On 27th August 2020, equity market of Australia settled in green. The benchmark index S&P/ASX200 moved up by 9.8 points to 6126.2. S&P/ASX 200 Consumer Staples (Sector) witnessed a rise of 75.2 points to 13,132.6. S&P/ASX 200 Health Care (Sector) stood at 43,137.0 with a rise of 75.8 points. At the end of same trading session, All Ordinaries closed at 6310.6 with an increase of 16.1 points.

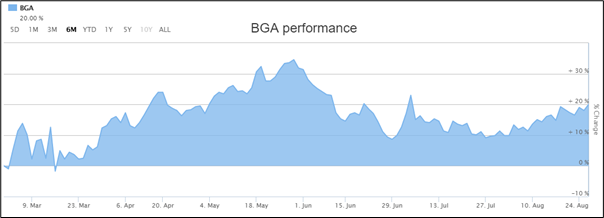

On ASX, the share price of Bega Cheese Limited (ASX: BGA) stood at $5.240 per share. The stock of Challenger Limited (ASX: CGF) rose by 5.195% to $4.050 per share.

Stock Performance (Source: ASX)

S&P/NZX50 ended the session at 12,053, indicating an increase of 0.18%. The share price of Vista Group International Ltd (NZX: VGL) rose by 19.26% to NZ$1.610 per share. The stock of Just Life Group Limited (NZX: JLG) inched up by 17.31% to NZ$0.610 per share. On the other hand, the share price of Geo Limited (NZX: GEO) tumbled by 14.06% to NZ$0.055 per share.

Recently, we have written an article on Middle Island Resources Limited (ASX:MDI), and the readers can view the content by clicking here.

Bega Cheese Limited Recorded Decent Growth in Statutory EBITDA

Bega Cheese Limited (ASX:BGA) recently released its FY20 results, wherein, it reported normalised earnings before interest, depreciation and tax (EBITDA) amounting to $103.0 million. Statutory EBITDA for the period amounted to $87.8 million with a rise of 11% against the prior year. These results reflect the value of consistent strategy as well as the capacity to manage unpredictability in the supply chain. The company recorded statutory net cash inflow from operating activities of $137.7 million against $100.3 million of FY19. The company declared a fully franked final dividend of 5.0 cents per share, which took the total dividend for FY20 to 10.0 cents per share. The company will pay the final dividend on 7th October 2020. BGA is well-positioned for EBITDA growth in FY21 on the back of the completion of the new lactoferrin plant at Koroit, the execution of the organisational review in 1H FY21 as well as the continued optimisation planned for its secondary processing plants.

Challenger Limited Ended in Green on Australian Securities Exchange.

On August 11, 2020, Challenger Limited (ASX:CGF) released FY 2020 results. It recorded assets under management of $85.2 billion with a rise of 4%. The normalised net profit after tax for the period amounted to $344 million, reflecting a decline of 13%. The company achieved a normalised cost to income ratio of 35.7% with a rise of $17 million in expenses to $284 million. This showcases increased investment in distribution, product and marketing initiatives to address the structural changes in the market.