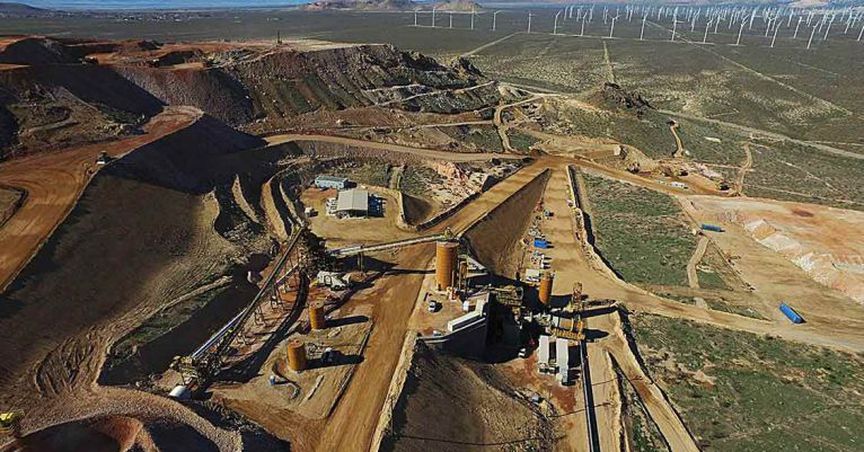

Metal X Limited (ASX:MLX) is the largest producer of Tin in Australia and a significant copper producer as well. It is a diversified group engaged in operations including mining, development and exploration of metals.

On 11 February 2019, the company has provided an update on the ongoing drilling programs in Area five and Leatherwood Trend targets at the Renison Tin Operations in Tasmania. Renison is 50% owned by Metals X through the Bluestone Mines Tasmania Joint Venture.Â

As per the release, the assay results for a further 25 holes completed at Area 5 and 22 holes completed at the Leatherwood Trend have been received returning the following exceptional intersections. The results in Area five consists the following results. The hole - U6805 dug till depth of 148.90 meter, extracted 2.79% tin at 20.20 meter, the hole - U6806 dug till depth of 151.0 meter, extracted 5.14% tin at 12.5 meter, the hole - U6808 dug till depth of 176.0 meter, extracted 3.82% tin at 14.0 meter, The hole - U6809 dug till depth of 148.80 meter, extracted 6.27% tin at 20.0 meter and the hole - U6811 dug till depth of 167.9 meter, extracted 6.27% tin at 8.7 meter.

The results in Leatherwood Trend consists the following results. The hole â U6458 dug till depth of 173.90 meter, extracted 2.44% tin at 6.8 meter, the hole â U6461 dug till depth of 222.0 meter, extracted 4.18% tin at 5.6 meter, the hole â U6688 dug till depth of 160.0 meter, extracted 2.40% tin at 17.0 meter, the hole â U6689 dug till depth of 161.2 meter, extracted 2.67% tin at 7.7 meter and the hole â U6690 dug till depth of 148.5 meter, extracted 3.67% tin at 15.0 meter.

Area 5 and the Leatherwood Trend are located near to the existing development and mining areas and have the potential to be brought into the mining schedule relatively quickly. The tin mineralisation at both targets remain open at depth and along strike and infill drilling programs are underway with the intention of completing an updated Mineral Resource estimate during the June 2019 quarter in advance of mine planning studies. The managing Director of the company Mr Damien Marantell stated these latest drilling results to be impressive and mentioned to provide further mineral resource updates in the June quarter for Rension.

Now let us quickly have a look at Metal X Limitedâs stock performance and the return it has posted over the last few months. The stock is currently trading at a price of $0.365 with a market capitalization of circa $251.51 million. The stock opened at $0.370 with its day high at the same price and a dayâs low price of $0.360. The stock has yielded a negative YTD return of 13.10% and posted negative returns of 37.61%, 23.16% and 14.12% over the last six months, three months and one-month period respectively. It has a 52-week high price of $0.980 and a 52-week low of $0.340, with an average volume of 2.79 million approximately.Â

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.