Australian Gold producer, Northern Star Resources Ltd (ASX: NST) released its December 2018 quarterly activities report today (i.e., 23 January 2019). In the December quarter, the company sold 210,561 ounces of gold at an AISC (All-in Sustaining Costs) of A$1,365 per ounce. From the Australian operations, the company sold 153,027 ounces of gold at an AISC of A$1,246 per ounce and from the US operations the company sold 57,534 ounces of gold at an AISC of A$1,681 per ounce. As per the announcement, the Company is on track to achieve its FY 2019 production guidance of 850,000-900,000 ounces. Despite this announcement, the share price of the company decreased by 5.543 percent as on 23 January 2019.Â

During the quarter, the companyâs Australian operations were impacted by weather events, but despite that, the companyâs performance was in line with expectations and strong productivity gains were made at its Pogo mine in Alaska. Further, the companyâs Australian operations are on track to meet FY 2019 production guidance of 600,000-640,000 ounces.

During the December quarter, from the Jundee mine, the company mined 67,211 ounces of gold sold 69,403 ounces at an AISC A$1,052 per ounce. At Jundee mine, production was impacted marginally by one-off operational disruptions (weather related) resulting in lower milled tonnes.

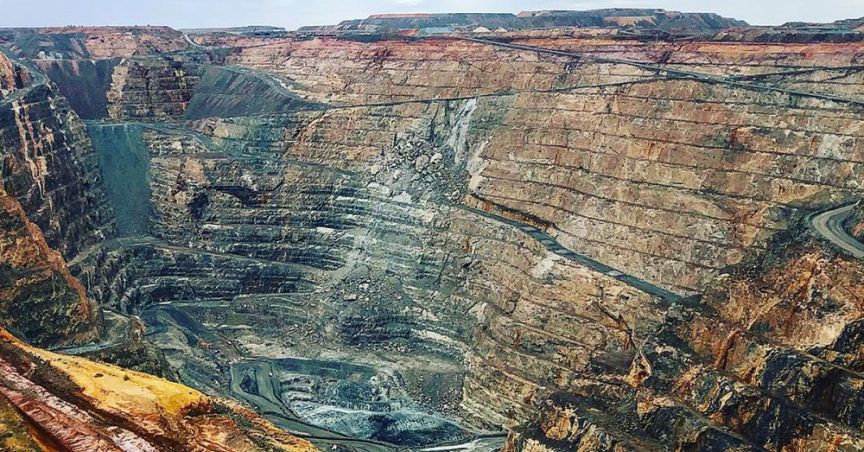

From the Kalgoorlie mine, the company mined 82,500 ounces and sold 83,624 ounces at an AISC A$1,406 per ounce. At Kalgoorlie mine, the higher gold price allowed lower-grade ore to be mined, resulting in development ore tonnes rising 41 percent from September quarter and lower production, which in turn led to higher costs. The FY 2019 cost guidance of Kalgoorlie was increased by A$50 per ounce to AUD$1,190-$1,300/oz, reflecting strategic decision to mine lower grade ore which has given the ability to maintain margins due to the significantly higher gold price.

At the Pogo mine, the company mined 59,219 ounces and sold 57,534 ounces at an AISC A$1,681 per ounce. The Pogoâs FY 2019 production guidance is maintained at 250,000-260,000 ounces while AISC cost guidance increased from US$880/oz to US$950-1,025/oz. As per the announcement, the groupâs FY 2019 AISC guidance increased by 6.8% to AUD$1,125-1,225/oz.

During the December quarter, the company made legally binding offers to acquire the 49 percent joint venture interest held in the East Kundana Joint Venture by Tribune Resources Limited, Rand Mining Limited, and Rand Exploration NL, for A$150 million cash. However, the offers were rejected on 30 December 2018. During the quarter, the company declared a Maiden Joint Ore Reserves Committee (JORC) Resource at Pogo of 4.15 Moz at 14.7 grams per tonne (gpt), taking Group Resources to 20.5 Moz at 3.4 grams per tonne.

As at 31 December 2018, the company had Cash and equivalents of A$292 million with no bank debt in its balance sheet. At the end of the December quarter, the company had Operating cash flow of A$110 million which is 73 percent higher than the September quarter.

In the last six months, the share price of the company increased by 32.95 percent as on 22 January 2019. NSTâs shares traded at $8.690 with a market capitalization of circa $5.88 billion as on 23 January 2019 (AEST 1:38 PM).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.