Highlights

- King River Resources ended March quarter with over AU$1.6 million in cash.

- The company outlined its 2023 exploration plans during March quarter for gold-copper projects across Tennant Creek.

- KRR also plans to undertake detailed geophysical surveys across the mining lease MLC629 acquired during 2022.

- The company intends to conduct reconnaissance work to follow up on the encouraging gold outcomes received from 2022 work across the Kurundi Project.

- Under collaboration grants from the NT government, the company is undertaking exploration work at Epennarra tenements.

ASX-listed King River Resources Limited (ASX: KRR) is a mineral exploration company with major holdings at Mt Remarkable in the Kimberley region of northern Western Australia and at Tennant Creek in the Northern Territory.

In the latest announcement, the company uncovered its quarterly report for the three months ended 31 March 2023. KRR unveiled its 2023 exploration plans for the Tennant Creek gold-copper projects during the quarter. Also, subsequent to the March quarter, the company completed sale of its Speewah project.

At March quarter end, the company held AU$1,614,839 in cash. The company received a research & development (R&D) tax refund of AU$781,697 during the quarter for expenditure on R&D of the processing methodology in FY2021/22. Also, it has received the first AU$2.5 million instalment under the sale of the Speewah Project.

As of 19 April 2023, KRR held over AU$3.74 million in cash.

KRR’s exploration plans for 2023 for its Tennant Creek Projects

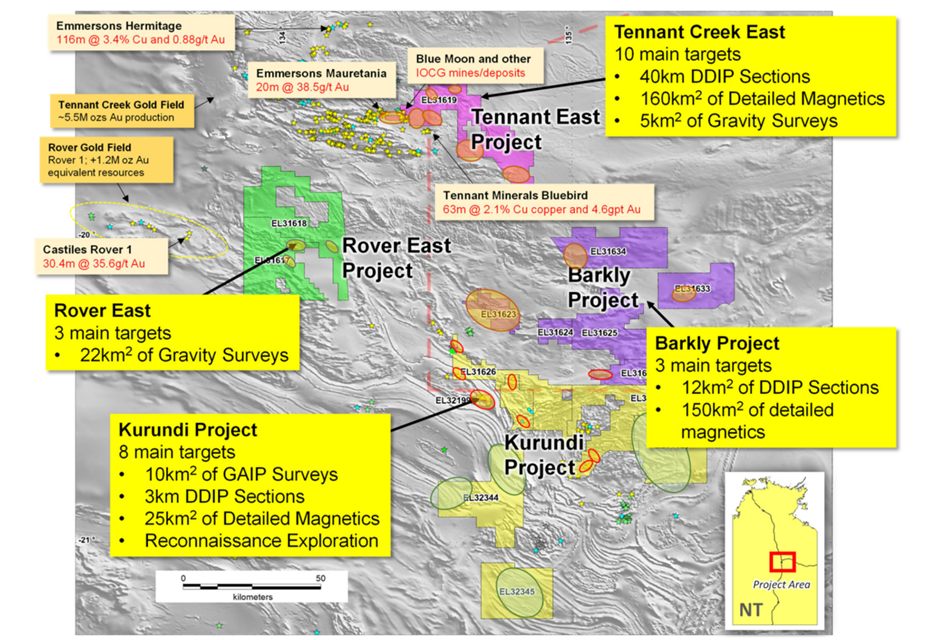

Tennant Creek Project areas (coloured polygons) and proposed geophysical programmes.

