Highlights

- Monger Gold (ASX:MMG) is establishing a portfolio of lithium assets in the tier 1 mining jurisdictions of North America.

- MMG has shared a three-fold FY23 Strategic Business Plan for transitioning to a focused lithium player.

- The Company has planned various activities ready to be undertaken across its lithium projects, including the Brisk and Scotty lithium projects.

Monger Gold Limited (ASX:MMG) has come a long way since its listing on the ASX in Q3 2021.

The ASX-listed well-structured resource exploration Company has increased its focus on lithium exploration with a robust project portfolio in North America. Meanwhile, it is considering pivotal moves for the advancement of its Western Australian projects.

Recently, MMG shared its FY23 Strategic Business Plan, which outlines the Company’s commitment to transitioning into a lithium-led battery minerals and technology company.

MMG has started to build a portfolio of lithium assets with powerful fundamentals, including the recently acquired Scotty Lithium Project located in Nevada, US and the ongoing acquisition of Brisk Lithium Project in Quebec, Canada.

Transitioning towards lithium exploration

Lithium is a technical mineral, and the lithium supply chain is still evolving. The metal is altering the ways of daily human life activities by helping in the electrification of the world. Besides the electrification of energy grids across the globe, there is an enhanced consumer and legislative shift towards electric vehicles.

Given the opportunity to benefit from increased lithium demand, MMG is transitioning to a lithium-led battery minerals and technology company.

MMG aims to discover, delineate, mine and refine assets that indicate the potential for a full lithium supply chain and not just resource potential.

Source: MMG Presentation

MMG’s FY23 Strategic Business Plan

According to MMG, all lithium resources have low in situ grades, and all lithium mineral concentrates have low grades. Currently, battery grade purity is produced through refineries, and an emerging trend is a midstream product which has high concentration but lower purity level.

MMG supports the midstream product trend to deliver a more responsible and sustainable intermediate product with 1/6th of the concentrate mass and agnostic to the dynamic cathode chemistry market (purity & chemistry).

The Company’s FY23 Strategic Business Plan includes the following:

Source: © 2022 Kalkine Media® | Data Source: MMG Presentation| Image Source: © Shutter999 | Megapixl.com

A part of its strategy to develop and drive lithium projects forward is the recent appointment of highly experienced lithium and development professional, Mr Adam Ritchie, as the CEO Mr Ritchie brings with him more than 20 years of experience in the resources sector, wherein he has held senior positions at some of Australia’s leading resources companies.

Drilling planning underway for Scotty Lithium Project

The Scotty Lithium Project comprises two prospects that indicate the potential for brine and sediment targets. Notably, the project shares border with the Bonnie Claire Lithium deposit, which is one of the largest lithium resources in the US.

Moreover, the project indicates regional strength as it is located in the tier 1 mining jurisdiction, 330Kms from Tesla’s Nevada gigafactory.

Currently, MMG is awaiting the results of the soil testing undertaken at the project. The Company has planned an MT Survey and a drilling program for the project.

Acquisition of Brisk Lithium Project

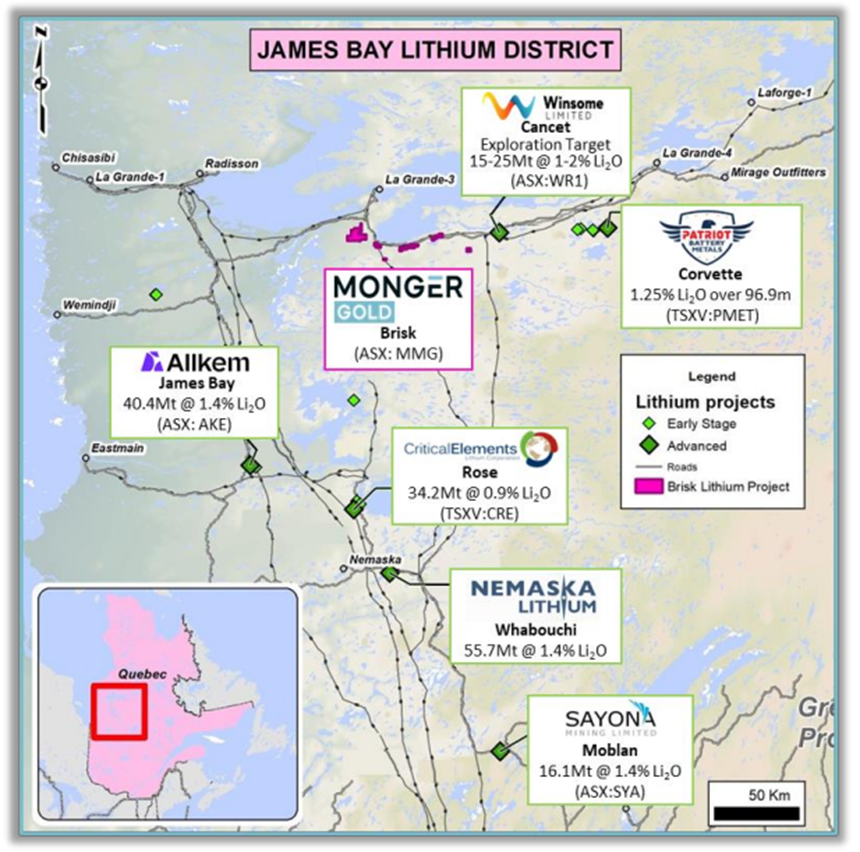

The Brisk Lithium Project sits within the prospective James Bay Lithium District, which is an emerging hard rock capital of North America. The district is a tier 1 mining jurisdiction where initiatives from the proactive Government indicate grants and funding alternatives to explorers and developers.

DG Resource Management, the vendor of the Brisk Lithium Project, identified this project using similar methods that helped in identifying the potentially world-class Corvette Project. The Brisk Project, a host to multiple known pegmatite outcrops, comprises six prospects extending across 98.5Km2.

Source: MMG Presentation

MMG believes that the performance milestones and open-ended deal structure indicate long-term and continuing commitment.

The Company looks forward to various works across its Brisk Lithium Project, including the maiden field program, as well as defining drill targets.

Continued advancement of Western Australian assets

MMG’s Western Australian projects include the Monger North, Monger South and Gibraltar Projects.

Recent developments across these projects include the following:

- The Monger North project indicates a maiden resource of 16.4koz (2.5g/t).

- VHMS potential has been discovered at the Monger South Project.

- The Gibraltar Project has delivered a large >21ppb, 66ppb peak Au in soil anomaly.

MMG is eyeing growth opportunities for its Western Australian assets such as divestments or joint ventures with regional players to completely maximise their potential.

MMG shares were trading at AU$0.405 midday on 7 September 2022, up nearly 11%.