner, Sumitomo Chemical Company Limited, through a wholly owned subsidiary.

- A key term of the security emphasises that the securities could be exchanged for Nufarm shares at Sumitomoâs election at an exchange price of $5.85 per Nufarm share any time after 24 months.

Change of Companyâs Secretary

In another update, Ms. Fiona Smith was appointed as the company secretary with effect from 27 June 2019.

Business Simplification

- The company redeployed its capital into businesses where it can generate higher margins and stronger cash flow and increased focus on major agricultural markets in Europe, North America and Asia Pacific.

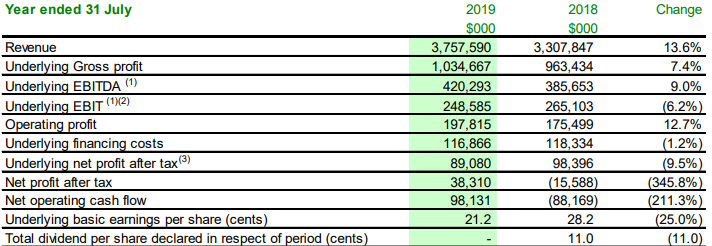

FY19 Financial Performance (as at 31 July 2019)

- During the year, NUF reported net profit after tax of $38 million for FY19 as compared to the prior year loss of $16 million.

- Revenue went up by 14% to $3,758 million with growth in all regions except Australia/New Zealand, partially offset by the impact of increased competition in Latin America, cost pressures in Europe and pricing pressure in North America resulting in a decline in gross profit margins from 29.1% in the prior year to 27.5% in FY19.

- During the year, the underlying net profit after tax went down by 9% primarily due to the impact of a full year of depreciation and amortisation relating to the acquired European portfolios.

- Underlying earnings before interest, tax, depreciation and amortisation (EBITDA) increased by 9% to $420 million with a full year contribution from the European portfolios acquired in 2018 and strong earnings in North America, Seed Technologies and Asia offsetting a weaker performance in Australia New Zealand and flat earnings in Latin America.

- The underlying earnings before interest and tax (EBIT) declined by 6%, primarily due to the inclusion of a full year of depreciation and amortisation for the European portfolios acquired in 2018.

- Financing costs were in sync with the prior year, with higher interest costs offset by lower foreign exchange costs. Underlying interest costs were up by 17% to $107 million, in sync with the higher average debt levels throughout the year.

- Foreign exchange losses slumped by 64% to $10 million as the Latin American hedging costs of approximately $15 million (which were in sync with the prior year), were offset by gains from other foreign exchange exposures.

- The leverage ratio of 2.97 times (slightly better than prior year) reflected a lower net debt and higher earnings.

- During FY19, interest coverage reduced to 3.92 times reflecting the increase in interest costs on higher average debt levels.

- Underlying basic earnings per share declined to 21.2 cents with earnings growth less than the increase in issued equity.

Segment wise Results

- Crop Protection: Sales and earnings increased in all regions except Australia/New Zealand. Herbicide sales increased by 8% to $2.29 billion with growth in phenoxy herbicides offsetting a 3% decline in glyphosate sales due to unfavourable weather conditions in Australia. Other herbicide revenues were up 21% on the prior year with Dicamba, Flumioxazin, Bromoxynil and Fluazifop being the major contributors.

- Seed Technologies: Revenue increased 19% to $221 million, with seed treatment revenues increasing 17% to $98 million and Nuseed revenues increasing 20% to $123 million, driven by higher sales of Sumitomo products in Latin America.

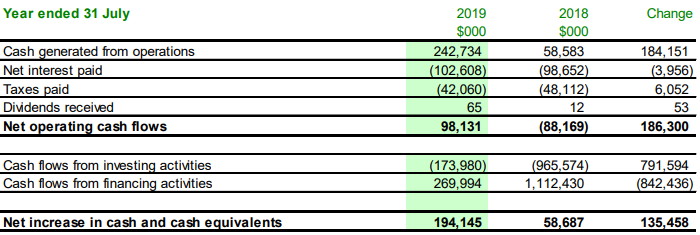

Cash flow

- Net operating cash flows was up by $186 million in FY19 due to higher earnings and a smaller increase in net working capital requirements was witnessed, compared to the prior year.

- Net investing cash flows reduced, with the prior year including the acquisition of product portfolios in Europe.

- The major financing activity during the year was an equity raising that raised net proceeds of $296 million.

Financial Performance: Companyâs Annual Report

Outlook

NUF expects growth in sales, cost saving benefits and improvements in supply chain efficiencies to drive earnings growth in the remaining businesses in 2020. As per its Annual Report, the 2020 outlook would concentrate on:

- The performance improvement program in Australia is forecast to deliver increased earnings before interest, tax, depreciation and amortisation within the range of $10 million to $15 million in 2020.

- The business is well positioned to benefit further from improved weather conditions in Australia and New Zealand.

- The supply issues that impacted product availability in Europe is expected to contribute positively to earnings for 2020.

- The cost of goods is expected to decrease due to the supply conditions in China (the net impact of which would benefit EBIT by $15 million).

- High levels of inventory in sales channels and lower farm incomes are expected to result in competitive market conditions in North America.

- There would be a decline in earnings from Seed Technologies, due to the divestment of the South American seed treatment assets to Sumitomo.

- The company forecasts the net interest expense to range between $105 million and $110 million in 2020 (including an estimated $30 million of interest costs related to the South American businesses that are proposed to be divested).

- The companyâs effective tax rate is expected to be approximately 33% in 2020 and the capital expenditure is forecast to be approximately $150 million.

- Depreciation and amortisation outlook of $190 million includes a full year forecast of $8 million related to the South American businesses.

- Improving working capital efficiency across all regions would remain a key focus for all levels of the organisation with a medium-term target to return to 2018 levels of average net working capital to sales, and in the longer term to return this ratio to the range of 35 to 37%.

Stock Performance

The NUF stock was trading at $6.440 on 3 October 2019 (AEST 12:30 PM), down 0.617% from its previous close, with an annual dividend yield of 0.93%. The market cap of Nufarm Limited is $2.46 billion and the stock has generated 34.44% in the past 6 months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.