Highlights

- Haranga Resources shares surged following a major acquisition announcement.

- The company is acquiring Seduli Sutter Operations Corporation, owner of the Lincoln Gold Project in Sutter Creek, California.

- The company secures the richest section of the Mother Lode, historically producing 3.4 million ounces of gold.

- The project contains 286,000 oz @ 9.3 g/t Au in Indicated & Inferred resources.

- All major approvals for the Lincoln Gold Mine have been secured, making it near production ready.

- The long-term goal is to define at least 1 million ounces of high-grade gold for large-scale production.

- The company is conducting financial & legal due diligence, seeking shareholder approval, and planning an aggressive drilling campaign after finalising the deal.

Haranga Resources Limited (ASX:HAR; FRA:65E0) saw its shares jump nearly 34% to AU$0.075 on Tuesday, following the announcement of a major acquisition deal. The company has entered into an agreement with Seduli Holdings (Australia) Ltd to acquire Seduli Sutter Operations Corporation, the entity that owns the Lincoln Gold Mine in Sutter Creek, California, USA.

Strategic Acquisition of High-Grade Gold Belt

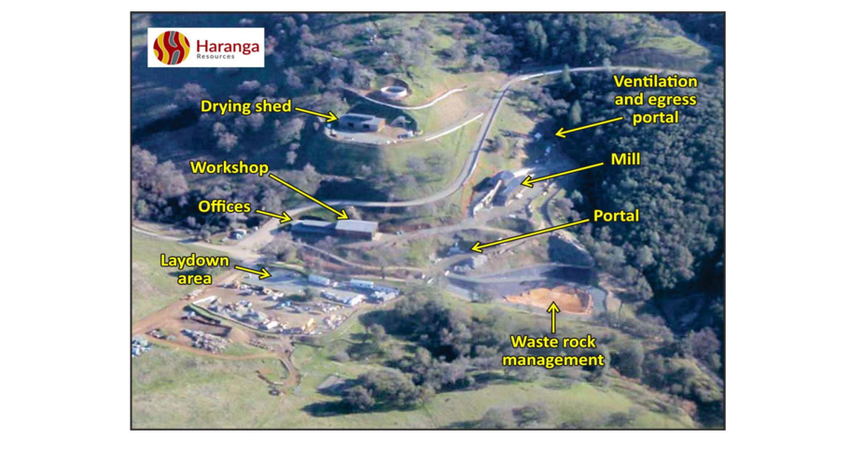

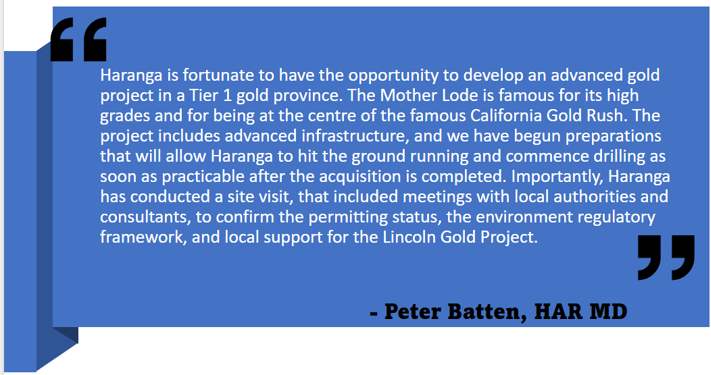

The Lincoln Gold Project is situated in Amador County and spans 5.8 km along the historic Mother Lode, one of the region’s most productive gold belts. The project includes 47 property parcels, covering 322 hectares, through a mix of owned and leased mineral and surface rights.

The company has acquired the richest section of the Mother Lode belt, which hashistorically produced approximately 3.4 million ounces (Moz) of gold. Notably, the Jackson-Plymouth segment of the Mother Lode has yielded around 8.4Moz gold with Haranga securing half of this section, offering a commanding position of this Tier 1 gold region.

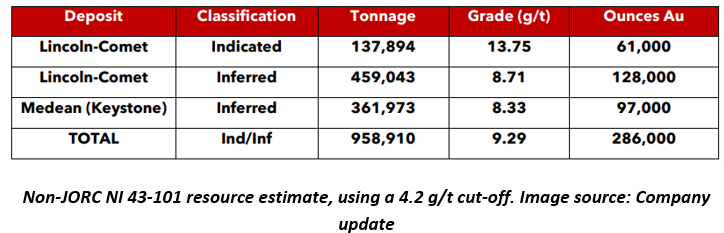

A 2015 NI 43-101 (Non-JORC) resource estimate reported 286,000 ounces of gold at 9.3 g/t Au in Indicated & Inferred resources, broken down as follows:

- Lincoln & Comet deposits: 189,000 oz @ 9.9 g/t Au (Indicated & Inferred)

- Medean deposit: 97,000 oz @ 8.3 g/t Au (Inferred)

More on Lincoln Gold Mine

At the Lincoln Gold Mine, 336 holes covering 34,771m were drilled between 1983 and 2013. Drilling has been limited to the upper Mother Lode structure, leaving deeper extensions unexplored.

The most recent resource estimate was prepared in 2015, and it classified most of the deposit as inferred due to drill spacing and data quality issues. Recent drilling will be incorporated into future updates.

Extensive metallurgical testing shows gold recovery rates between 64% and 99%, depending on processing methods. No mining has occurred since 2015.

The mine is near production-ready with all significant approvals in place, allowing processing of 315,000 tonnes annually, with expansion potential. The company aims to define over 1 million ounces of high-grade gold and commence large-scale production, with due diligence and an aggressive drilling campaign underway.

The transaction is subject to numerous conditions including financial, technical, and legal due diligence, as well as shareholder and regulatory approvals.

This acquisition positions Haranga for significant gold resource expansion and near-term development at Lincoln.

HAR raising AU$6 million

HAR has received firm commitments from institutional and sophisticated investors to raise AU$5.28 million through a placement and AU$0.72 million through a convertible note. The placement will be conducted in two tranches, with the second tranche subject to shareholder approval.

The placement will involve the issue of 105.6 million shares at an issue price of AU$0.05 per share, representing a 12% discount to the last traded price of AU$0.056, as of 20 March 2025 and a premium to the 15-day VWAP of AU$0.049 per share.

HAR shares closed the day at AU$0.071, up over 27% from the last close.