Highlights

- Surefire Resources advances the Victory Bore Vanadium Project with a JORC Resource of 464Mt @ 0.39% V2O5.

- Pre-feasibility Study (PFS) revealed strong financials, including a pre-tax NPV10 of US$1.1 billion and IRR of 42.2%.

- SRN made a breakthrough in its vanadium extraction process, achieving 91% vanadium recovery from Victory Bore magnetite concentrate, along with reduced energy consumption and carbon footprint.

- The company eyes downstream processing opportunities in the Kingdom of Saudi Arabia with non-binding MOUs established with two Saudi firms.

- SRN is tapping further Saudi collaborations for Victory Bore development and downstream processing opportunities.

Surefire Resources (ASX:SRN) is an Australian mineral exploration company with exploration licences over vanadium, magnetite and gold projects located in Western Australia. Currently, the company is focused on advancing its 100%-owned Victory Bore Vanadium Project.

With a steadfast focus on developing the project, SRN has demonstrated remarkable progress and garnered significant attention. Backed by a substantial JORC Resource, coupled with a pre-feasibility study unveiling compelling financial metrics, the company stands at the forefront of innovation and sustainability in vanadium extraction. Moreover, strategic partnerships forged in the Kingdom of Saudi Arabia signal a strategic expansion into downstream processing opportunities, promising further diversification and growth avenues.

Let us know more!

Victory Bore – Robust Economics

The Victory Bore Project has a JORC Resource of 464Mt @ 0.39% V2O5 including 139Mt @ 0.33% V2O5 in M+I. The attributes of orebody make it ideal for open pit bulk mining. The deposits at Victory Bore comprise of several stacked vanadium titanium-magnetite-rich layers up to 80m wide. The Victory Bore project resource also contains oxides of titanium, iron, aluminium and silicon, providing diversification opportunities for revenue generation.

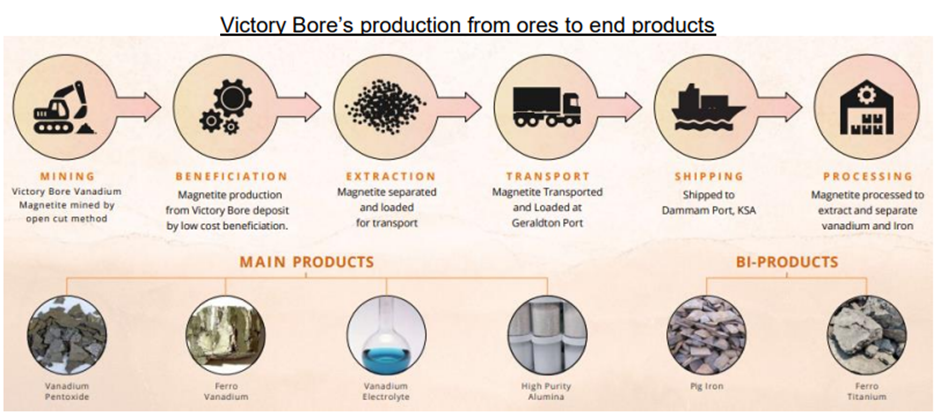

The company has already completed the project PFS) with excellent results. The study explored various scenarios and returned the optimal pathway whereby, on average, an ROM of 4Mtpa will be beneficiated into ~1.25Mtpa of high-grade magnetite concentrate on-site before shipping to the KSA for further processing into six end products.

Image source: SRN ppt

The PFS results highlighted strong project financials as highlighted below:

- Pre-tax NPV10 of US$1.1 billion

- IRR of 42.2%

- Payback of 2.4 years over a 24-year life of mine

Downstream processing in the KSA

Surefire plans to conduct downstream processing in the KSA, leveraging low-cost energy in the region with the target production of six end products. The ASX-listed company has a non-binding Memorandum of Understanding (MOU) with the Saudi Arabian Ministry of Investment (MISA). The MOU aims to look at downstream processing opportunities in the KSA. The MOU will assist SRN on the import and processing of its mineral concentrate in the region, investment opportunities, assistance to secure binding agreements, opportunities for establishing high purity alumina (HPA) production facilities and other opportunities in vanadium.

Further, SRN has MOUs with two other Saudi Arabian partners, Ajlan & Bros. Mining and Metals (Ajlan) and RASI Investment company (RASI). These agreements are related to the development of Victory Bore in Australia and downstream processing facility in the KSA.

SRN will work on securing binding joint venture agreements and binding offtake agreements with these partners (but not limited to) over the next few months.

Breakthrough in Vanadium Extraction

Recently, SRN announced a breakthrough in its vanadium extraction process. It attained a 3 percentile point increase in vanadium recovery to 91% from Victory Bore’s magnetite concentrate. As per the company, the new process bypasses the need for a kiln which substantially cuts down energy consumption. It results in a much smaller carbon footprint.

The road ahead

SRN is engaged in geotechnical operations to progress towards obtaining a mining license application and optimising its vanadium extraction process for commercial use.

After finalising an excellent PFS, the company proposes to initiate a Definitive Feasibility Study (DFS) later this year to swiftly attain bankable status and expedite production. Additionally, SRN plans to conduct a scoping study to produce high purity alumina in the KSA as stipulated in the MOU with MISA.

As the company embarks on the next phase of development, the stage is set for Surefire Resources to revolutionise the vanadium market and establish itself as a formidable player in the global minerals industry.

SRN shares traded at AU$0.010 at the time of writing on 9 April 2024.