Highlights

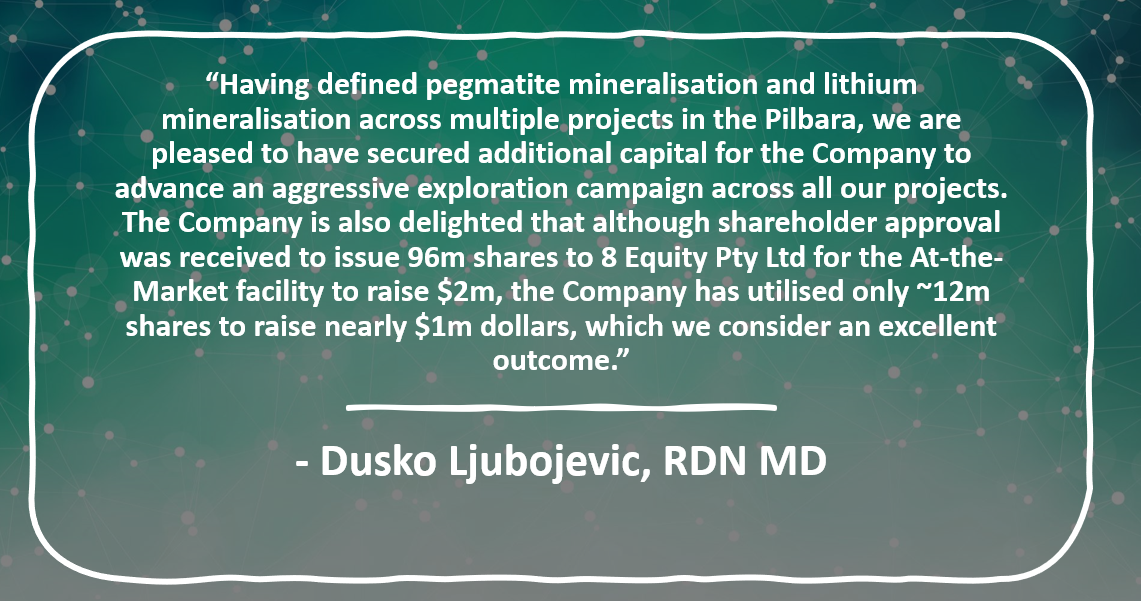

- RDN has boosted its financial position with ~$833,524 raised through an at-the-market facility.

- Proceeds raised will assist in advancing the company’s projects.

- RDN held over AU$7.94 million in cash at bank, as of 11 December 2023.

Raiden Resources Limited (ASX: RDN, DAX: YM4) has raised ~$833,524 by using an at-the-market financing deed with 8 Equity Pty Ltd.

Under the deed, 12,150,000 advanced subscription shares have been set-off, which were earlier issued to 8 Equity, at a deemed share price of AU$0.075 per share. Based on the last RDN trading price (on 8 December 2023), the deemed share price represented a premium of around 88%.

For more details on the deed, click here.

Initially, under the deed, 96,000,000 advanced subscription shares were issued to the financer. With this development, the total has been reduced to 83,850,000 advanced subscription shares, which RDN might draw down on to raise further funds.

The funds raised are planned to be directed towards further advancing the company’s projects.

RDN held over AU$7.94 million in cash at bank, as of 11 December 2023.

RDN shares closed at AU$0.037 apiece on 11 December 2023.