Today, on 6th May 2019, Landmark White (ASX:LMW) announced multiple updates. The company published its half-yearly (H1FY19 ended on December 31, 2019) report, where it showcased an increase in revenues from continuing operations by 6.1% pcp to $23.89 million, which was primarily due to the acquisition of the Taylor Byrne Holdings Pty Ltd business but offset by reduction in the valuation fees from the existing business. The groupâs profit before tax from continuing operations decreased by 81.6% pcp to ~$0.52 million. Its Profit after tax (PAT) from continuing operations fell by 92.1% pcp to ~$0.162 Mn.

The downturn in the residential property market, primarily due to APRA tightening credit and the impact of the Banking Royal Commission, has adversely impacted revenues and hence profits. This was partially offset by the acquisition of Taylor Byrne effective October 1, 2018, but also negatively affected by one-off acquisition costs of $0.5 million.

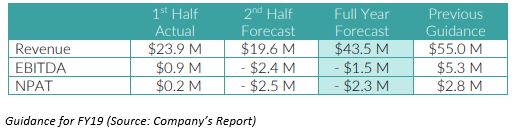

Earnings per share fell 93% to 0.20 cents per share (2017: 2.68 cents) as a result of both the reduced profits and additional shares issued as part consideration for the acquisition of Taylor Byrne. The first half profits include significant one-off costs. Cost savings will be delivered in the second half of FY2019 as synergies are realised. Further, the Directors believe that revenues from the statutory services will increase in the second half. With the acquisition of Taylor Byrne, the company will be able to perform a significant volume of statutory services valuation work in-house, which was previously outsourced thereby improving the margin on this revenue. As a result of the poor performance and resulting weaker cash flows for the half, the Directors have decided not to declare an Interim Dividend for the current half-year.

As for the business growth, the company witnessed drop in revenue with residential valuations declined by 19%; commercial valuations by 24%; and statutory services valuations by 7%.

Under the financial impact of Cyber Incident, due to suspension from bank panels, the company estimated a revenue loss of ~$5 million to $6 million, with around further $1 million of revenue likely to be lost between now and the date of full reinstatement by the remaining financial institutions and restoration of more normal revenues. Additionally, the company incurred significant costs upgrading cybersecurity measures, which is expected to add high maintenance cost to the company expenses.

As per the company outlook, with the acquisition of Taylor Byrne in October 2018, the company is in a strong position to maintain and grow its market share in a soft market. The full impact of cost-saving initiatives in the companyâs existing business and the flow through of synergies from the acquisition of Taylor Byrne is expected to impact profit in the second half of FY2019 positively.

In another update, the company announced material terms of Timothy Rabbitt, Acting Chief Executive Officer of the company. Mr Rabbittâs fixed remuneration has been set at $270,000 per annum. Additionally, the short term incentives will comprise discretionary, performance-based, remuneration up to a maximum of $30K per annum (exclusive of superannuation). Mr Rabbitt is not entitled to any long-term incentives or equity-based remuneration.

At market close on 6th May 2019, the stock of Landmark White was trading at $0.380.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.