On 18th August 2020, equity market of Australia ended in green, and the benchmark index S&P/ASX200 went up by 47 points to 6123.4. Most of the sectors on ASX closed in green, including S&P/ASX 200 Consumer Discretionary (Sector), which moved up by 33 points to 2,634.8. S&P/ASX 200 Health Care (Sector) stood at 43,637.9, reflecting a rise of 1771.5 points or 4.23%. At the close of same session, All Ordinaries experienced a rise of 50.2 points to 6268.7.

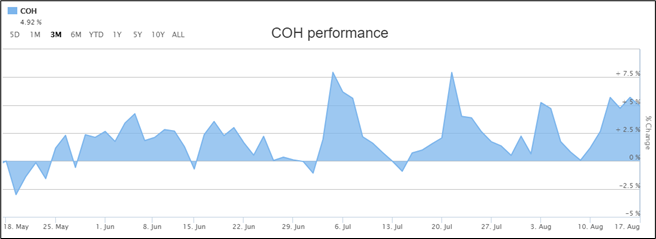

On ASX, the share price of Monadelphous Group Limited (ASX: MND) settled at $10.050 per share. The stock of Cochlear Limited (ASX: COH) went up by 9.803% to $217.740 per share.

Stock Performance (Source: ASX)

S&P/NZX50 ended the session at 11,849, reflecting an increase of 1.51%. The share price of Blackwell Global Holdings Limited (NZX: BGI) soared by 84.62% to NZ$0.024 per share. The stock of Cannasouth Limited (NZX: CBD) inched up by 10.00% to NZ$0.660 per share. On the other hand, the share price of New Talisman Gold Mines Limited (NZX: NTL) plunged by 25.00% to NZ$0.006 per share.

Recently, we have written an article on Corazon Mining Limited (ASX:CZN), and the readers can view the content by clicking here.

Monadelphous Group Limited Reported a Growth of 2.6% in Revenue

Monadelphous Group Limited (ASX:MND) recently released its FY20 results, wherein, it reported revenue amounting to $1.65 billion. The company added that the maintenance and industrial services division has recorded revenue of $1.05 billion with an increase of 5.1% over the previous year. Net profit after tax for the period amounted to $36.5 million. The company declared a fully franked final dividend of 13 cents per share, taking the full-year dividend to 35 cents per share. This reflects a dividend pay-out ratio of around 91% of reported net profit after tax. Despite the recent challenging economic and operating conditions, the company closed the year with a healthy balance sheet comprising a cash balance of $208.3 million.

Cochlear Limited Reported a Fall in Net Profit.

Cochlear Limited (ASX:COH) recently notified the market with FY20 results, wherein, it witnessed a decline of 6% in sales revenue to $1.4 billion. Cochlear implant units fell by 7% to 31,662. Underlying net profit experienced a sharp fall of 42% to $153.8 million as a result of the brisk fall in sales during 2H FY20 due to COVID?19?related surgery deferrals. In the month of March 2020, the company has withdrawn the payment of dividend until the improvement in trading conditions. During March and April 2020, the company has strengthened its liquidity position via capital raising of $1.1 billion and an increase of $225 million in debt facilities. During FY20, the company invested $185 million in R&D, reflecting 14% of sales revenue.

.jpg)