At the close of trading session on 8th September 2020, the equity market of Australia closed in green. The benchmark index S&P/ASX200 went up by 63 points to 6007.8. S&P/ASX 200 Health Care (Sector) witnessed a rise of 637.7 points to 42,087.2 and S&P/ASX 200 Materials (Sector) stood at 14,148.5 with a rise of 148.6 points. At the end of same session, All Ordinaries settled at 6190.2, indicating an increase of 60.3 points.

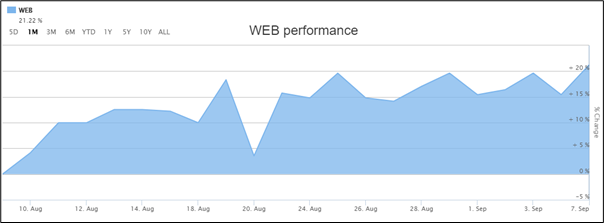

On ASX, the share price of SIMS Limited (ASX: SGM) closed at $8.480 per share. The stock of Webjet Limited (ASX: WEB) inched up by 7.692% to $4.060 per share.

WEB Performance (Source: ASX)

Recently, we have written an article on Cirralto Limited (ASX:CRO), and the readers can click here to view the information.

SIMS Limited Reported Fall in Sales Revenue

SIMS Limited (ASX:SGM) recently notified the market that UBS Group AG and its related bodies corporate have made a change to their holdings in the company on 19th August 2020 with a current voting power of 6.61% as compared to the previous voting power of 8.00%. For FY20, the company reported underlying sales revenue of $4,908.5 million, reflecting a fall of 26.1% due to lower volumes and pricing. In the same time span, SGM posted a fall of 10% in non-ferrous proprietary sales volumes, and a decline of 19% in ferrous proprietary sales volumes. In addition, the company experienced a fall of 60.1% in underlying EBITDA to $144.9 million. Considering the market disruptions, the company has decided not to pay a final dividend for 2H FY20.

Perenti Global Limited Ended in Green on the Australian Securities Exchange

Perenti Global Limited (ASX:PRN) recently announced that its subsidiary Barminco has secured a $200 million development and production contract at Odysseus mine at Western Areas.

For FY20, the company reported revenue amounting to $2.045 billion, reflecting a rise of 3.8%. The company experienced a rise of 6.8% in Underlying EBITDA to $443.8 million. The company declared a fully franked final dividend of 3.5 cents per share, which took the total dividends for the year to 7.0 cents per share. The company is aiming a substantial tender pipeline of $8.8 billion.