Highlights

- Imugene has received firm commitments from new and existing institutional and sophisticated investors for AU$35 million placement at AU$0.084 apiece.

- The company also plans an SPP to further raise around AU$30 million at AU$0.084.

- Proceeds will be used to fund the company’s latest licensing deal.

Biotechnology firm Imugene Limited (ASX: IMU) is undertaking a capital raising program to fund a new cancer treatment licensing deal.

The company has secured firm commitments from institutional and sophisticated investors for a placement of AU$35 million at AU$0.084 apiece. Under the arrangement, approximately 416.7 million new shares will be issued.

A share purchase plan (SPP) is expected to follow the placement to raise ~AU$30 million at the lower end of AU$0.084 or a 2.5% discount to the closing 5-day VWAP up to and including the closing date of the SPP.

The participants in SPP and placement are expected to receive one free option for every new share received under the offer.

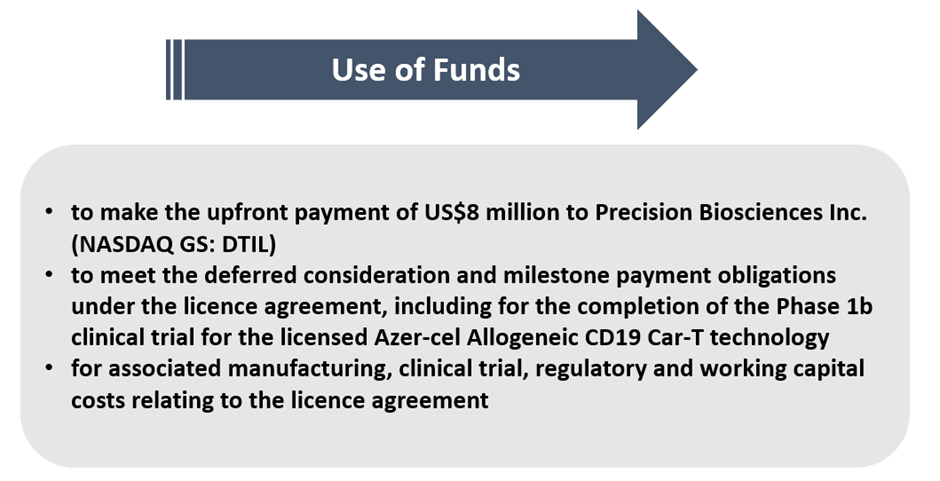

The funds from the capital raise will be used to meet the financial obligations under the licence agreement recently signed by IMU with Precision Biosciences Inc. (NASDAQ GS: DTIL).

To know the details of the licence agreement, click here.

Data source: Company update

Placement receives strong interest and support

The company would issue ~416.7 million new shares under the placement at the issue price of AU$0.084 apiece. The issue price represents a discount of 10.64% to the closing price on Tuesday (15 August 2023) and a 12.38% discount to the 20-day VWAP up to and including Tuesday’s closing price.

The expected issue date of new shares under the placement is 25 August 2023.

IMU highlighted that the placement gained significant support from specialist biotech institutional investors, its directors and key management personnel.

SPP for existing eligible shareholders

Eligible shareholders can apply for ordinary new shares valued at up to AU$30,000 in IMU without incurring transaction costs and brokerage fees. Shareholders listed on the company’s register on the record date of 17 August 2023 are eligible for SPP participation.

The SPP is not underwritten. The expected issue date of new shares under the SPP is 19 September 2023.

Details of the options offer

The company intends to issue around 773.9 million options for shares subscribed under the placement and SPP.

The exercise price of new options will be AU$0.118 with expiry due on 31 August 2026.

The issuance of options will be subject to shareholder approval at an extraordinary general meeting.

Use of funds

The proceeds raised will be used to fund the licence agreement, under which the exclusive licensing rights to the Azer-cel Allogeneic CD19 Car-T licence have been acquired.

Here’s the detail of the use of funds-

Data source: company update