Fenix Resources Limited (ASX: FEX) belongs to the metals and mining sector and is a WA-based minerals explorer, that is transitioning into a miner.

On 29 May 2019, Fenix Resources announced that it had signed a JCA (Joint Cooperation Agreement) regarding the export of Iron Ore product, with the manager of the Port of Geraldton (Port), the Mid West Ports Authority (MWPA).

This agreement further progresses the company, to another important zone which is crucial to the development of Iron Ridge Project of the FEX, which is situated in the Mid-West area of Western Australia.

The Iron Ridge Project lies ~600 kilometres north-northeast of Perth and ~67 kilometres in the direction of the northeast of the township of Cue in the Murchison region of Western Australia. Iron Ridge Project is a wholly owned flagship project of the company.

Fenix and MWPA have entered into the Joint Cooperation Agreement in order to find out how MWPA might provide ~ 1 million tonnes of Iron ore per annum of export capacity through the Port. As per the JCA agreement, Fenix and MWPA agree to negotiate Port access, capacity reservations, handling services along with the Iron Ore product export contracts.

The Joint Cooperation Agreement would provide the next breakthrough in the progression of the Iron Ridge Project as the company steps towards the development. As a part of this agreement, a major component of the Iron Ridge Project, being the Port Logistics, is about to get completed.

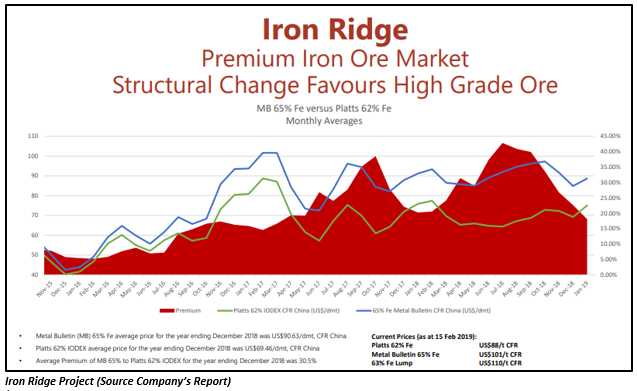

Recently, on 24 May 2019, the company announced that it had received strongly positive metallurgical testwork results in respect of potential products from its Iron Ridge Project. The testwork indicated that the potential Project products had low impurities or harmful elements. More than 65% iron lump products along with more than 63% iron fines products with small toxic elements were produced. The samples which were tested indicated that the deposit delivers around 25-30% of the mineralization as a lump product. The properties of the lump product, which includes Reduction Index, Reduction-Disintegration Index and Decrepitation Index derived for the three composites were encouraging for blast furnace use.

Also, on 7 May 2019, the company notified the market that it had entered into the Strategic Alliance with Minehaul Pty Ltd, a trucking and logistics company, through a joint venture, where Minehaul Pty would provide all trucking services to the project. Thus, it will support the company in commercializing the project.

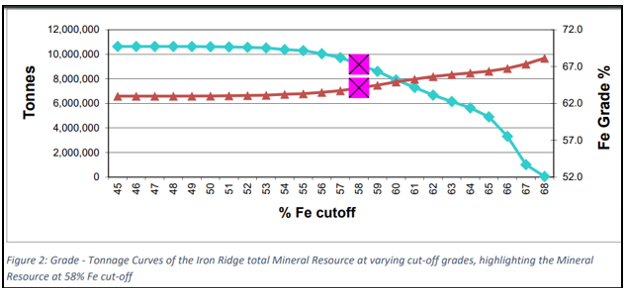

In the Q3 FY2019 report, the company reported an 84% increase in the total Mineral Resource to 9.2Mt at 64.1% of iron, 3.36% of silicon oxide, 2.66% of Aluminium oxide and 0.045% of phosphorus using the cut?off grade of 58% iron. High?Grade Iron Ore assays obtained at the Iron Ridge Project during the period.

FEX used net cash of AUD0.488 million for operating activities. By the end of Q3 FY2019 period, Fenix had net cash and cash equivalent standing at AUD2.110 million. The estimated cash outflow for the Q4 FY2019 is around A$0.990 million.

Source: Companyâs Report

The shares of Fenix have generated an outstanding YTD return of 313.64%. The stock of the company was trading at A$0.092 (as on 30 May 2019, AEST 12: 40 PM). Fenix Resources holds a market cap of A$22.73 million and approximately 249.77 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.