On 14th August 2020, equity market of Australia ended in green, and the benchmark index S&P/ASX200 witnessed a rise of 35.2 points to 6126.2. Most of the sectors on ASX closed in green such as S&P/ASX 200 Health Care (Sector), which moved up by 383.5 points to 41,813.1. S&P/ASX 200 Consumer Discretionary (Sector) stood at 2,607.1 with a rise of 27.5 points.

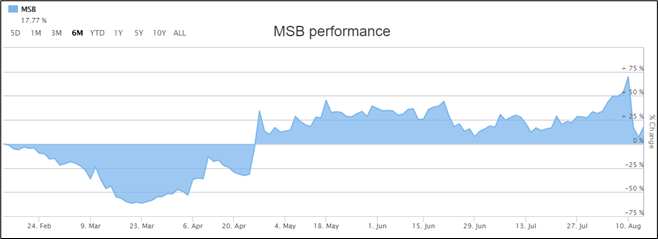

On ASX, the share price of Mesoblast Limited (ASX: MSB) settled at $4.700 per share. The stock of Computershare Limited (ASX: CPU) inched up by 7.792% to $14.110 per share.

Stock Performance (Source: ASX)

S&P/NZX50 closed the day at 11,452, reflecting a fall of 0.42%. The share price of Good Spirits Hospitality Limited (NZX: GSH) rose by 11.86% to NZ$0.066 per share. The stock of NZME Limited (NZX: NZM) gained 5.77% and closed the session at NZ$0.275 per share. On the other hand, the stock of New Talisman Gold Mines Limited (NZX: NTL) witnessed a sharp fall of 12.50% to NZ$0.007 per share.

Recently, we have written an article on Middle Island Resources Limited (ASX:MDI), and the readers can view the content by clicking here.

A Recent Update on MSB

Mesoblast Limited (ASX:MSB) came forward and made an announcement that Oncologic Drugs Advisory Committee (or ODAC) of the US FDA voted in favor that available data support efficacy of remestemcel-L (RYONCIL™) in pediatric patients with steroid-refractory acute graft versus host disease (SR-aGVHD).

The company stated that cash on hand at the end of fourth quarter of FY 2020 stood at US$129.3 million (A$188.4 million). The company has wrapped up US$90 million (A$138 million) capital raising from the global institutional investors in the month of May 2020.

Computershare Limited Ended in Green on Australian Securities Exchange.

Computershare Limited (ASX:CPU) recently released its FY20 results, wherein, it reported revenue amounting to $2.3 billion, reflecting a fall of 1.9%. Management EBITDA for the period stood at $650 million, down by 3.7%. During the year, the company has generated free cash flow of $506 million. The company has refinanced USD$500 Mn debt facility as well as extended its duration to 2024.

The company has decided to pay a final dividend of 23.0 cents per share on 14th September 2020. For FY21, the company anticipates Management EPS of around 50.0 cps. In addition, the group is well-positioned to self-finance its growth strategies.