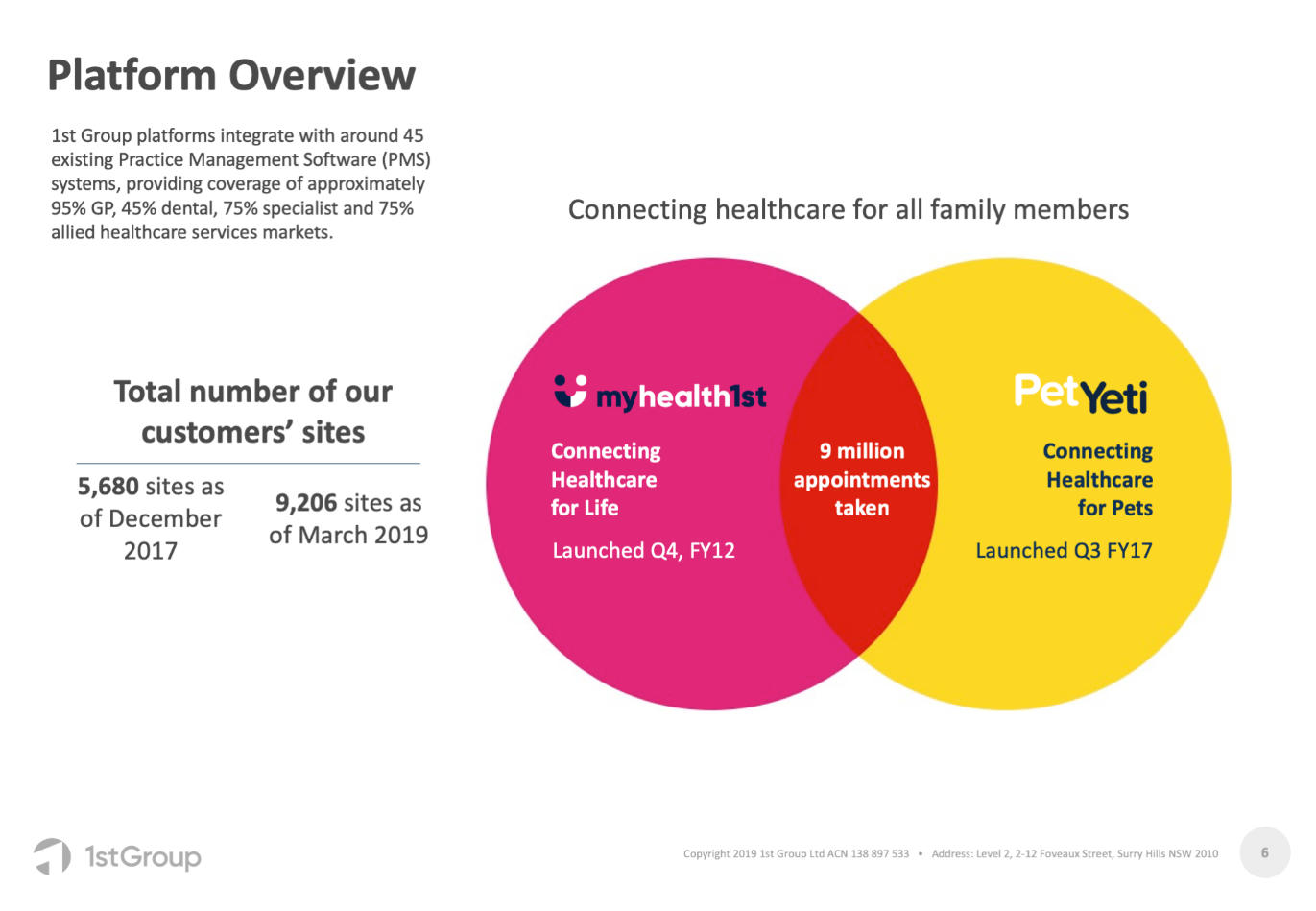

1st Group Limited (ASX:1ST), a healthcare sector company based in Sydney, Australia, supplies a convenient, straightforward, integrated technology platform to aid online search and appointment reservation services to the healthcare services industry. In addition, the company offers a range of value-added applications and online services that facilitate enhanced customer experience and engagement, improving retention and lifetime customer value. It also operates an online pet service portal (PetYeti.com.au) and a corporate and government solutions platform (GoBookings.com).

Source: Companyâs website

Source: Companyâs website

June 2019 Quarterly Highlights and Full Year Results: Recently on 30 July 2019, the Australian digital health group announced its results for the quarter ended 30 June 2019 (Q4 FY19), including revenues presented for the quarter and the full year figures, demonstrating an outstanding performance.

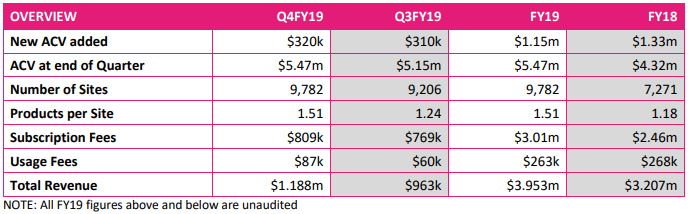

A summary of the key performance indicators is tabulated below, with growth in the number of sites, products per site and improvement in customer retention rates being the leading indicators of future revenue growth.

