Highlights

- Arcadia Minerals has received initial assay results for the Stryfontein pan, confirming presence of lithium-in-clay.

- The assay results of the first two auger holes reflect lithium grades similar to that of the holes drilled at the Eden and Madube pans.

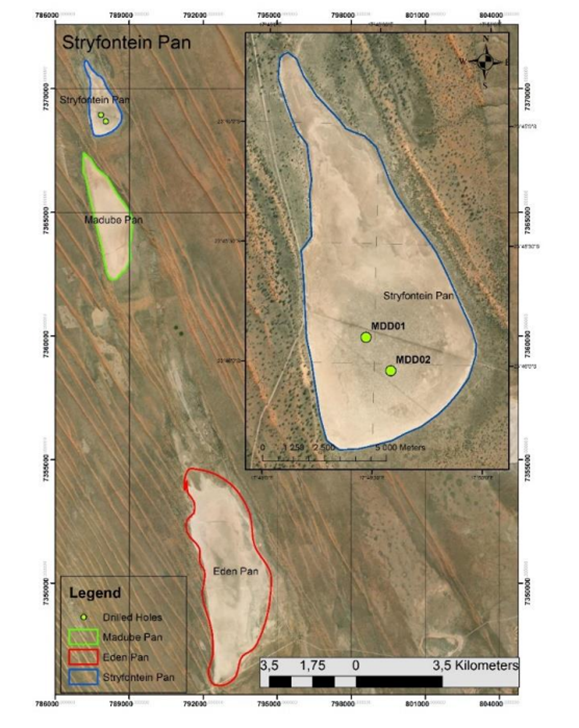

- Stryfontein is the third pan drilled out of 14 known exposed pans across the Bitterwasser Pan district.

- The company expects Stryfontein to contribute to an enlarged Mineral Resource at the Bitterwasser Lithium Clay Project that is planned for the second quarter.

- AM7 will conduct cyclone test work on Madube and Stryfontein clays to check the potential to upgrade lithium.

In the latest announcement, diversified exploration company Arcadia Minerals Ltd (ASX:AM7 FRA: 8OH) revealed the initial assay and stratigraphic results of the first two holes drilled at the Stryfontein pan in its Bitterwasser lithium clay project during the December 2022 drilling campaign.

According to the drill assays, lithium mineralisation is confirmed at the Stryfontein pan. It is the third such pan in the Bitterwasser Pan district where lithium mineralisation has been confirmed. Also, the Stryfontein pan’s lithium mineralisation is similar to a tenor at the Eden Pan, where a Lithium-in-Clay JORC Mineral Resource of 286,909-ton Lithium Carbonate using a 500ppm Li cut-off has been defined.

Map indicating the location of the Stryfontein Pan (outlined in blue) in relation to the Eden (outlined in red) and Madube (outlined in green) pans and the location of the holes of MDD01 and MDD02

Assay results of the first two auger holes:

- Hole MDDO1 returned up to 763ppm Li over a width of 1.6m and an average grade of 634 ppm Li over 4m at a cut-off of 500ppm Li (Note: only drilled from surface to a depth of 7m)

- Hole MDD02 returned up to 603ppm Li over a width of 1.4m and an average grade of 596 ppm over 4.2m at a cut-off of 500ppm Li (Note: only drilled from surface to a depth of 7.4m)

In line with the Eden and Madube pans, mineralisation presence is dominant in olive green clay divisions. In hole MDD01, the green clay unit was 4m wide and in the hole MDD02, it was 5m wide, as compared to the average widths of 5.5m at the Eden pan and 7.5m at the Madube pan.

Drilling campaigns conducted previously over the Eden pan delivered an average of 663 ppm Li over an average width of 5.5m at a cut-off of 500ppm and led to an Inferred JORC Mineral Resource over the green clays of 85.2 million tons at 633 ppm Li for 286,909-ton Lithium Carbonate using a 500ppm Li cut-off.

As per the cyclone test work on the clays of Eden Pan, it is confirmed that using a 14-micron cut off the cyclone overflow occasioned in a 30% reduction of volume with a concomitant surge of 28% in the lithium grade to 810 ppm Li versus feed ore material grade of 633ppm Li.

Management commentary

Image and data source: Company update

Mr. Philip also highlighted that ‘with the results received at the Madube Pan and the possible confirmation of mineralisation over the rest of the Stryfontein pan, the company expects to be able to meaningfully expand our lithium-in-clay mineral resource at Bitterwasser’.

Plans ahead…

Arcadia Minerals is focused on exploring the clay pans at Bitterwasser to amplify its understanding of the Bitterwasser Basin and ascending the company’s resource base to maximum strengths.

At the Eden Pan, Arcadia will initiate an in-fill drilling campaign in March 2023 to reclassify the Mineral Resource to indicated or measured mineral resources from inferred resources.

During May 2023, the company is planning to conduct additional drilling of around 15 holes at Stryfontein.

A revised Mineral Resource for the Eden Pan is expected to be announced in Q2 2023, while a maiden Mineral Resource for Madube Pan is likely to be declared in the month of April this year.

Moreover, cyclone test work is planned over the clays of the Madube and Stryfontein pans with the purpose to check an upgrade in lithium grades.

AM7 share price jumps over 4%

AM7 shares traded at AU$0.240 on 27 February 2023, up more than 4% from the last close. The market capitalisation stood at AU$19.66 million.