Most of the Sectors Closed in Red: On September 9, 2020, S&P/ASX200 ended the session in red as there was a fall of 2.15% to 5878.6 and All Ordinaries encountered a decline of 2.12% to 6058.9. On the same day, energy sector witnessed a significant fall of 4.35%. However, the impact was also felt in other sectors like technology (-2.58%) and financials (-2.44%). The image provides a broad idea of the performance:

Sector Summary (Source: Refinitiv (Thomson Reuters))

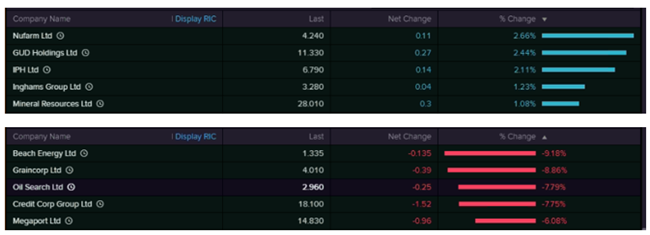

Top Movers: Nufarm Limited (ASX:NUF) (up 2.66%), GUD Holdings Limited (ASX:GUD) (up 2.44%) and IPH Limited (ASX:IPH) (up 2.11%). On the flip side, Beach Energy Limited (ASX:BPT) fell by 9.18% while Graincorp Ltd (ASX:GNC) decreased by 8.86%.

Top Movers (Source: Refinitiv (Thomson Reuters))

Sell-off Experienced on Wall-Street: It can said that Australian markets are influenced by the fluctuations in the US markets. This is evident from the fall witnessed in S&P/ASX200 on September 9, 2020. On September 8, 2020, Dow Jones Industrial Average fell 2.25% to 27,500.89 while Nasdaq Composite was down by 4.11% to 10,847.69.