At the close of trading session on 1st September 2020, equity market of Australia closed in red. The benchmark index S&P/ASX200 witnessed a fall of 107.1 points to 5953.4. Most of the sectors on ASX ended in red, including S&P/ASX 200 Health Care (Sector), which moved down by 577.8 points to 41,563.0 and S&P/ASX 200 Energy (Sector) stood at 7,040.7, reflecting a fall of 2.52%. All Ordinaries ended the trading session at 6143.2, with a fall of 102.7 points.

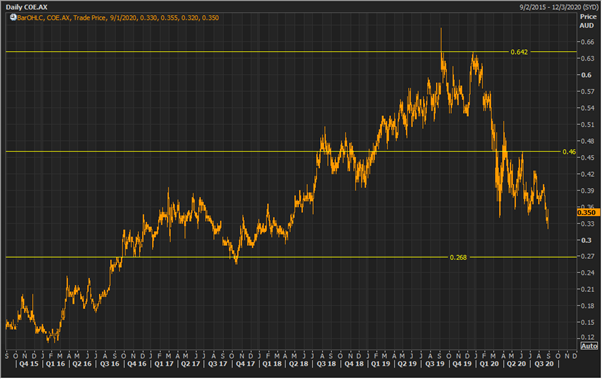

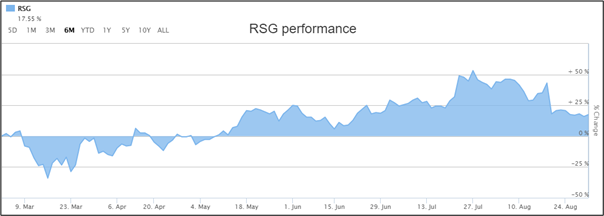

On ASX, the share price of Cooper Energy Limited (ASX: COE) settled at $0.350 per share. The stock of Resolute Mining Limited (ASX: RSG) went up by 3.167% to $1.140 per share.

RSG Performance (Source: ASX)

Recently, we have written some important information on Pental Limited (ASX:PTL), and the readers can view the content by clicking here.

On September 1, 2020, S&P/NZX50 closed the session in red, reflecting a fall of 1.21% to 11,793.16 while S&P/NZX20 fell by 1.32% to 7,808.52. On the same day, S&P/NZX10 encountered a fall of 1.64% to 2,110.24.

Cooper Energy Limited Reported Growth in Sales Revenue

Cooper Energy Limited (ASX:COE) recently released its FY20 results, wherein, it reported a statutory net loss after tax of $86.0 million and an underlying loss after tax of $6.6 million against the underlying profit of $13.3 million of FY19. The fall in earnings was due to increased expenses including gas processing costs, net finance costs, care and maintenance and depreciation and amortisation.

Despite a reduction of 38% in oil revenue due to lower prices and production, COE experienced a rise of 3% in sales revenue to $78.1 million.

Resolute Mining Limited Ended in Green on ASX

Resolute Mining Limited (ASX:RSG) recently notified the market with 1H20 results, wherein, it recorded a growth of 24% in gold production to 217,946 ounces. The company reported gold sales of 212,668 ounces at an average gold price of US$1,427/oz.

RSG witnessed a rise of 33% in revenue while net profit after tax rose by 32%. The company successfully completed refinancing activities via equity raising and new low-cost, flexible syndicated debt facility.

The company closed the half-year with cash and bullion balance of US$88 million, listed investments of US$35 million and a promissory note of A$50 million. The company’s net debt position stood at US$220 Mn as at June 30, 2020.