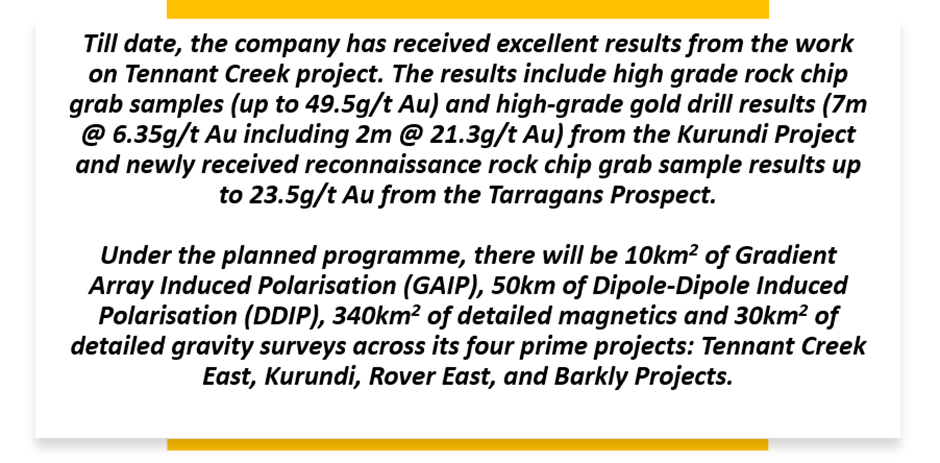

The company plans to conduct geophysical exploration worth AU$1.25 million to prioritise drill positioning over specific targets across the Tennant Creek field. This will include areas only 2.5km along NW/SE strike of the Bluebird/Perseverance deposits (where Tennant Minerals recently reported 30m @ 6.2% Cu, 6.8g/t Au, ASX: TMS 8/2/23)

King River Resources possesses substantial holdings of about 7,000km2 in the highly contended Tennant Creek and Barkly regions. Recently, Tennant Minerals, Castille and Emmerson’s had an exploration success in the region, showing the impressive potential of the field.

Data source: company update

An overview of KRR’s four project areas

- Rover East Project (EL31617 and EL31618)

The Rover East Project hosts many significant geophysical targets as well as proven geochemically anomalous ironstones. The company is planning to undertake 22km2 of Gravity surveys to test 3 main targets, Explorer 42 trend, Anomaly 2 zone and Biff Hill East. - Tennant Creek East Project (EL31619)

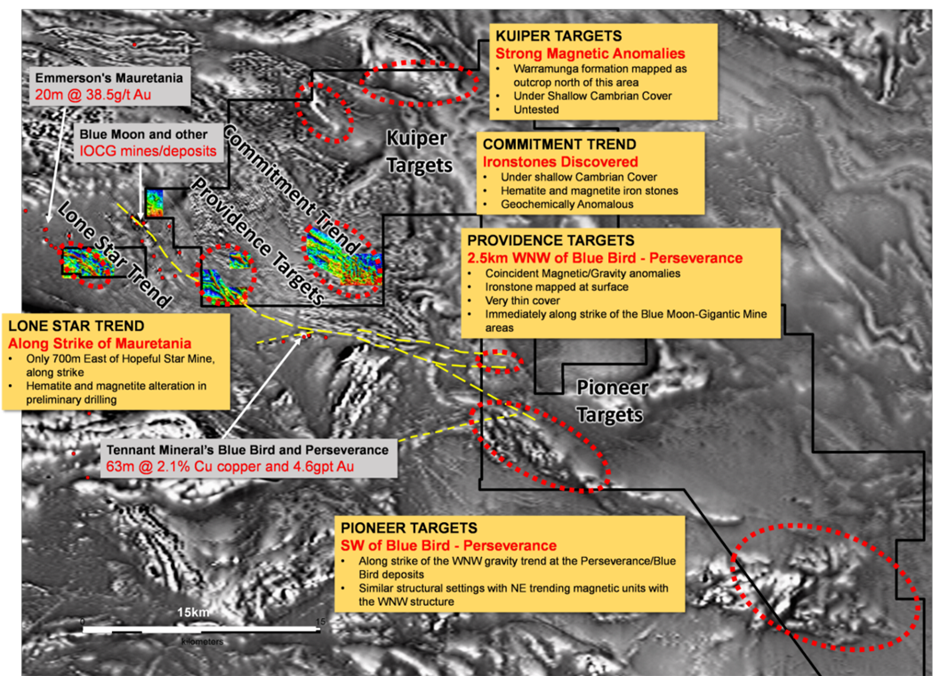

The project area is divided into the Lonestar Trend, Providence, Commitment, Kuiper and Pioneer Areas.

