At the close of trading session on 4th August 2020, the equity market of Australia settled in green. The benchmark index S&P/ASX200 went up by 111.5 points to 6037.6. Most of the sectors on ASX closed in green including S&P/ASX 200 Consumer Staples (Sector), which moved up by 266.8 points to 13,284.5 and S&P/ASX 200 Health Care (Sector) experienced a rise of 846.6 points to 42,308.5.

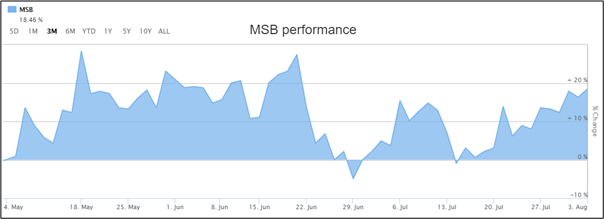

On ASX, the share price of Mesoblast Limited (ASX: MSB) rose by 7.013% to $4.120 per share. The stock of Afterpay Limited (ASX: APT) ended the trading session at $70.800 per share.

Stock Performance (Source: ASX)

S&P/NZX50 witnessed a rise of 0.91% to 11,772. The share price of Ascension Capital Limited (NZX: ACE) rose by 50.00% to NZ$0.003 per share. The stock of Blis Technologies Limited (NZX: BLT) went up by 5.13% to NZ$0.082 per share. On the other hand, the share price of Evolve Education Group Limited (NZX: EVO) plunged by 7.48% to NZ$0.099 per share.

BLT announced that it has managed to finalise agreement with Purity Life Health Products LP with regards to the distribution of BLIS branded products into pharmacy as well as health store retail channels in Canada.

Recently, we have written an article on Great Southern Mining Limited (ASX:GSN), and the readers can click here to view the information.

Mesoblast Limited Ended in Green on 4th August 2020.

Mesoblast Limited (ASX:MSB) wrapped up the capital raising of US$90 million from global institutional investors. The company is likely to have access to an additional US$67.5 million via existing financing facilities and strategic partnerships over the upcoming 12 months.

In another update, the company announced the appointment of Dagmar Rosa-Bjorkeson for the position of Chief Operating Officer to manage commercial operations, lead the business units, build out key strategic alliances, and oversee product launches.

Afterpay Limited Completed Share Purchase Plan.

Afterpay Limited (ASX:APT) recently notified the market that it has finished its Share Purchase Plan wherein it offered eligible shareholders in Australia and New Zealand an opportunity to apply for up to $20,000 worth of new shares in the company without spending brokerage or other transaction costs. Issuance of 2,070,776 shares under the SPP would be done.

The company stated that new shares under the share purchase plan would be issued by APT and allotted to the applicants on August 6, 2020.