ACV- Annualised Contract Value; Source: June Quarterly and Full-Year Update

ACV- Annualised Contract Value; Source: June Quarterly and Full-Year Update

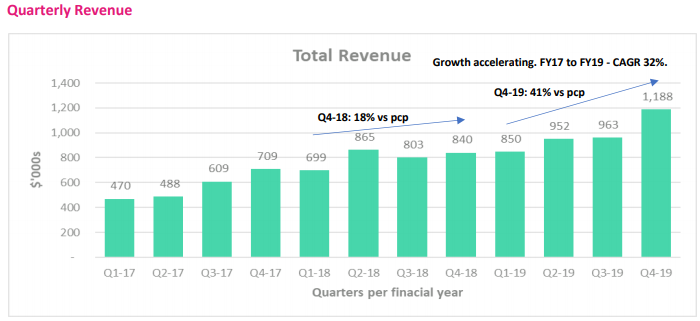

Revenue - The revenue for Q4 FY19 amounted to $ 1,188k, representing 23% growth on the prior quarter (Q3 FY19) and 41% on the prior corresponding period (pcp), primarily on the back of increasing site numbers propelling a corresponding uplift in the revenue per site.

Source: June Quarterly and Full-Year Update

Source: June Quarterly and Full-Year Update

Interestingly, a portion of the Q4 FY19 revenue increase arises from the one-off customisation revenue related to the major deals (detailed in the following article). The strong one-off fees for Q4 FY19 reflect significant new customer activations, particularly in the month of June, and paid customisation work. Besides, the usage fees grew by 45% on the prior quarter while the subscription revenue for Q4 FY19 amounted to $ 809k, up by $ 40k on Q3 FY19 and up by $138k (21%) on the pcp.

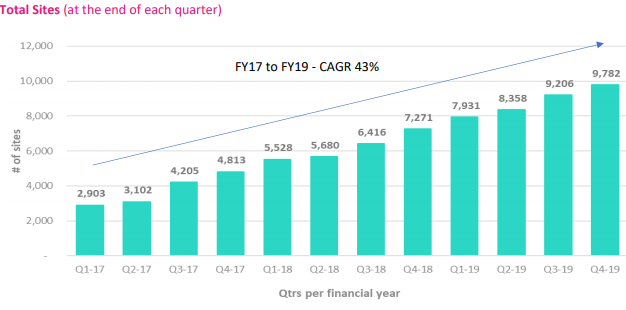

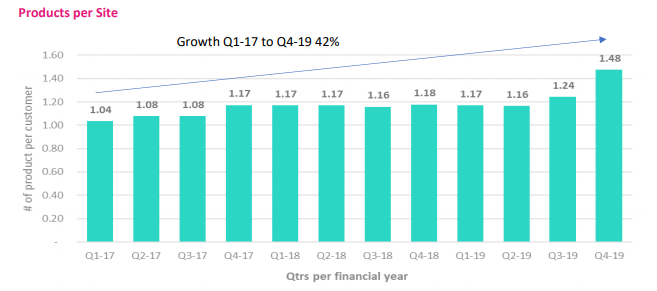

Total Sites- The companyâs acquisitions of site/customer continued to grow steadily across all markets, with a 35% increase (on pcp) in Q4 FY19. Site acquisition plays a key role in expanding upsell and cross sell opportunities, enabling the company to drive additional revenues from its existing customer relationships, as evidenced by the Products per Site metric and by recent quartersâ sales.

Source: June Quarterly and Full-Year Update

The increase in products per site subsequent to the end of Q3 FY19 may be attributed to the newly added multi-product customers and the addition of a new product, EasyInvites (an improved version of EasyRecalls), which assists in automating and simplifying the invitations sent for healthcare services such as flu vaccinations by key existing corporate customers. The historical stability and recent growth in Products per Site demonstrate solid performance and success in upselling customers with additional products resulting in future revenue growth per customer.

Source: June Quarterly and Full-Year Update

Source: June Quarterly and Full-Year Update

Annualised Contract Value â ACV as at 30 June 2019 stood at $ 5.5 million, up 6% on Q3 FY19 and includes the annual expected revenue from contracted customers for subscription products such as Online Bookings, EasyFeedback and EasyCheck-in Kiosks but excludes additional revenues from setup, usage and advertising.

Source: June Quarterly and Full-Year Update

Annual Customer Retention Rate - 1st Group managed to improve its Annual Customer Retention Rate (ACRR) from 92% at the end of Q1 FY19 to 96% in the last quarter, reflecting high customer loyalty and satisfaction.

During Q4 FY19, the Group also completed a placement and share purchase plan that raised $ 2.6 million and $ 1.14 million, respectively. The cash receipts for the quarter totalled ~$ 1.141 million, compared to $ 1.133 million in Q3 FY19 and the closing cash balance as at 30 June was $ 2.8 million.

