Highlights

- Revolver Resources has secured AU$1.0 million in funding through the sale of 2% gross revenue royalties on future production at the Dianne Copper Mine.

- The newly issued royalties apply exclusively to the six mining leases of the Dianne Project, excluding its broader exploration areas.

- Including a previous 1% GRR agreement with Strumbos Trust, the total private royalties over the project now stand at 3%.

- Revolver raised an additional AU$116,200 via its established At-the-Market (ATM) facility.

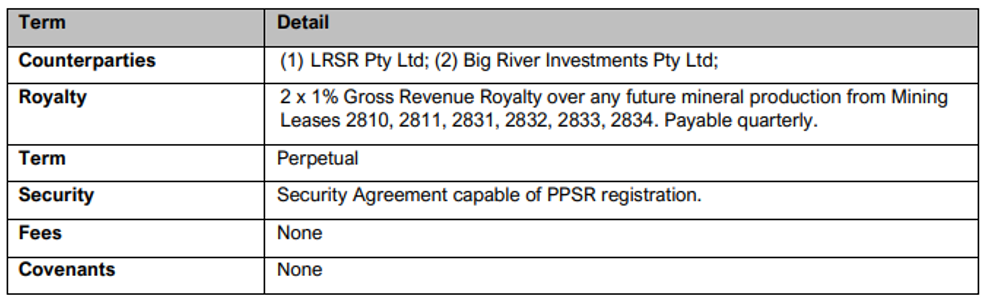

Revolver Resources Holdings Limited (ASX:RRR) has secured AU$1.0 million in new funding through the sale of two additional 1% gross revenue royalties (GRRs), totalling 2%, over future mineral production from its Dianne Copper Mine Project. These royalties apply to the six mining leases that make up the project and exclude the broader exploration areas at Dianne.

The newly established GRRs are in addition to a previously announced 1% GRR agreement with Strumbos Trust, bringing the total private royalties over the project to 3% GRR.

Revolver views this funding structure as an attractive, project-specific, and non-dilutive financial solution for its shareholders.

Key Royalty Terms

Image source: Company update

Additional Funds Raised Through ATM Issuance

The company has raised AU$116,200 through its established At-the-Market (ATM) at-call funding facility with Alpha Investment Partners. This involved the issuance of 3,150,000 shares at a price of AU$0.03689 per share, representing a 4.2% premium to the 5-day volume-weighted average price (VWAP) of AU$0.0354 as of 8 April 2025.

Revolver continues to advance key workstreams at the Dianne Copper Mine Project, with a Final Investment Decision (FID) anticipated in the coming months.

RRR shares were trading at AU$0.033 per share at the time of writing on 10 April 2025.