Healthscope Limited (ASX: HSO) provides healthcare services worldwide The Company manages a network of hospitals, clinics, and physicians for the provision of emergency care, women's services, cancer care, and pediatric services. Of these, 43 private hospitals are located across Australia and pathology operations across New Zealand. Healthscope employs around 18,000 people and ~ 17,500 accredited medical practitioners that provide intensive care to patients, including pathology tests to complex surgeries.

Recently, S&P Dow Jones Indices announced that it would remove Healthscope Limited from the S&P/ASX 200, subject to shareholder and final court approval of the scheme of arrangement whereby the company will be acquired by Brookfield Capital Partners Ltd.

This would be effective at the open of trading on 27th May 2019. Meanwhile, Healthscope Limited will be replaced by Cooper Energy Limited (ASX: COE) in the S&P/ASX 200, and effective at the open on 27th May 2019.

With around 1.74 billion outstanding shares and a market capitalisation of around AUD 4.27 million, the HSO stock closed the market trading on 20th May 2019 at AUD 2.460, edging up 0.41% by AUD 0.010, with ~ 7.83 million shares traded. In addition, HSOâs YTD return is also positive at 11.87% so far.

On 16th May 2019, BCP VIG Holdings L.P. (Brookfield LP), on its behalf and on behalf of ANZ Hospitals Pty Ltd, increased its shareholding in the company from 14.60% to 14.94% on the purchase of additional fully paid ordinary shares.

In hindsight, Healthscope had informed the market on 1st February 2019, that it had entered into an Implementation Deed with an entity owned by Brookfield Business Partners and its institutional partners, whereby Brookfield had proposed to acquire up to 100% of Healthscope by way of a scheme of arrangement and a simultaneous off-market takeover offer.

Commenting on this development, Healthscopeâs Chairman Paula Dwyer had quoted, âHaving fully considered a range of alternatives, the Board unanimously concluded that the Brookfield transaction was attractive and in the best interest of the shareholders. â

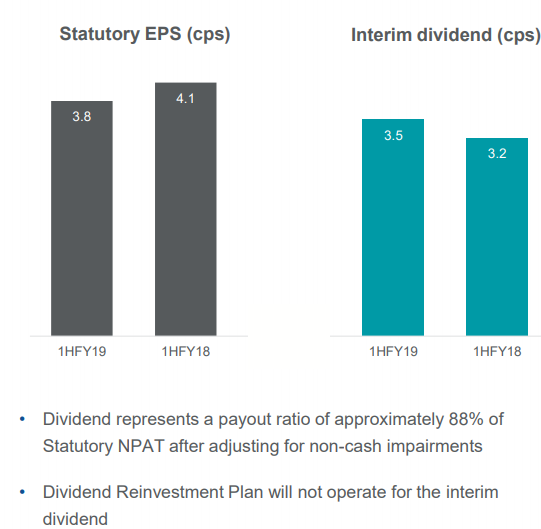

Under the terms of the arrangement, Healthscope shareholders would be entitled to receive a total value of $ 2.50 per share (inclusive of an interim dividend of 3.5 cents per share). The scheme consideration represents a premium of c.40% to the undisturbed closing price of Healthscope shares on 22nd October 2018 of $ 1.785, an implied equity value of $ 4.375 billion and an enterprise value of $ 5.71 2 billion.

EPS and dividends (Source: FY19 half-year results presentation)

On 30th April 2019, the company informed that Australian Super, which holds ~15.86% of the issued shares, had expressed its consent to vote in favour of the proposed scheme of arrangement.

Healthscope reported a significant turnaround in Hospitals 2019 first half (ended 31st December 2018) earnings with EBITDA growth of 8.85 in contrast to a decline of 8.7% in the prior period. The statutory NPAT was up 199% to $ 236.6 million (1H18: $ 79.1 million) and a Group revenue of $ 1224.6 million, up 3% on $ 1,189.4 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_07_02_2025_07_09_20_593716.jpg)