Highlights

- VRX Silica has joined hands with the School of Photovoltaic and Renewable Energy Engineering of UNSW for a strategic research project.

- The research project would assess the market opportunities for recycling end-of-life solar panel glass in Australia.

- The prime objective of the agreement is to support modelling of possible low-iron glass recycling and manufacturing pathways in Australia.

Australian listed pureplay silica sand company VRX Silica Limited (ASX: VRX) has signed a new partnership agreement with the School of Photovoltaic and Renewable Energy Engineering (SPREE) of the University of New South Wales (UNSW). Under the agreement, VRX and SPREE will jointly work on a strategic research project to assess the market potential for a local, low carbon, solar panel glass recycling program in Australia.

Research Project Overview

The prime objective of the agreement is to support modelling of possible low-iron glass recycling and manufacturing pathways in Australia. The project is likely to be based close to VRX’s Muchea Silica Sand Project, WA.

The pilot phase of this work has been funded by the Australian Renewable Energy Agency (ARENA) and carried out through the Australian Centre for Advanced Photovoltaics (ACAP) at UNSW. With the support of a highly credentialed industry partner specialising in the sustainability of the material critical to solar panel production – silica sand, ACAP is now able to take this work to its next phase.

The two-year-long project would cover a techno-economic analysis of a proposed closed-loop photovoltaic (PV) glass industry in Australia, built on recycling the glass component of solar panels once they reach their end of life. One of the important requirements for this industry will be the recreation of a local, low-iron, flat glass manufacturing industry, where solar panel cover glass could be returned as cullet–crushed glass.

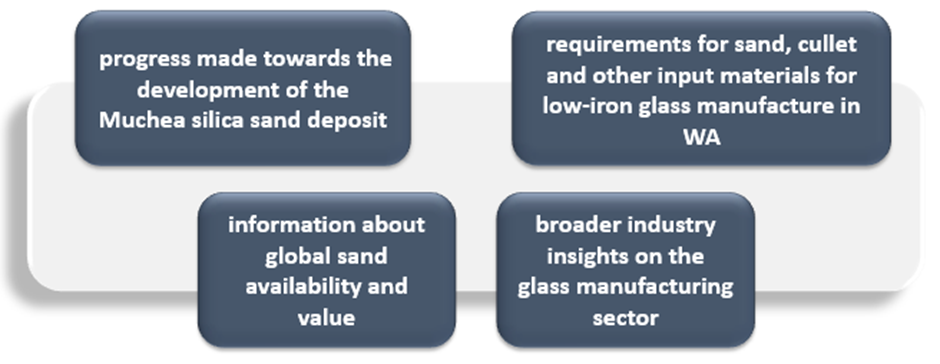

VRX will share following information with the Australian Centre for Advanced Photovoltaics:

Data source: company update

UNSW will render data on PV glass recovery activities taking place across Australia and elsewhere. This will also cover expected glass demand for the global PV industry and the results of techno-economic modelling.

VRX shares gain 4%

The company shares traded at AU$0.130 on 29 June 2023, 4% higher from the last close. VRX shares have gained over 8.3% in the past one month. The company has a market capitalisation of AU$70.05 million.