Highlights

- Cyprium Metals aims to become a significant profitable mid-tier copper producer with a multi-asset strategy set to capitalise on the global electrification thematic.

- CYM hosts an attractive portfolio of three copper projects in Western Australia with a Mineral Resource of +1.6Mt of contained copper.

- The company has been progressing well to restart its Nifty Project, following its Nifty development strategy.

Australian copper company, Cyprium Metals Limited (ASX: CYM) is involved in development and exploration of multiple near-term development projects focused in Western Australia. The firm is driving forth its copper projects with the aim to become a significant profitable mid-tier copper producer with a multi-asset strategy set to capitalise on the global electrification thematic.

As per a study data released by S&P Global in 2022, copper demand is projected to grow to about 50 MMt by 2035, a record-high level that is expected to be sustained and continue to grow to 53 MMt by 2050. This is mainly because many nations, including the United States and the European Union, have set net-zero emissions by 2050 as their climate goal and copper, often described as the “metal of electrification” is essential to all energy transition plans.

CYM’s role in fulfilling copper demand

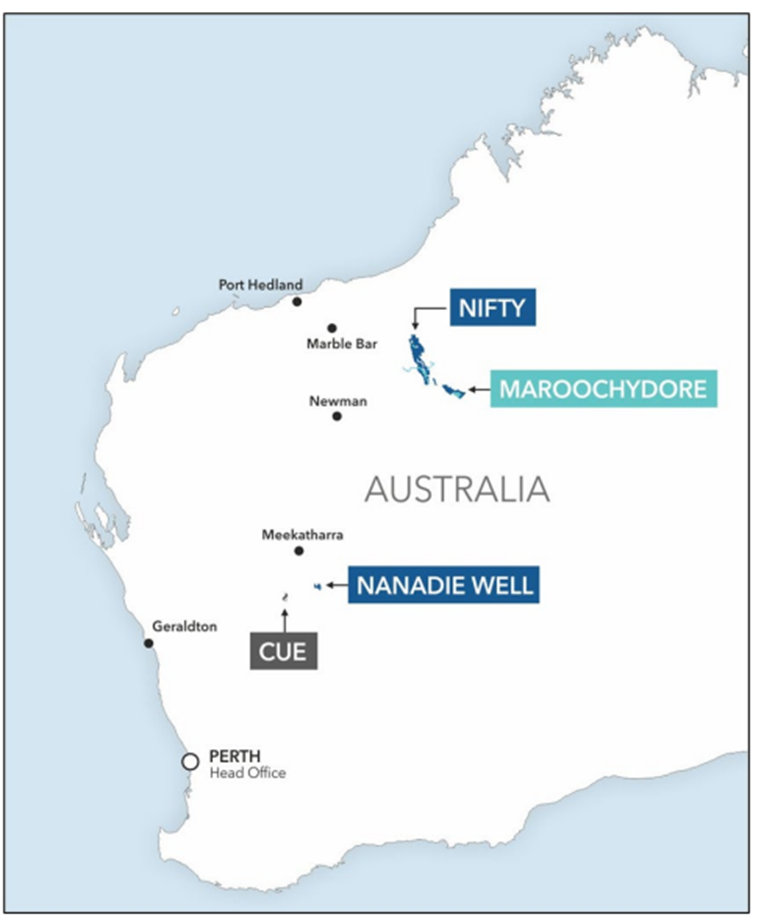

The ASX-listed company hosts an attractive portfolio of three copper projects in Western Australia with a Mineral Resource of +1.6 million tonnes of contained copper.

Image source: Company PPT

- Nifty Copper Mine(100%)

The company has been progressing well to restart the operations at its Nifty Copper Mine Project in Western Australia, in line with its Nifty development strategy. The company has all its focus centred on building a large-scale open cut mine using the huge sunk capital infrastructure.

Under the current Nifty strategy, the integration of a copper oxide starter open pit operation and a larger scale sulphide open pit is included.

As per the company, Nifty’s prospectivity is phenomenal and the mineral inventory is comparatively shallow, open along strike in multiple directions and at depth. It poses good potential to expand the present resource endowment.

The project is fully permitted to commence open pit oxide heap leach SX-EW Operations.

- Paterson Exploration Project(100%, diluting to 30%)

The project is located at a premier exploration destination in Australia.. It holds a highly prospective position in the Paterson Province, next to Nifty processing infrastructure.

IGO Ltd is authorised to sole fund AU$32 million of exploration activities over a period of 6.5 years to secure a 70% interest, with a minimum expense before withdrawal of AU$11 million over 3.5 years. Once IGO secures the 70% interest, the joint venture will be in function and IGO would free-carry to the completion of a Pre-feasibility Study on a new mineral discovery.

The 100%-owned Maroochydore Copper Project has the potential to unlock value from a substantial copper resource, says the company. It has reported a substantial shallow Oxide and Sulphide Mineral Resource of over 480,000 tonnes of copper, with mineralisation open along strike >3km and down-dip as well as material cobalt endowment.

The company has completed diamond drilling for metallurgical testwork.

According to CYM, Maroochydore and Nifty have similar mineralogy as it is hosted in the shales of the Broadhurst Formation. It has potential for synergies with the Nifty Heap Leach strategy.

Image source: Company website

A shallow resource development opportunity, the Murchison Copper Project includes complementary deposits of Hollandaire and Nanadie Well.

While Hollandaire Mineral Resource (JORC 2012) is of 2.8Mt @ 1.9% Cu Contained metal of 51.5kt of Cu, 28Koz Au & 0.5Moz Ag, Nanadie Well Mineral Resource (JORC 2012) is of 40.4Mt @ 0.4% Cu Contained metal of 162kt of Cu, 130Koz Au & 1.4Moz Ag.

Nanadie Well is a polymetallic deposit with Cu, Au, Ag, PGE’s as well as other base metals including Ni.

Image source: Company website

Copper is a critical mineral for the green transition. CYM, backed by its Tier 1 location copper assets with substantial endowment, expects to tap the emerging opportunities.

CYM shares traded at AU$0.026 apiece on 10 January 2024, with a market cap of over AU$45 million.