The company expects the follow-on revenue from subscription, usage fees, new patient booking fees and advertising fees to progressively grow in the subsequent quarters.

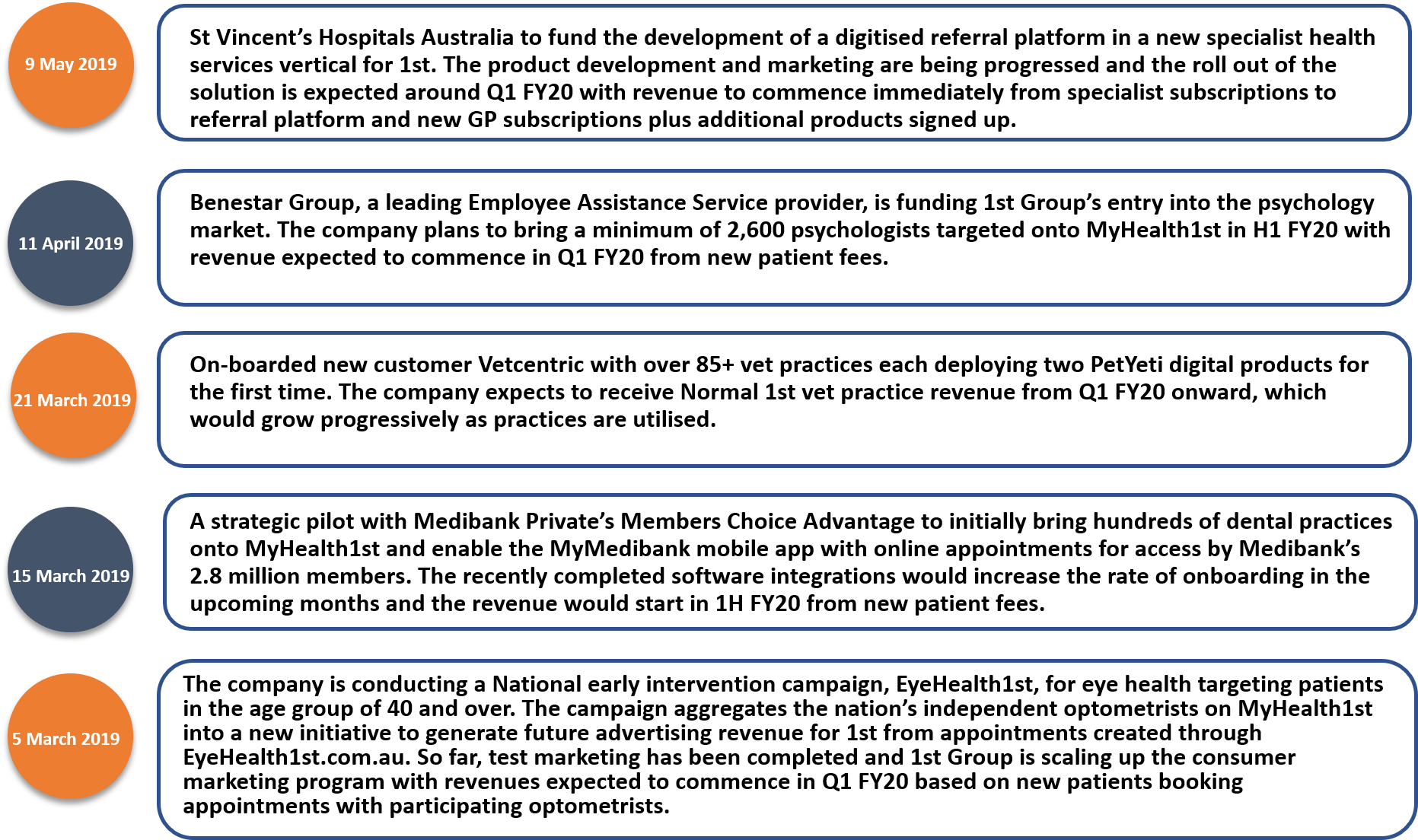

During Q4 FY19, 1st Group achieved major headways with respect to the 2019 CY Strategic Roadmap, released in March 2019, outlining the companyâs growth, customer experience and financial goals.

A progress update on the recent initiatives and deals (with their announcement dates) is given below:

Outlook for FY20: 1st Group plans to continue driving its organic growth through the addition of new sites at higher than historical revenue per site and advance the recently executed large deals from the design and implementation stages to marketing and onboarding of practitioners. The company is also trying to execute the additional strategic deals in its pipeline, with a few expected to be completed in H1 FY20 and others to be closed later in 2020.

Stock Performance: 1ST Group has a market capitalisation of around AUD 27.72 million with approximately 355.39 million shares outstanding. 1ST stock last traded on ASX at a price of AUD 0.078 on 7 August. In addition, the 1ST stock has delivered impressive returns of 168.97 in the last six months and 178.57% on year-to-date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.