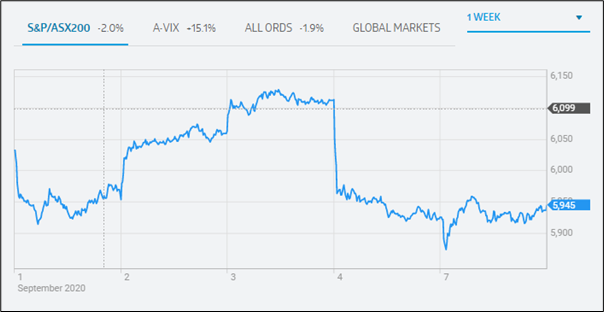

At the close of trading session on 7th September 2020, the equity market of Australia closed in green. The benchmark index S&P/ASX200 settled at 5944.8 with a rise of 19.3 points. In the last five days, the index has lost 2.0%. S&P/ASX 200 Materials (Sector) witnessed a rise of 226.4 points to 13,999.9 and S&P/ASX 200 Health Care (Sector) moved up by 158.1 points to 41,449.5. At the close of same session, All Ordinaries stood at 6129.9, indicating an increase of 21.1 points.

S&P/ASX200 Performance (Source: ASX)

On ASX, the share price of Virgin Money UK PLC (ASX: VUK) went up by 6.27% to $1.695 per share. The stock of Webjet Limited (ASX: WEB) ended the session at $3.770 per share, reflecting an increase of 5.014%.

On September 7, 2020, S&P/NZX50 closed in green, implying an increase of 0.30% to 11,859.45 while S&P/NZX20 rose 0.29% to 7,866.15. On the same day, S&P/NZX10 increased 0.06% to 2,114.74.

Recently, some important content has been written on PointsBet Holdings Limited (ASX:PBH). Readers can click here to view the content.

VUK Posted Increase in Customer Deposits: A Brief Look

Virgin Money UK PLC (ASX:VUK) reported a rise of 4.8% in customer deposits to £67.7 billion during the third quarter, mainly due to lower personal customer spending during lockdown and business customers maintaining higher levels of liquidity. The company reported a decline of 1% in mortgage portfolio to £58.9 billion during Q3. This indicates the effective closure of the new purchase market under lockdown, which was partially offset by improved retention rates. During the same period, VUK reported net interest margin (NIM) of 147bps. For FY20, the company expects to report NIM in the range of 155-160bps.

Webjet Limited Ended in Green on Australian Securities Exchange

Webjet Limited (ASX:WEB) recently notified the market that UBS Group AG and its related bodies corporate have become an initial substantial holder in the company on 2nd September 2020 with the voting power of 5.09%. In another update, the company announced that it would change its financial year-end in FY21 from 30 June to 31 March.

For FY20, the company recorded total transaction value (TTV) of $3.0 billion. Underlying revenue and EBITDA for the period amounted to $266.1 million and $26.4 million, respectively. WEB entered FY21 in a strong capital position with pro forma cash and liquidity of $320 million and $420 million, respectively.

.jpg)