The company is planning a 160km2 of detailed magnetics, a 40-line km of DDIP, and a 5km2 of gravity survey to test multiple targets in this highly prospective region, as part of the 2023 geophysical programme.

Tennant East Project area magnetics (black and white) and gravity (coloured)

- Barkly Project (EL31623, EL31624, EL31625, EL31627, EL31633, EL31634)

The Barkly Project area has been highlighted as a new unexplored region with IOCG potential during the government precompetitive work. The raw, unexplored potential of the field is demonstrated by the Middle Islands Crosswinds prospect, where a malachite rich exposure was observed at surface (130m @ 0.76% Cu).

The company has more than 2,000km2 in 6 tenements within this highly contended area. The Epennarra tenements (EL31633 and EL31634) is being explored by the firm under collaboration grants from the NT Government. Several magnetic and VTEM anomalies have been detected in geologically significant settings. As per interpretation, these targets are within Warramunga equivalent units under shallow Cambrian cover and mark quality IOCG targets.

The ASX-listed company is looking forward to a 12-line km of DDIP and 150km2 of detailed magnetics for testing different targets in this highly prospective region.

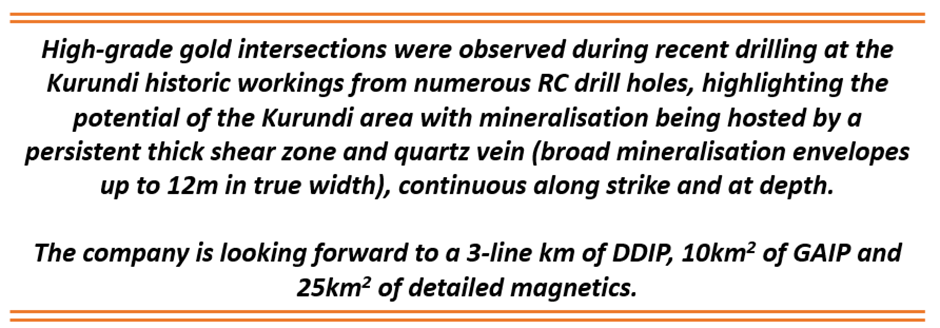

- Kurundi Project (EL32199, EL32200, EL31626, EL31628, EL31629, EL32344, EL32345)

This project is spread over a region with high- grade gold mineralisation. Multiple undrilled gold targets including best rock chip result of 49.5g/t Au from the Priesters Prospect and recent 23.93g/t Au from the Tarragans prospect were identified during the 2022 reconnaissance exploration programme.

Data source: company update

Kurundi Reconnaissance

Following the encouraging 2022 high-grade gold results, KRR is planning to conduct reconnaissance work for the Kurunidi Project.

Reconnaissance rock chip grab sampling done previously delivered high-grade gold results from a subvertical fault zone with quartz veining and strong iron alteration at the Tarragans historical workings with best results of 9.28g/t Au and 5.72g/t Au.

Also, the company has discovered a significant fault associated hematite-magnetite ironstone at the Millers area (20km NW of Kurundi main). As per the release, it is the 3rd Au mineralised structure found in the Millers Area and further reconnaissance work is planned.

Serendipity Mining Lease (MLC629 and ML32745 application)

Mining lease MLC629 was acquired by the firm in 2022 as per the terms of a 3% royalty deal to complement its mining lease application ML32745.

The acquisition of MLC629 gives KRR a +900m strike length of prospective ground within the main Tennant Creek Gold Field with at least two ironstone trends and historical workings, including the Dot mine and the Big Boulder workings.

The area has not been effectively explored and KRR believes that the two iron stone trends are continuous at depth between Big Boulder and the Dot mine.

Detailed geophysical surveys are planned to target the continuation of these ironstone bodies along strike and at depth.

Stock price performance

KRR stock has witnessed a jump of over 10% on a year-to-date basis. The stock was trading at AU$0.011 midday on 24 April 2023, with a market cap of AU$17.08 million.