Gold Spot Price (XAU/USD) reported at $1526.76 (August 26, 2019, 18:51 UTC+10). Recently, it broke an important resistance level at ~$1366, and with the escalation of trade war between the USA and China and other macro-economic concerns, more Gold investments will be witnessed in the coming times.

The five important gold stocks under discussion are Ramelius Resources Limited (ASX:RMS), Duketon Mining Limited (ASX:DKM), West African Resources Limited (ASX:WAF), Bellevue Gold Limited (ASX:BGL) and Red 5 Limited (ASX:RED).

Ramelius Resources Limited (ASX:RMS)

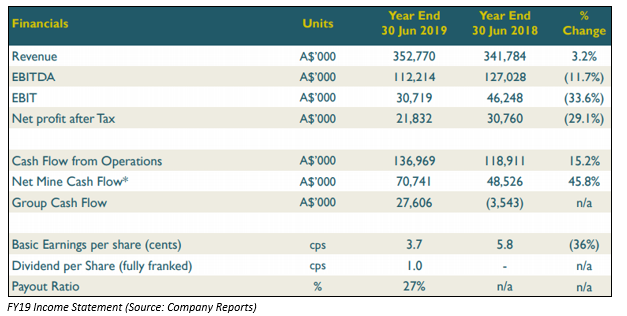

Gold exploration company, Ramelius Resources Limited (ASX:RMS) on August 26, 2019, published its FY2019 result report, where it highlighted that its Gold production for the period stood at 196,679 ounces at All-In Sustaining Cost of $1,192 per ounce, as compared to 208,118 ounce at All-In Sustaining Cost of $1,191 per ounce in FY2018. Its sales revenue for the period was reported at $352.8 Mn, as compared to $341.8 Mn in FY18. Its EBITDA for the period was reported at $112.2 Mn, as compared to $127.0 Mn in FY18. The net profit before tax was reported at $30.4 Mn, as compared to $45.5 Mn in FY18. The net profit after tax was reported at $21.8 Mn, as compared to $30.8 Mn in FY18.

RMSâ net cash and bullion for the period was reported at $106.8 Mn with no debt, whereas the net cash and bullion in FY18 was reported at $95.5 Mn. FY2020 production guidance has been estimated at 205â225,000koz at an All-In Sustaining Cost of A$1,225â$1,325/oz. The Board of Directors declared (fully franked) dividend of 1 cent per share for the first time since 2010, with record date and payment date on September 4, 2019 and October 4, 2019, respectively.

On the stock information front

On August 26, RMS settled the dayâs trade at A$1.255 up 10.573%, with the market cap of ~$746.69 Mn. Its current PE multiple is at 27.220x and its last EPS was noted at $0.042. Its 52 weeks high and 52 weeks low stand at A$1.290 and A$1.200, respectively, with an annual average volume of 4,937,558. It has generated an absolute return of 131.63% for the last one year, 80.16% for the last six months, and 36.75% for the last three months

Duketon Mining Limited (ASX:DKM)

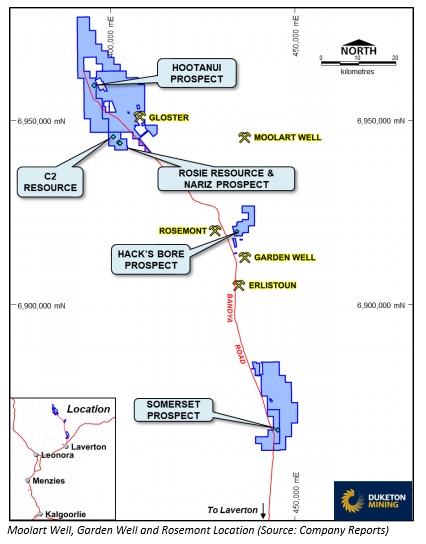

Duketon Mining Limited (ASX:DKM) is involved in the exploration and evaluation of mineral resources. On August 26, 2019, DKM announced about the acquisition of a large strategic tenement holding by Regis Resources from DKM for $20m cash and up to $5m in contingent payments. With this Regis now controls 90% of the gold rights in the Duketon Greenstone Belt, tripling its landholding to ~3,000km2, along strike and adjacent to its existing resources and processing plants at Moolart Well, Garden Well and Rosemont. Under the agreement, Duketon retains nickel rights over E38/2866, E38/2805, E38/2916, E38/2834 and E38/2666 tenements and will remain with 100% ownership of mining licence M38/1252 (which contains 71,000 tonnes of nickel in resources).

At the end of Juneâ19 Quarter, the cash and cash equivalents position of the company was reported at $2.1 Mn.

On the stock information front

On August 26, DKM settled the dayâs trade at A$0.160 trading flat, with the market cap of ~$18.88 Mn. Its 52 weeks high and 52 weeks low stand at A$0.230 and A$0.095, respectively, with an annual average volume of 43,228. It has generated an absolute return of -23.81% for the last one year, 23.08% for the last six months, and 14.29% for the last one month.

West African Resources Limited (ASX:WAF)

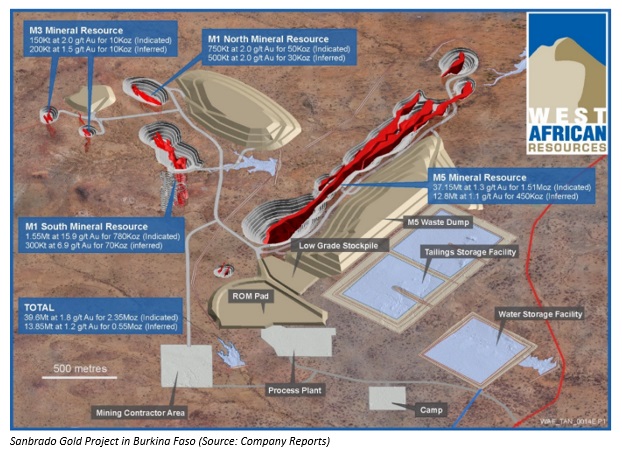

West African Resources Limited (ASX:WAF) is involved in the development of the Sanbrado Gold Project and mineral exploration in Burkina Faso. The company recently announced that one of its substantial holders Van Eck Associates Corporation changed its voting power from 7.11% to 6.10%, effective from August 5, 2019. In another update, WAF appointed Ausdrill Ltdâs wholly owned subsidiary African Mining Services Ltd, as preferred tenderer for the open-pit mining contract for the Sanbrado Gold Project.

