Highlights

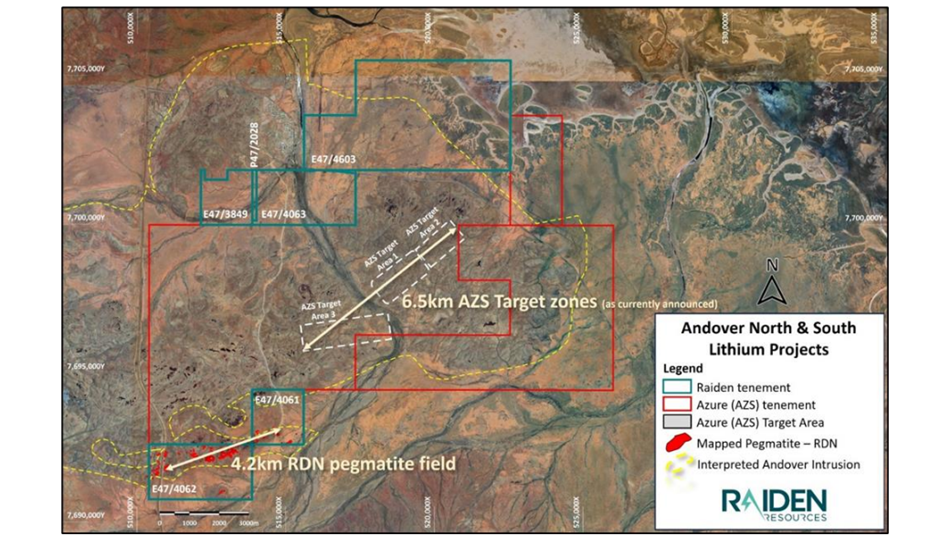

- Heritage surveys completed for the Andover North and South projects are awaiting final reports for drill program schedule.

- Significant nickel anomaly has been discovered in soil at Mt Sholl, enhancing district-scale potential in the Pilbara region.

- IP Survey over main deposit at the Mt Sholl Ni-Cu Project demonstrated significant upside for further Ni-Cu sulphide mineralisation at depth.

- Soil sampling conducted in the infill area revealed anomalies indicating the presence of lithium at Mt Sholl.

Raiden Resources Limited (ASX: RDN / DAX: YM4) has released its progress report for the quarter ended 31 March 2024. The report highlights major developments across the company’s Western Australia-based Andover South Project, Andover North Project, Mt Sholl Ni-Cu Project, and Mt Sholl Li Project.

Raiden, a dual-listed exploration and development company, primarily focused on advancing exploration at the Andover North and South Lithium projects in the latest quarter. Also, the company made significant hits across its Mt Sholl project. The company holds a significant project portfolio focusing on essential metals and commodities crucial for the energy and electrification transformation.

Image source: RDN ppt

Image description: Raiden’s Andover North and South Project and adjacent Azure Minerals Ltd.’s Andover Lithium project

Heritage surveys completed over Andover projects

During the quarter, the company commenced heritage surveys for both the Andover North and Andover South projects. The surveys have been successfully concluded, as per a company update dated 16 April 2024.

The company aimed to integrate the knowledge of the Ngarluma Traditional Owners to pinpoint and steer clear of culturally significant areas.

Both surveys were completed according to the planned schedule and within budget. The company is currently awaiting preliminary reports for both projects, with final reports contingent on approval from the Ngarluma Aboriginal Corporation.

A timetable for the drill program will be established once the final reports are received.

Promising potential of Mt Sholl Ni-Cu Project

Infill soil sampling conducted across the northern regions of the Mt Sholl project area revealed a significant nickel anomaly in the soil, stretching across several kilometres along a WNW striking corridor.

Data source: RDN update

All sampling and analysis activities were carried out in accord with the memorandum of understanding (MOU) with First Quantum Minerals. First Quantum exclusively funds all activities related to base metals on the Mt Sholl project.

The origin of the nickel anomalies remains uncertain but may be linked to a potential Volcanogenic Massive Sulphide (VMS) system. These anomalies enhance the district-scale potential of Raiden's base metal portfolio in the Pilbara region. First Quantum is currently conducting further field mapping and potential geophysical surveys over the nickel anomalies identified through this soil program.

First Quantum has scheduled additional activities for the Mt Sholl Ni-Cu-PGE deposits, including a ground electromagnetic (EM) survey to identify additional zones with potential massive sulphide mineralisation, which are found within the lower concentration disseminated mineralisation zones on the Mt Sholl deposits.

Lithium targets at Mt Sholl Lithium Project

Results released during the quarter from infill soil sampling validated previously identified lithium anomalies on the Mt Sholl project. This program has pinpointed two high-potential lithium targets. The lithium anomalies are further constrained within distinct geometries, with peak values of 188 ppm Lithium (405 ppm Li2O) in soils.

These results will facilitate a more targeted follow-up campaign aimed at defining potential targets. Additionally, further mapping and sampling efforts ate planned across all identified anomalies.

RDN shares traded at AU$0.032 apiece at the time of writing on 18 April 2024.