Highlights

- QX Resources has received final assay results from Phase 1 drill campaign conducted at its Turner River Project.

- The results have confirmed a lithium mineralisation halo with elevated REE results at the hard rock lithium project.

- The best drill hole results reflect 1m @ 0.38% Li2O and 4m @ 1,693ppm TREO from drilling performed at an average of 100 metres.

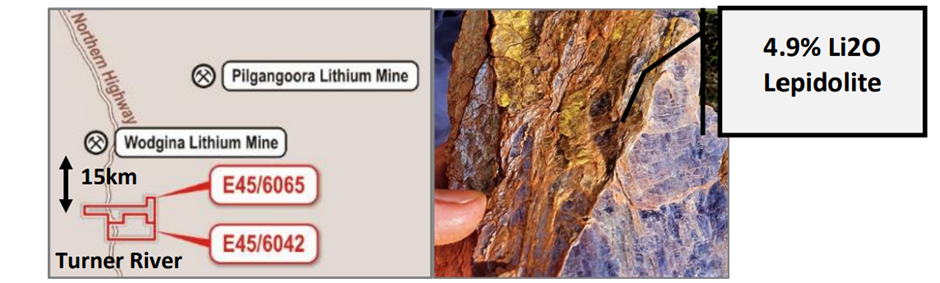

ASX-listed QX Resources (ASX: QXR) has announced final assay results from its reverse circulation (RC) drilling along with a detailed analysis, for its 100%-owned Turner River Project. The hard rock lithium project is based 15 km to the SE of Wodgina lithium mine of Mineral Resources in Western Australia.

For detecting better lithium grades in the drilling, the company plans to undertake further exploration work as it considers the project to be a high priority location. There would be an exploration campaign covering high resolution airborne geophysics with extensive trenching so as to outline more drill targets.

With this campaign, the company intends to secure access to other pegmatites in outcrop at the project site as well as in the Split Rock leases.

Also, sampling would be performed in the region as high-grade lithium micas outcrop near the drilling field.

Data source: Company update

Tracking the developments

From the 12-hole (1166m) maiden reverse circulation (RC) drill campaign conducted at Turner River in December 2022, the company received encouraging signs of major areas of potential lithium bearing pegmatites identified in drill pads and drill chips at the project site.

The indications observed extend beyond the area with formerly reported high-grade rock chip samples of 1.6% Li2O, 1.1% Li2O and 4.9% Li2O.

The maiden drilling intersected pegmatites and potential lithium-rich micas on the basis of visual observations. Soon after the maiden drilling, a 10-hole (1130m) reverse circulation drilling program was conducted, based on the geology intersected downhole.

The best sample results from the drilling were:

- 3m @ 0.26% Li2O, including 1m @ 0.38% Li2O, from 4m (22QXRC007)

- 4m @ 1,693 ppm TREO from 18m (22QXRC007) including 1m @ 2,391.51 ppm TREO and 1m @ 369ppm Nd203

- 6m @ 1,497 ppm TREO from 27m (23QXRC009)

- 122% Li2O from 31 – 32 m depth in RC hole 23QXRC009

- 03% Li2O from 61 - 62 m depth in drillhole 23QXRC003

- 046% Li2O from 40 - 41 m depth in drillhole 23QXRC008

- 2,278 ppm TREO 31 – 32 m depth in RC hole 23QXRC009

- 1590 ppm TREO from 40 – 41 m depth in drillhole 23QXRC008

- 954 ppm TREO from 8 – 9 m depth in drillhole 23QXRC002

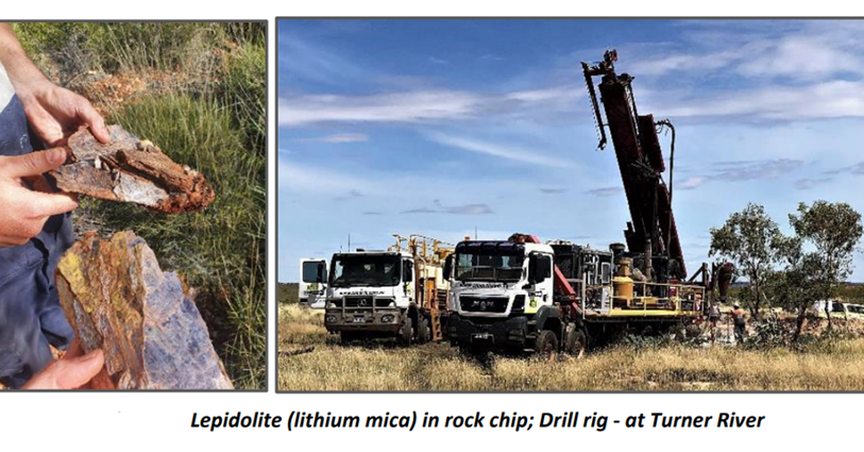

Location map of QXR’s Turner River project licences relative to large Pilbara lithium mines, and photo of weathered lepidolite in rock samples from the drilling area

Location map of QXR’s Turner River project licences relative to large Pilbara lithium mines, and photo of weathered lepidolite in rock samples from the drilling area

Also, the company shared alternative drill result analysis that hints at a potential trend connecting the following drillhole assays and rock chips ordered from west to east:

- 141% Li2O in Rock chip: 22QX5_172

- 376% Li2O in RC hole 22QXRC007, from 4-5 metres

- 122% Li2O in RC hole 23QXRC009, from 31-32 metres

- 070% Li2O in RC hole 22QXRC005, from 29-30 metres

- 514% Li2O in Rock chip TR010

The company has been granted all the tenements that it had applied for, including Western Shaw Projects (E45/6107, E45/4960), Yule River (E45/6159), and Split Rock (E46/1367), in the Pilbara lithium region, for five years.

QXR shares were spotted trading at AU$0.025 at the time of writing this article on 27 June 2023.