Juneâ19 Quarter Key Highlights: The project expenditure in the Quarter was reported at $51.1 Mn. The administration costs in the period was reported at $0.7 Mn. The cash and cash equivalents at the end of the period was reported at $79.3 Mn. Around US$75 Mn was drawn by the company under US$200 Mn Taurus finance facility.

On the stock information front

On August 26, WAF settled the dayâs trade at A$0.480 up 9.09%, with the market cap of ~$383.01 Mn. Its 52 weeks high and 52 weeks low stand at A$0.500 and A$0.212, respectively, with an annual average volume of 2,050,122. It has generated an absolute return of 41.94% for the last one year, 54.39% for the last six months, and 39.68% for the last three months.

Bellevue Gold Limited (ASX:BGL)

Explorer of the Bellevue Gold Project, Bellevue Gold Limited (ASX:BGL) recently announced that it has issued 3,750,000 fully paid ordinary shares as a result of the exercise of 3,750,000 options with an exercise price of $0.05 and exercisable on or before 31 August 2019. These shares were issued to investors without disclosure under section 708A (5) of the Corporations Act 2001. In another update, BGL announced that one of its shareholders Tolga Kumova changed its voting power from 12.08% to 7.88%.

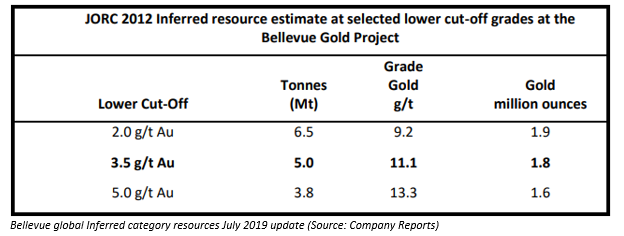

Juneâ19 Quarter Key Highlights: In the Bellevue Gold project, the JORC (Joint Ore Reserves Committee) resource estimates were upgraded to 1.8 Moz @ 11.1 g/t gold inferred category in less than 18 months from discovery, making it one of the fastest & highest-grade gold discoveries globally. The resource is located adjacent to historic underground workings, and the mine produced 800,000 oz @ 15 g/t gold from 1986 when it closed in 1997. Numerous recent significant results outside the current resource update include:

- 8 m @ 14.8 g/t gold from 544.6 m at Viago/Bellevue

- 7 m @ 34.6 g/t gold from 624 m at Viago South

- 5m @ 13.4 g/t gold from 528 m at Viago/Bellevue

As on June 30, 2019, BGLâs cash position was reported at $19.8 million as compared to $28.7 million on March 31, 2019.

On the stock information front

On August 26, BGL settled the dayâs trade at A$0.615 up 3.361%, with the market cap of ~$330.77 Mn. Its 52 weeks high and 52 weeks low stand at A$0.735 and A$0.185, respectively, with an annual average volume of 2,230,238. It has generated an absolute return of 197.50% for the last one year, -8.46% for the last six months, and -10.53% for the last three months.

Red 5 Limited (ASX:RED)

Red 5 Limited (ASX:RED) is involved in the gold mining and production and mineral exploration. The company recently announced that AIMS ASSET MANAGEMENT SDN BHD has disposed-off all its share in the company, effective from August 13, 2019.

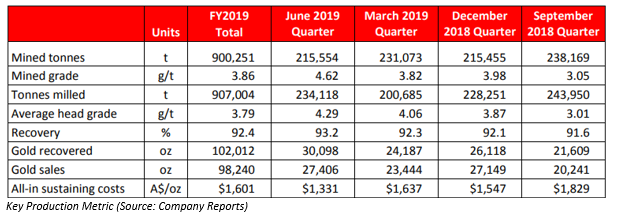

Juneâ19 Quarter Key Highlights: The Gold production for the Quarter was reported at 30,098 ounces, as compared to 24,187 ounces in March Quarter, and the gold sales for the Quarter was reported at 27,406 ounces, as compared to 23,444 ounces in March Quarter. The All-In Sustaining Costs for the period was reported at $1,331 per ounce of gold sold, as compared to $1,637 per ounce of gold sold in the March Quarter. Full Year production (FY19) was reported at 102,012 ounces, whereas total gold sales for FY19 stood at 98,240 ounces at an AISC of A$1,601 per ounce of gold sold.

Gold recovery for FY20 has been estimated in the range of 110,000-120,000oz at an AISC of A$1,350 â A$1,500 per ounce, whereas for September Quarter, the expected range is 27,000-31,000 ounces at an AISC of A$1,400 â A$1,550 per ounce.

Groupâs cash and bullion position at the end of June Quarter was reported at A$24.9 million.

On the stock information front

On August 26, RED settled the dayâs trade at A$0.345 up 7.69%, with the market cap of ~$404.41 Mn. Its 52 weeks high and 52 weeks low stand at A$0.360 and A$0.054, respectively, with an annual average volume of 6,236,352. It has generated an absolute return of 441.67% for the last one year, 150.00% for the last six months, and 160.00% for the last three months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.