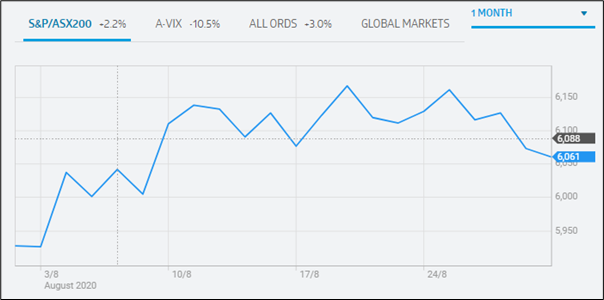

On 31st August 2020, equity market of Australia ended in red, and the benchmark index S&P/ASX200 moved down by 13.3 points to 6060.5. During the last one month, the index has gained 2.2%. S&P/ASX 200 Consumer Staples (Sector) witnessed a fall of 128.3 points to 12,826.1 and S&P/ASX 200 Financials (Sector) stood at 4,759.8 with a fall of 34.5 points. At the end of same session, All Ordinaries settled at 6245.9, reflecting a fall of 14.9 points.

S&P/ASX 200 Performance (Source: ASX)

On ASX, the share price of EML Payments Limited (ASX: EML) went up by 6.562% to $3.410 per share. The stock of Service Stream Limited (ASX: SSM) closed at $1.920 per share with a rise of 5.785%.

Recently, we have written an article on Renascor Resources Limited (ASX:RNU), and the readers can click here to view the content.

Service Stream Limited Secured Long?Term Agreement with nbn Co.

Service Stream Limited (ASX:SSM) recently announced that it has signed a long?term agreement with nbn Co. for the provision of network operations, maintenance and optimisation services to its multi?technology National Broadband Network. Under the terms of the agreement, the company will be responsible for performing operations and maintenance activities in core network technologies, which include Fibre to the Node (FTTN), Fibre to the Premise (FTTP), Fibre to the Basement (FTTB), Fibre to the Curb (FTTC) and Hybrid Fibre Coax (HFC).

For FY20, the company reported EBITDA from operations amounting to $108.1 million, reflecting a rise of 15.9% on FY19. Statutory NPAT for the year amounted to $49.3 million. The company declared a fully franked final dividend of 5.0 cps, which took the full-year dividend to 9.0 cps.

Scentre Group Ended in Green on Australian Securities Exchange

Scentre Group (ASX:SCG) recently notified the market with 1H20 results, wherein, it reported operating earnings of $361 million. Funds from operations for the period amounted to $362 million. During the half-year, the company reported gross cash inflow of $1,059 million and a net operating cash surplus of $261 million. The company experienced a fall of 16% in revenue to $1,094.1 million. The fundamentals of the company are strong, and it seems to be well-placed to deliver long-term sustainable returns through economic cycles. SCG has available liquidity of $4.4 billion, which seems adequate to cover all debt maturities to January 2023.