Highlights:

- QX Resources (ASX:QXR) remained committed to building its position as a diversified minerals exploration company in FY22.

- During the period, the company strengthened its portfolio of highly prospective assets in the Pilbara lithium province.

- The period saw the expansion of the company’s portfolio of precious and base metal assets in Queensland.

- A trenching program recorded multiple intersections of high-grade gold mineralisation at Big Red.

Perth-based exploration company QX Resources Limited (ASX:QXR) carried out extensive groundwork on its project suite in FY22 and is heading into FY23 with an established and exciting asset base with a range of flexible development options.

QX Resources recently released its annual report for the financial year ended 30 June 2022, highlighting various activities that align with its strategy of advancing its portfolio of highly prospective assets in well-established mining jurisdictions across Queensland and Western Australia.

The period saw strategic merger & acquisition initiatives, along with the expansion of the company’s portfolio of precious, battery, and base metal assets.

QX Resources advancing lithium exploration strategy

QX Resources boosted its Pilbara lithium portfolio during the reported period. The company now holds 355km2 of granted tenements and those under application in the Pilbara region.

Last year, the company entered into a binding option agreement with Redstone Metals Pty Ltd. The company exercised its option to acquire the Turner River lithium project (ELA 45/6042). Moreover, the period saw QX Resources boosting its portfolio with ELA 45/6065, which adjoins the Turner River lithium project to the north.

The group achieved one of its operational achievements in Q4 of the year with a successful high-grade rock-chip sampling program at Turner River that returned up to 4.90% Li2O.

In another major event during the period, QXR exercised the option over the highly prospective Western Shaw lithium project (E45/4960), which is also prospective for iron ore, gold and nickel mineralisation.

The company further strengthened its Pilbara lithium portfolio with the addition of the Split Rock Lithium Project covering E46/1367 and E45/6107. Along with lithium, the project also holds prospects for base metals, including copper, lead, zinc, silver, and gold.

Expansion of QXR’s precious and base metals portfolio

In Queensland, the company now has a project portfolio covering 976km2.

QXR secured an exploration licence from Queensland regulators through its fully owned subsidiary, Skyfall Resources. It extended the company's hold over the Llanarth tenement (232km2). The company believes it to be an underexplored tenement with high prospects of gold and silver mineralisation.

Skyfall also acquired exploration permits for two additional tenements considered highly prospective for gold, silver, and base metals (molybdenum, copper, lead, zinc and cadmium) in the Clermont Goldfields.

Trenching program delivers high-grade gold mineralisation

Along with penetrating new assets, the company was also focused on its existing project portfolio including the development of the Lucky Break and Belyando projects. Both these projects are in highly prosperous Drummond Basin, with >6.5moz gold endowment.

QXR completed a maiden 370-metre trenching program at the Big Red prospect under Disney Tenement. The program recorded multiple intersections of high-grade gold mineralisation. However, the company halted the program due to inclement weather, and Phase 2 was recommenced just before year-end and completed in August 2022. For more insights into trenching program, click here.

Strong financial footing

In its annual report, QXR highlighted that its strategy of lithium exploration attracted the interest and financial backing of sophisticated global investors.

The period saw a share placement of AU$2.85 million to Suzhou TA&A Ultra Clean Technology Co Ltd.

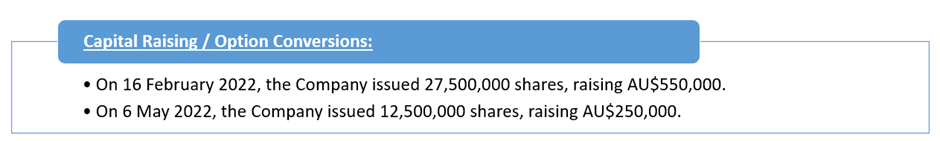

Other capital raising activities for the year are shown below:

Data Source: Company’s update

The company ended FY22 with cash reserves of AU$3,637,449.

QXR believes that the company has established an exciting asset base with a range of flexible development options heading into FY23.