Highlights

- Surefire Resources achieved a dual listing on the Frankfurt Stock Exchange during the September quarter.

- The Victory Bore pre-feasibility study has highlighted encouraging metrics for the project, with the maiden ore reserve estimated at 93Mt.

- Next steps for the Victory Bore project include securing binding joint venture (JV) agreements and obtaining funding for development.

- New drill targets have been identified at the Yidby gold and copper project.

- Advancing environmental approvals remains a key priority for the Perenjori project.

Surefire Resources NL (ASX:SRN) shares traded 33.33% higher in early morning trade on 29 Noveber 2024, with the share price reaching AU$0.004. The Perth-based mineral exploration company has shared a presentation from its annual general meeting, highlighting key developments across its projects.

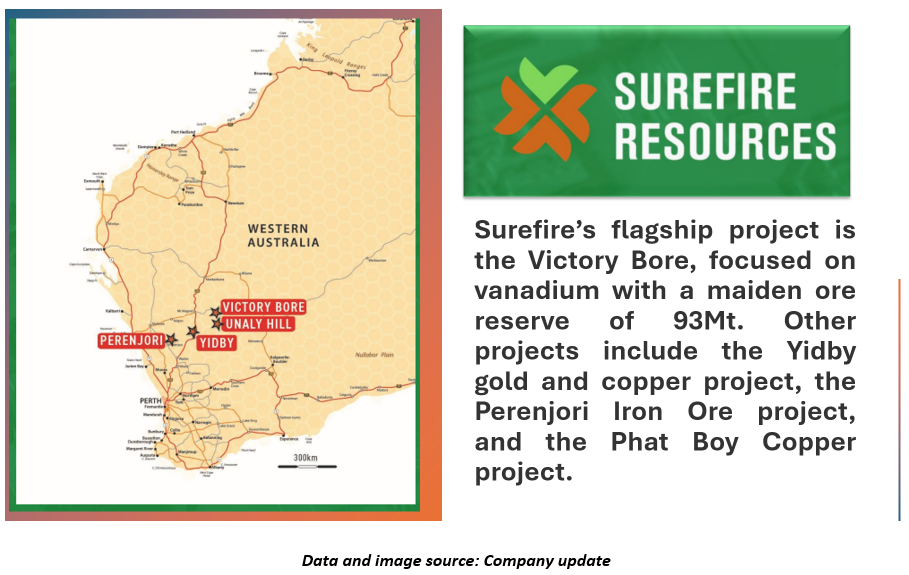

SRN’s portfolio includes vanadium gold, copper, and iron ore projects. The company is also engaged in research & development into alternative vanadium extraction methods and high purity alumina.

During the September 2024 quarter, Surefire completed a dual listing on the Frankfurt Stock Exchange under the code GBL.

Victory Bore Achieves Pre-Feasibility Milestone and Strategic MOUs

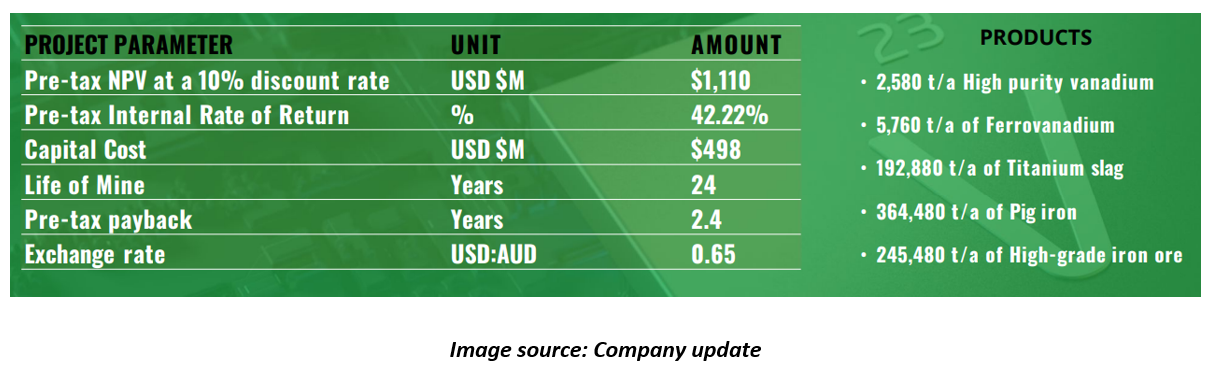

Surefire has made significant strides with several key developments related to the Victory Bore project. The pre-feasibility study has been completed, and the maiden ore reserve is estimated at 93Mt.

The company has signed a Memorandum of Understanding (MOU) with the Kingdom of Saudi Arabia (KSA), opening the door to significant investment opportunities. Under the agreement, up to 50% of the capital expenditure (CAPEX) for the KSA processing plant will be available through the Saudi Investment Development Fund.

Key strategic partnerships include MOUs with AJLAN Bros and RASI Investment, as well as a collaboration agreement with Geraldton Ports and MWPA. Additionally, a new vanadium extraction leach patent has been submitted, and a Heads of Agreement (HOA) has been signed with DRA Global, a global engineering group.

The project is also progressing with an Expression of Interest (EOI) for offtake with HMS Bergbau AG.

Encouraging Victory Bore PFS Results

New Drill Targets Selected at Yidby Gold and Copper Project

The Yidby gold and copper project has achieved significant progress with the completion of leach test work, resulting in a 68% increase in gold content. New drill targets have been selected following a re-interpretation of existing data, highlighting further potential for discovery.

An extensive copper-in soils anomaly has been uncovered, suggesting the possibility of a VHMS (Volcanogenic Massive Sulphide) style deposit. Drilling is now underway, aiming to further explore these opportunities and advance the project.

Perenjori Project Integrates Environmental Considerations with Proposed TEC Plan

Surefire is actively engaging with the Environmental Protection Authority (EPA) for the submission of its proposed mining and development plan for the Perenjori project. Additionally, the management of the project’s Targeted Environmental Conservation (TEC) plan has been proposed, ensuring that environmental considerations are integrated into the development process.

Moving forward

Next steps for the Victory Bore project include securing binding joint venture (JV) agreements and obtaining funding for development work. Additionally, the project will focus on securing offtake agreements, completing permitting, and conducting further studies. Progress will also continue on vanadium extraction test work to enhance project feasibility. For the Yidby gold and copper project, the focus will be on assessing results from recent drilling and sampling efforts. Meanwhile, for the Perenjori project, advancing environmental approvals remains a key priority. SRN shares were trading at AU$ 0.003 at the time of writing on 29 November 2024.